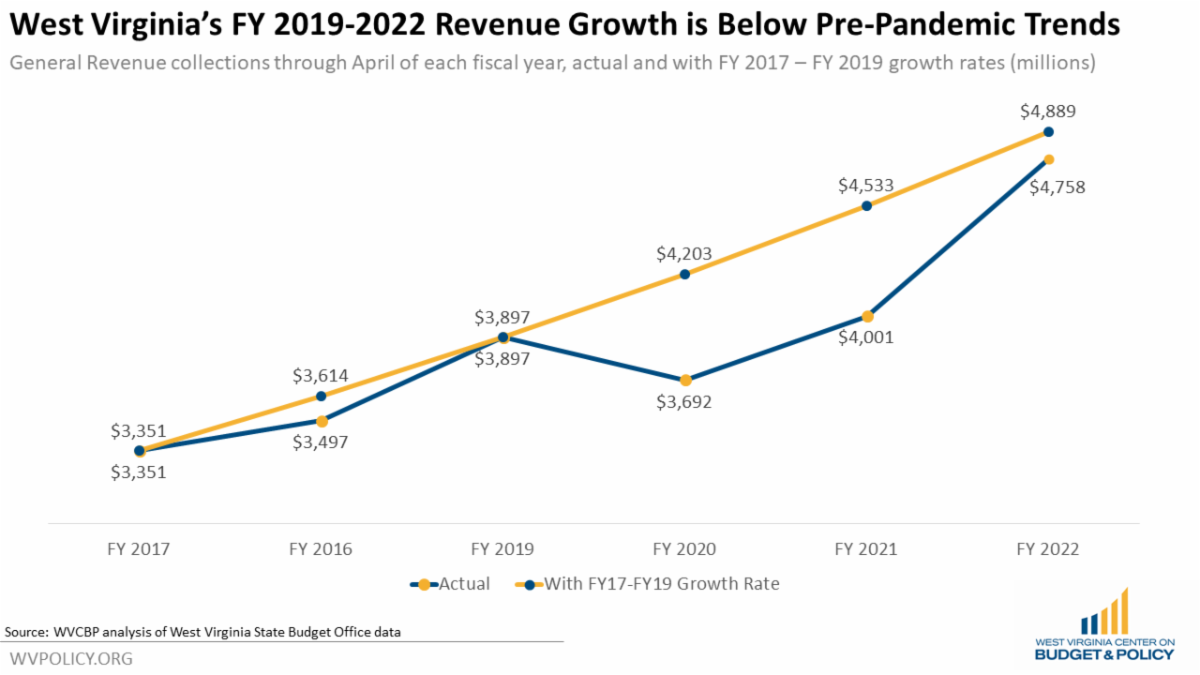

West Virginia’s tax revenue collections made a fast turnaround after the initial decline in the early months of the pandemic recession. General Revenue collections fell from $4.756 billion in FY 2019 to $4.49 billion in FY 2020, before bouncing back to $4.988 billion in FY 2021. But while the state largely recouped its pandemic revenue losses and has posted large surpluses in FY 2021 and so far in FY 2022, it has underperformed its pre-pandemic growth trends, and the temporary factors that led to the surpluses are largely over.

It is important to note that, as opposed to revenue growth leading to West Virginia’s FY 2021 surplus, the surplus was largely due to the combined impact of low revenue estimates and shifting Tax Day from April to July. And despite being $993 million above the revenue estimate, FY 2022’s revenue collection through April of $4.758 billion is actually $131 million less than what it should have been if the state had simply maintained the pre-pandemic growth rates it experienced from FY 2017 to FY 2019.

Unprecedented amounts of federal aid to individuals and business – including stimulus checks, supplemental unemployment benefits, expanded child tax credits, and forgivable business loans – helped boost revenue during the pandemic, while rising energy prices and inflation have boosted revenue in 2022. In addition, the federal government has pumped billions into the state budget, allowing West Virginia to maintain a flat budget, which in conjunction with low revenue estimates, helped generate large surpluses.

Without the federal dollars helping keep the state budget flat and the federal aid boosting the economy and fueling a quick recovery, West Virginia may not have made it through the pandemic recession without any significant budget problems. And while the state is currently experiencing large budget surpluses, revenue collections are below what they would have been if the pandemic had not occurred. As federal aid winds down, it will be increasingly important that the state use its surpluses wisely to restore investments that benefit all West Virginians and carefully plan for future budget requirements. Using the surplus to justify further corporate subsidies or tax cuts for the wealthy will only create more budget problems in the future.

Read Sean’s full blog post.

Last weekend, we and communities across the nation were devastated to learn of the heinous, racist attack at the Tops Friendly Market grocery store in Buffalo, New York. We mourn the loss of lives and the harm done to the victims as the result of white supremacist violence, and our thoughts are with their loved ones and the Buffalo community.

As an organization that addresses food security and public safety issues, it is vital to our work that we are purposeful in ensuring that we take the time to think deeply about what both of those things mean. Borrowing from the sentiments of our friends at the Ohio Association of Foodbanks, food security is not just the ability to afford food – it is equally important to be safe shopping for food in one’s community. Similarly, true public safety requires that everyone can engage in daily activities and move through the world without the fear of violence.

We stand in solidarity with communities across the nation mourning this horrific tragedy and declaring zero tolerance for white supremacist hate and violence. Further, we would be remiss not to mention that efforts to ban education about our country’s racial history or to tout racist conspiracy theories for political gain undermine community safety, security, and equity.

We encourage you to consider taking action to support the impacted community in whatever ways you are able.

| If Congress is to pass robust clean energy and climate legislation this year, it is expected that they will do so ahead of midterm elections. As those elections approach, Appalachian advocates and activists continue to apply pressure on President Biden and our federal delegations to demand that they act with urgency. A recent article highlights the latest on these efforts. Excerpt below: Forty Appalachian and national organizations signed a letter addressed to President Joe Biden and members of Congress urging them to pass a budget package that revives the Civilian Conservation Corps. The groups contend that the corps would slow climate change while providing good-paying jobs in communities struggling through the energy transition. “A revised CCC could and should prioritize census tracts that have been exploited by absentee corporations in the extractive industries, including those communities hard hit from shuttered power plants, abandoned mine lands, former steel and industrial facilities,” the groups wrote, lobbying Biden and Congress to bring back and modernize the New Deal program established in 1933. The program allowed single men ages 18 to 25 to enlist in work programs to improve public lands, forests and parks across America. Climate advocates want a rebooted corps to pay participants $15 an hour to restore wetlands, clean up polluted and abandoned land, and enjoy widened access to careers through time in the program and jobs connected to apprenticeship programs. The West Virginia Rivers Coalition, the Chesapeake Climate Action Network, the West Virginia Council of Churches, the West Virginia NAACP Conference of Branches and the West Virginia Citizen Action Group were among the groups signing onto the letter headed by the ReImagine Appalachia coalition of environmental and community organizations across the region. The call to action followed a similar letter late last month signed by 71 Appalachian organizations and seven national groups that urged Biden, House Speaker Nancy Pelosi, D-Calif., and Senate Majority Leader Chuck Schumer, D-N.Y., to support a solar production tax credit, reinstate the coal production tax supporting the Black Lung Disability Trust Fund that expired at the end of last year, and tab funding for rural electric cooperatives, in addition to creating a new CCC. “We cannot afford to miss this opportunity,” wrote the groups in the environmental group Appalachian Voices-led letter signed by Coal River Mountain Watch, the West Virginia chapter of Moms Clean Air Force, Solar United Neighbors of West Virginia, the West Virginia Center on Budget and Policy, the West Virginia chapter of Citizens’ Climate Lobby and West Virginia Interfaith Power and Light. Read the full article. |

The costs of insulin continue to rise while income wages remain stagnant, exacerbating pressure on individuals and families to skip or ration insulin doses in order to make ends meet.

You can help us in our fight to urge Congress to take action! If you or your family is being impacted by insulin costs or rationing, please consider completing our survey and aiding us in our advocacy– we appreciate your time and insight.

Applications for Appalachian Prison Book Project (APBP)‘s 2022-2023 Education Scholarship are live!

Four, $3,000 scholarships will be awarded to individuals who have been released from a West Virginia Department of Corrections and Rehabilitation (WVDCR) state prison or federal prison (BOP) in West Virginia and who will be beginning or continuing their undergraduate or graduate education at a college or university in West Virginia.

This is an incredible opportunity for justice-impacted folks in the Mountain State who want to further their education. Please share with anyone you think may be interested and eligible! Application submission deadline is July 15, 2022.

You can find full details and instructions to apply here.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

The impact on children and families since the expiration of the enhanced Child Tax Credit has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make the enhanced Child Tax Credit permanent is as urgent as ever.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) expired.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.