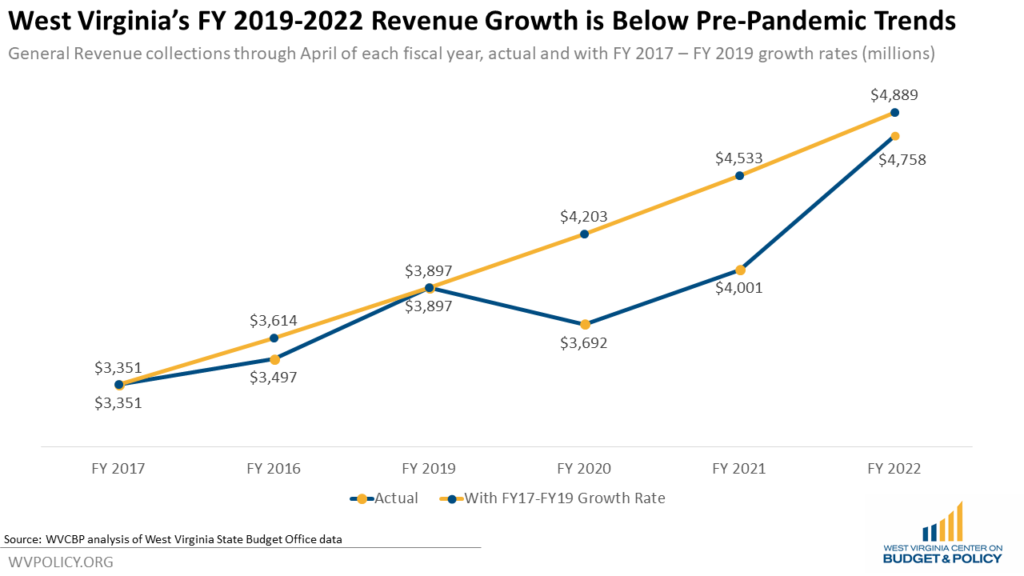

West Virginia’s tax revenue collections made a fast turnaround after the initial decline in the early months of the pandemic recession. General Revenue collections fell from $4.756 billion in FY 2019 to $4.49 billion in FY 2020, before bouncing back to $4.988 billion in FY 2021. But while the state largely recouped its pandemic revenue losses and has posted large surpluses in FY 2021 and so far in FY 2022, it has underperformed its pre-pandemic growth trends, and the temporary factors that led to the surpluses are largely over.

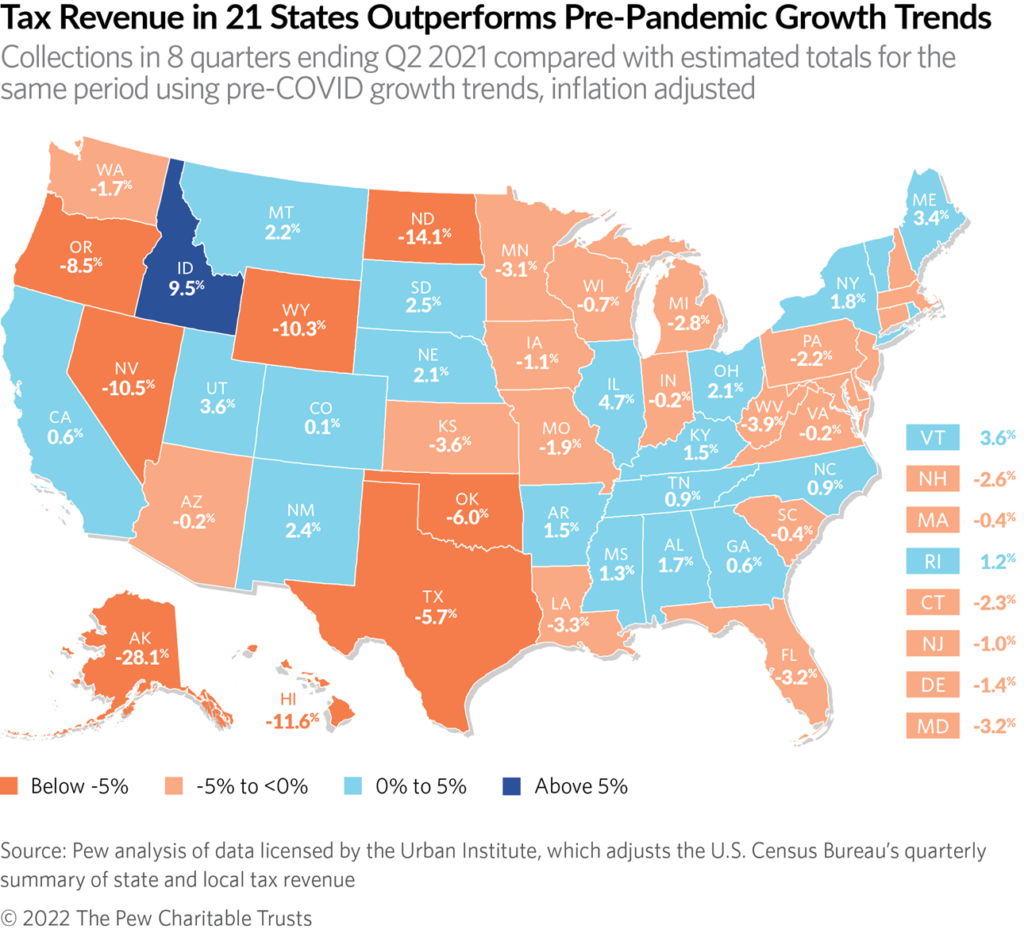

An analysis from Pew Charitable Trusts compared inflation-adjusted tax revenue in the eight quarters ending June 30, 2021 with estimates for that same period had collections grown at their pre-pandemic, five-year average annual growth rate. Despite posting a $413 million surplus in FY 2021, West Virginia was one of 12 states that had not collected enough tax revenue to offset their initial pandemic losses, and one of 29 states where tax revenue collections remained below their pre-COVID growth trends. It is important to note that, as opposed to revenue growth leading to West Virginia’s FY 2021 surplus, the surplus was largely due to the combined impact of low revenue estimates and shifting Tax Day from April to July.

That trend has continued in West Virginia in FY 2022. Through April, West Virginia has posted a significant surplus, with revenue collection coming in at $993 million above the revenue estimate. But FY 2022’s revenue collection through April of $4.758 billion is actually $131 million less than what it should have been if the state had simply maintained the pre-pandemic growth rates it experienced from FY 2017 to FY 2019.

Unprecedented amounts of federal aid to individuals and business – including stimulus checks, supplemental unemployment benefits, expanded child tax credits, and forgivable business loans – helped boost revenue during the pandemic, while rising energy prices and inflation have boosted revenue in 2022. In addition, the federal government has pumped billions into the state budget, allowing West Virginia to maintain a flat budget, which in conjunction with low revenue estimates, helped generate large surpluses.

Without the federal dollars helping keep the state budget flat and the federal aid boosting the economy and fueling a quick recovery, West Virginia may not have made it through the pandemic and recession without any significant budget problems. And while the state is currently experiencing large budget surpluses, revenue collections are below what they would have been if the pandemic had not occurred. As the pandemic ends and federal aid winds down, it will be increasingly important that the state use its surpluses wisely to restore investments that benefit all West Virginians and carefully plan for future budget requirements. Using the surplus to justify further corporate subsidies or tax cuts for the wealthy will only create more budget problems in the future.