Earlier this month, Governor Justice approved the budget passed by the West Virginia Legislature at the end of the 2022 legislative session. Very little in the budget was changed from the flat budget proposed by the governor at the beginning of the legislative session. While appropriations from the base budget (which includes the General Revenue Fund and Lottery Fund) remained relatively unchanged from the previous year, the FY 2023 budget relies heavily on appropriations from the FY 2022 revenue surplus and a dramatic increase in federal funding related to the ongoing pandemic.

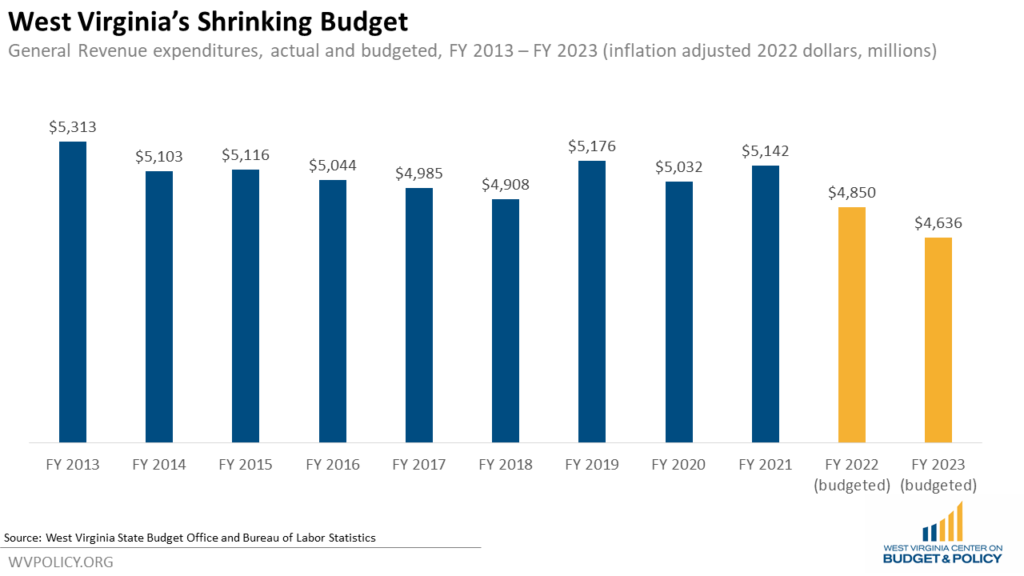

Overall, General Revenue spending in the final FY 2023 budget was $9.7 million below the governor’s proposal, and $140 million above the final FY 2022 budget. Despite the small increase from FY 2022, adjusting for inflation, the FY 2023 budget will be the lowest spending level from the General Revenue Fund in recent history. General Revenue spending in the FY 2023 budget is $677 million, or 12.7 percent, below what it was in FY 2013 (again, adjusting for inflation).

Most of the General Revenue changes between the governor’s proposed budget and the final budget involved actuarial changes to the Teachers’ Retirement System. The Teachers’ Retirement Savings Realized line item under the State Department of Education was reduced by $15.8 million, while under the school aid formula, the General Revenue contribution to the Teachers’ Retirement System was reduced by $4.0 million, and the contribution to the retirement system’s unfunded liability was reduced by $25.0 million.

While the actuarial changes to the Teachers’ Retirement System saved the state millions compared to the governor’s proposal, those savings were largely offset by a newly inserted line item to pay for the state’s Hope Scholarship private school voucher program. The Hope Scholarship requires at least two percent of the total per pupil state aid for public school districts to be set aside for private school vouchers. The FY 2023 budget sets aside $23.3 million for the Hope Scholarship. That amount is expected to grow substantially to over $100 million in the coming years.

Other increases in General Revenue appropriations compared to the Governor’s proposed budget include $3.6 million for the Supreme Court, $5 million for Court Improvement in the Governor’s Civil Contingent Fund, $957,000 for Public Defenders Corporations, $1.2 million for sexual assault intervention and prevention, $5.7 million for Correctional Units, $15.4 million for the State Police, $8.2 million for the Department of Veterans’ Affairs, and $1.0 million for the West Virginia State University Land Grant Match.

Decreases in General Revenue appropriations compared to the Governor’s proposal include $7.0 million from the Department of Tourism, $500,000 from the Division of Culture and History, $13.8 million from Medicaid, $5.0 million from the Marshall University School of Medicine, and $3.9 million from the West Virginia School of Osteopathic Medicine.

Some of the General Revenue reductions are planned to be replaced with appropriations from the FY 2022 surplus. The combination of artificially low revenue estimates along with high energy prices and federal aid have resulted in a significant revenue surplus in FY 2022. The FY 2023 budget appropriated over $1 billion in FY 2022 surplus for use in FY 2023. Of that $1 billion, Governor Justice vetoed $265 million that was to be set aside in a fund for future tax cuts. The remaining $793 million is still to be appropriated in FY 2023 if the surplus funds are available.

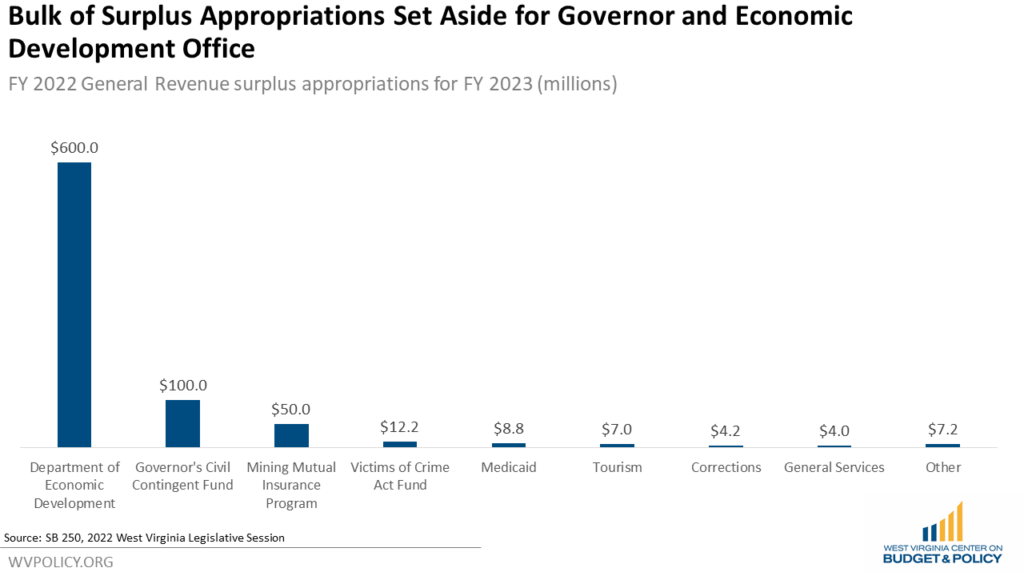

The bulk of the surplus appropriations are set aside for the Department of Economic Development and the Governor’s Office. $600 million of the surplus is appropriated to the Department of Economic Development for the Industrial Development Loans Fund, and $100 million is appropriated to the Governor’s Civil Contingent Fund for Congressional Earmark Maintenance of Effort, with no other details. Another $50 million is set aside for the Mining Mutual Insurance Program created by SB 1. Between the appropriations to the Industrial Development Loans Funds, the Governor’s Civil Contingent Fund, and the Mining Mutual Insurance Program, nearly 95 percent of the state’s $793 million surplus will be used to benefit businesses – with very little legislative oversight – while leaving just $42.6 million to be appropriated for the state programs and services that benefit West Virginia residents. The $42.6 million left from the surplus includes $8.8 million for Medicaid, $7.0 million for Tourism, $4.2 million for Corrections, $4.0 million for General Services capital outlays, repairs, and equipment, $1.0 million for the Department of Commerce, and $1.0 million for the Department of Natural Resources for “Equine Enrichment.”

While the FY 2023 base budget is “flat,” the state’s appropriations from federal sources is anything but. Total appropriations from federal funds and federal block grants in FY 2023 total $9.9 billion, up from $7.4 billion in FY 2022 and $5.8 billion in FY 2021.

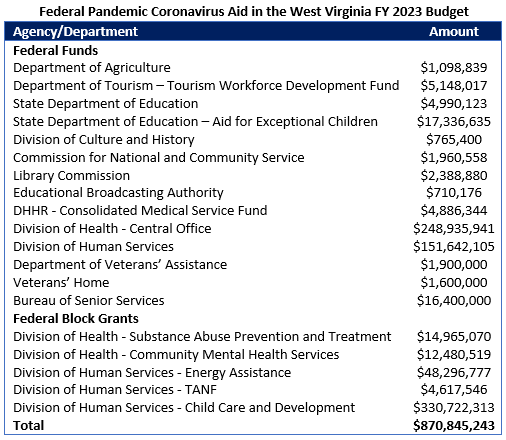

Much of the increase in federal funding is pandemic-related federal aid. The FY 2023 budget contains over $2.2 billion in federal pandemic aid, including $1.3 billion for the “Governor’s Office Coronavirus State Fiscal Recovery Fund” which is the state’s share of the American Rescue Plan (ARP) funding. The remaining $871 million in federal pandemic aid is distributed to various state agencies and includes $330 million for Child Care and Development, $249 million for the Division of Health, $151 million for the Division of Human Services, and $48 million for Energy Assistance. In addition, the state’s Federal Medical Assistance Percentage (FMAP) was increased by the CARES Act for the duration of the public health emergency, meaning the federal government is providing more Medicaid funding than is typical. Total federal funding for Medicaid in FY 2023 is $3.935 billion, up from $3.598 billion in FY 2021.

West Virginia was fortunate to make it through another year of the pandemic and recession without any significant budget problems. But without both federal aid and artificially low revenue expectations, the surpluses the state is currently experiencing wouldn’t exist. And while, fortunately, the state avoided making any costly and ineffective tax cuts during the 2022 legislative session that would have jeopardized the state budget, the state also failed to use these temporary surpluses to make needed investments that benefit all West Virginians and carefully plan for future budget requirements. As the pandemic ends and federal aid winds down, it will become exceedingly difficult to maintain flat budgets without harming the investments that help build a stronger and more equitable economy in the Mountain State.