In December, West Virginia state lawmakers in the Joint Committee on Finance discussed the “cliff effect,” a phenomenon wherein a small increase in household income makes an individual or family ineligible for public programs like Medicaid and food assistance. The result can often mean less economic security for the individual or family, as the cost of paying for other health insurance or loss of food benefits makes their total household income lower than before the pay increase.

Lawmakers and state officials posited that the cliff effect is a potential barrier to West Virginians joining the workforce or accepting better-paying jobs. While the context for this discussion was based on some dubious claims about a worker shortage – and in fact, while resignations are at an all-time high, workers are largely moving into better jobs, not leaving the job market – the cliff effect is still important to address to achieve increased family economic security and well-being. One powerful potential solution to the phenomenon that enjoys bipartisan support in West Virginia is a Medicaid buy-in, which would allow people who have income changes that put them above Medicaid expansion guidelines to remain in the program by paying a monthly premium. Implementing a Medicaid buy-in would mean that workers and families would no longer be dropped off a cliff, but instead gradually stair-stepped out of Medicaid coverage as their incomes go up.

A Medicaid buy-in is a state-initiated health insurance product that allows people above current Medicaid eligibility levels to pay a monthly premium (on a sliding scale based on household income) to receive health coverage through Medicaid or a Medicaid-like plan built atop the state’s existing Medicaid infrastructure. Such a program would allow a person on Medicaid whose income increases above the requirements of the existing Medicaid program to pay an affordable premium to stay with the same insurer, plan infrastructure, and provider network, thus helping increase continuity of care and improve health outcomes.

As it currently stands, transitions in and out of Medicaid eligibility based on small income changes can be disruptive to impacted workers and families, creating challenges to accessing providers, obtaining needed medications, and seeking care. These coverage disruptions can also result in increased costs for the state associated with uncompensated care. Under a Medicaid buy-in, rather than losing eligibility altogether with a change in income, a worker or household would have the option to move into a plan very similar to the one they are currently enrolled in, by beginning to pay a monthly premium that is affordable based on a sliding scale.

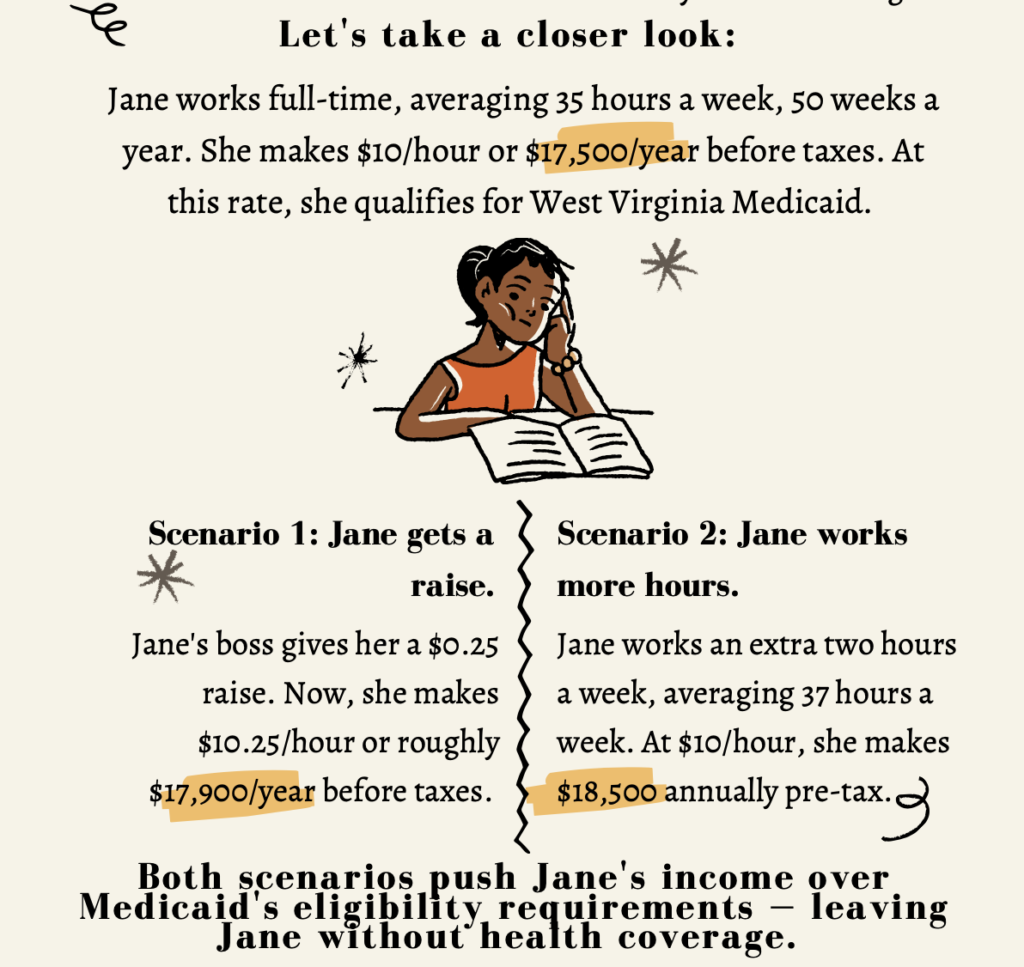

To illustrate the benefits cliff effect: say a person is working full-time (e.g., 35 hours a week for 50 weeks a year) at $10 per hour. They would make roughly $17,500 annually before taxes and just qualify for the Medicaid expansion (the cutoff is 138 percent of the federal poverty level or about $17,700 annually).

Now say that person was offered a raise of 25 cents – $10.25 an hour, or $17,937.50 annually pre-tax. At that rate, they would be over the income eligibility guidelines for Medicaid and would no longer have access to the program.

Knowing their Medicaid coverage was in jeopardy, consider that person turned down the raise and continued to work for $10 per hour. However, say they work an extra two hours per week, averaging 37 hours for 50 weeks. That would put their pre-tax annual income at $18,500 – again, over Medicaid’s income eligibility requirement.

Note: You can find a more detailed, standalone infographic here.

We can see how the eligibility cliff might put a worker or family at a crossroads: should they accept an income increase or a better job and risk losing their health coverage, or remain at a lower wage or fewer hours so they can remain insured?

A Medicaid buy-in addresses this problem – and it is not an altogether new concept. Along with forty-four other states, West Virginia already operates a program similar to a Medicaid buy-in, though with a different financing structure and targeted eligibility limited to a small population: adults with disabilities. In West Virginia, the Medicaid Work Incentive Network (MWIN), allows enrollees who work to pay a small monthly premium to keep Medicaid coverage when they no longer qualify for traditional Medicaid. The MWIN program is framed as “a work incentive for people with disabilities or chronic health conditions that… eliminates a major barrier to employment – losing current health benefits when an individual with a disability returns to work.” While a Medicaid buy-in would be structured a bit differently, the MWIN program shows the value and potential success in allowing people to work and also buy into Medicaid.

During this legislative session, lawmakers will have a chance to consider real solutions to the benefits cliff if they are serious about doing so. HB 3001 “Creating the Affordable Medicaid Buy-in Program,” has bipartisan sponsorship and was introduced on the first day of session. By enacting a Medicaid buy-in program that is available to West Virginians coming out of traditional Medicaid eligibility, we can address the benefits cliff and help empower West Virginia families so that they no longer have to choose between higher wages and affordable health coverage.

Please note, the WVCBP does not provide direct services. Our infographic is for educational purposes only. Visit dhhr.wv.gov to learn more about Medicaid. Visit us at wvpolicy.org org to learn more about a Medicaid buy-in.