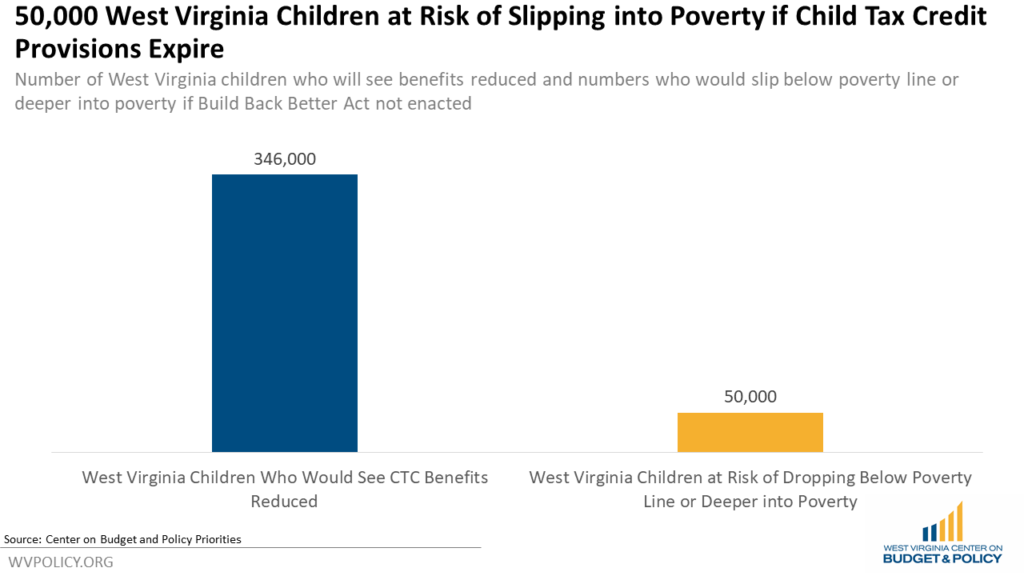

Under the American Rescue Plan Act (ARPA), Congress temporarily increased the Child Tax Credit (CTC) for more than 65 million children nationally, including 346,000 in West Virginia where it reaches 93 percent of children. Since July, most households with children have received $250- $300 per child monthly via the increased CTC, but the final payment is scheduled for this week unless Congress acts to extend the program. The CTC improvements via ARPA have driven historic reductions in child poverty and significantly decreased household hardship, progress which is at risk if the Senate does not pass the Build Back Better Act (BBBA). This would result in a reduced or eliminated Child Tax Credit for the 346,000 children in the state currently benefitting from the expansion and would drive 50,000 of the lowest income children in the state below the poverty line or deeper into poverty.

The ARPA increased the maximum CTC amount from $2,000 per child to $3,600 per child under the age of six and from $2,000 to $3,000 per child age six to seventeen. It also made the full credit available to low-income families and allowed families to receive the credit payment monthly so that they can use it in real time to address household needs, rather than waiting for a once-annual benefit at tax time. Survey data shows that West Virginia families have used their monthly CTC payments to afford basic needs, including groceries, utilities, rent or mortgage, and school supplies. The increased CTC has also had a significant impact more broadly, sending an estimated $539 million dollars into West Virginia, supporting in-state businesses and our state’s economy.

The BBBA would extend the increased value of the CTC for another year and ensure that low-income households continue to receive this important benefit. If it fails to be enacted, the maximum credit would fall by $1,000 to $1,600 annually per child and the poorest families would see their benefits reduced even further, causing 50,000 West Virginia children to fall below the poverty line or deeper into poverty. This would result in the CTC going back to a status quo where it provides the least help to the children and households who need it most.

Additionally, the BBBA would continue the option for families to receive CTC payments on a monthly basis, which has helped drive reductions in household hardship and boost households’ incomes throughout the year.

Reducing child poverty is imperative on its own, but it is also critical to consider the hardships that come along with it. Child poverty is associated with lower educational attainment, poorer health in adulthood, and lower lifetime earnings. Enacting the BBBA and its policies to help improve family and economic security will have significant economic and child well-being impacts for families across our state — and will keep tens of thousands of West Virginia children out of poverty.