The combination of tax changes in the Build Back Better bill recently approved by the House Ways and Means Committee would result in a tax cut for the average taxpayer in all income groups except the wealthiest 5 percent in West Virginia, according to a new report from the Institute on Taxation and Economic Policy. The bill would make the federal tax system more progressive, by raising taxes overall on the richest 5 percent of Americans and foreign investors, while cutting taxes overall for other income groups- and that is before accounting for the broad benefits of the programs that would be funded through these tax changes including paid family and medical leave, investments in the child care and home health workforces, and more.

The Build Back Better bill raises $2.1 trillion over 10 years through increases to individual income taxes, corporate income taxes, and taxes on tobacco and nicotine. The vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts — expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) — would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

On the income tax side, the Build Back Better Bill would reverse the 2017 income tax cut for top earners, restoring the top back to 39.6 percent from 37 percent, and adjust the top bracket so that it starts at taxable income of $450,000 for married couples, $425,000 for single parents, and $400,000 for singles. The bill would also partly repeal the special, lower personal income tax rate for certain income from wealth (long-term capital gains and stock dividends), repeal an exception in the 3.8 percent net investment income tax, limit deductions for pass-through business income, and create a 3 percent surcharge on adjusted gross income in excess of $5 million. In West Virginia, these tax increases would affect only 0.5 percent of all taxpayers, with 100 percent of the tax increases paid by the wealthiest 1 percent of taxpayers in the state.

The bill also would increase the corporate income tax rate from 21 percent to 26.5 percent, still well below the 35 percent rate before the 2017 tax cut bill, restrict and eliminate special corporate income tax breaks and loopholes, particularly those related to offshore profits, and increase federal tobacco and nicotine taxes. While the tobacco tax increases would fall more heavily on low and middle income earners, these, and all of the bill’s tax increases are more than offset by the bill’s biggest tax cuts, the expansions of the CTC and EITC.

The Build Back Better bill would extend the expansions of the EITC and CTC, which were enacted as part of the American Rescue Plan Act and are set to expire at the end of this year. For the CTC these expansions include increasing the credit from a maximum of $2,000 per child to $3,600 for each child younger than six and $3,000 for each child age six or older through 2025, extending the increase in the age of eligibility by one year to include 17-year-olds, and making permanent the repeal of limits on the refundable portion of the credit and restoring eligibility for an estimated one million immigrant children. For the EITC, these expansions include increasing the maximum EITC from roughly $540 to $1,525 for childless workers making up to nearly $22,000 in tax year 2022 and removing the age limits that prevented working adults without children in the home who are younger than 25 or older than 64 from receiving the credit.

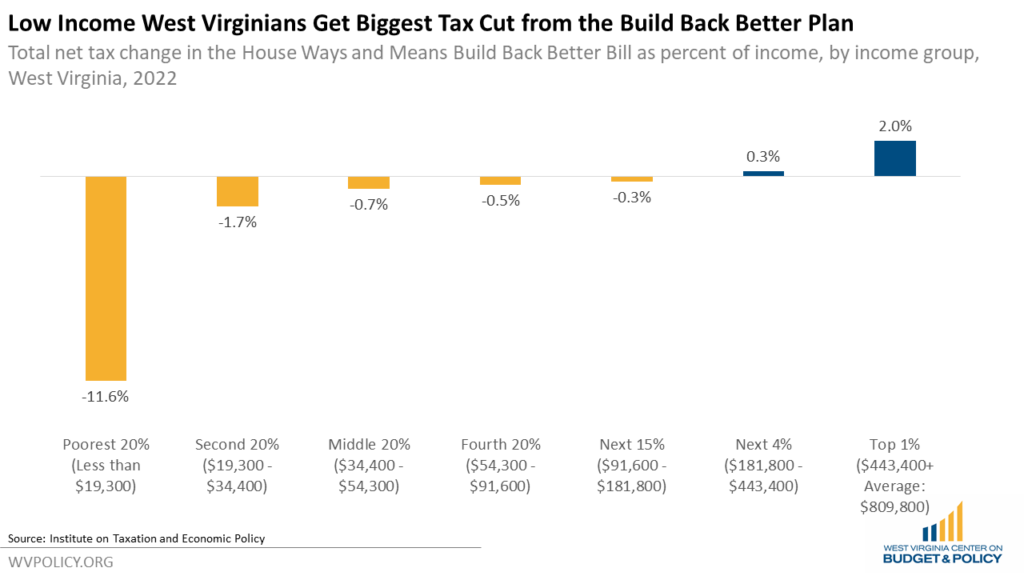

The net result of the tax changes would be a significant tax cut on average for low income earners, and a small tax increase for the very wealthy. In West Virginia, taxpayers in the bottom 20 percent of income earners (those making less than $19,300), would see an average tax cut of $1,240, or over 11 percent. Meanwhile, only the wealthiest 5 percent of taxpayers in West Virginia would see a tax increase.

While only a fraction of a percent of West Virginians will see a tax increase under the current version of the Build Back Better plan, tens of thousands of West Virginians will benefit from the expansions of the Child Tax Credit and Earned Income Tax Credit. The boost to the Child Tax Credit will benefit an estimated 346,000 children in West Virginia, dramatically reducing child poverty, while the expansion of the Earned Income Tax Credit for childless workers will benefit an estimated 110,000 West Virginia workers.