The enhanced child tax credit (CTC) is part of the federal government’s relief package (American Rescue Plan Act, or ARPA) to help families during the pandemic. In 2021, this plan increases the amount of money that families with children can get refunded from their taxes – up to $3,000 for six to 18 years old and $3,600 for children under six. The plan also helps families with low or no income get their fair share too. If made permanent, the enhanced CTC is a very powerful tool that can help up to 93 percent of West Virginia kids get the tools they need for a brighter future.

The enhanced CTC temporarily improves the traditional credit in several important ways:

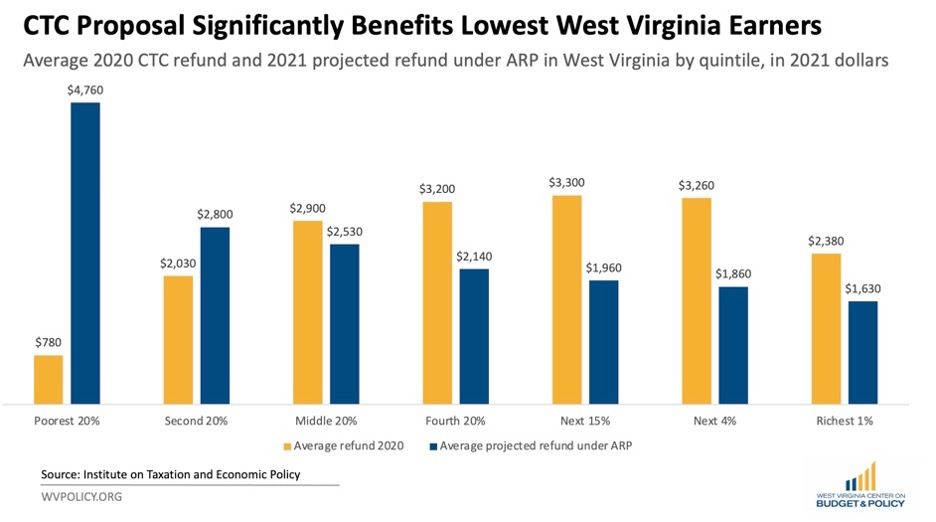

By temporarily improving the CTC, the enhanced CTC not only reaches more West Virginia kids – it also increases the amount of money the lowest-income families will receive. Experts expect the credit to reach most of West Virginia’s 400,000 children – and get more assistance to families that need it most.

If you claimed the CTC in 2019 or 2020, these payments have already begun – no further action is needed! If you have children but have not previously claimed the CTC or filed taxes, you will need to take further action to start receiving refunds. Those who have not previously filed taxes will also receive a stimulus payment. Claiming these payments will not disrupt any of your benefits – including Medicaid, CHIP, SNAP, WIC, WV Works, and others.

Scan the QR code here or go to bit.ly/getCTC2021 to check your eligibility, submit your information, and learn more.

Experts estimate that the enhanced CTC will lift 43 percent of West Virginia kids out of poverty if made permanent. According to a wide body of research, the CTC has long-term benefits on educational attainment, health, earnings, and work. Legislators on the federal level must take action to ensure a brighter future for our children.

For a shareable version of this information, check out our Child Tax Credit explainer: https://wvpolicy.org/wp-content/uploads/2021/09/ctc-explainer.pdf