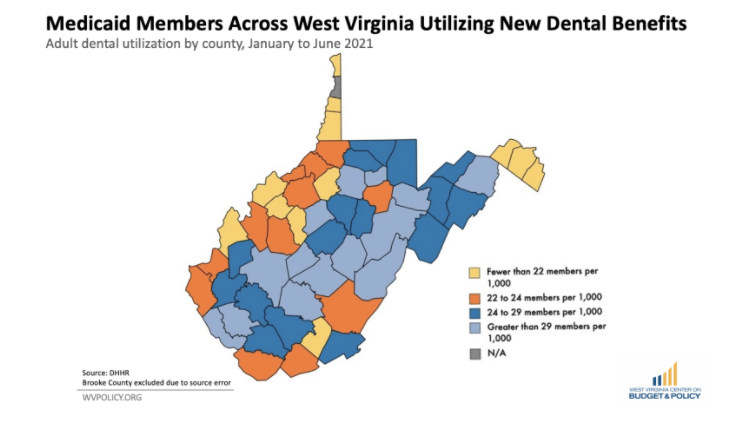

As a result of SB 648 (passed in 2020), this year West Virginia began offering a dental benefit for adults over the age of 21 who are enrolled in WV Medicaid. Our newest blog post takes a look at how this new benefit has impacted WV Medicaid members.

Nearly one in five West Virginia adults gained access to dental benefits via Medicaid this year. Over the first five months of this new benefit, over 18,500 members have utilized newly available dental services, totaling almost $7.8M in covered benefits and payments to dentists throughout the state.

While it will take some time to disaggregate the collective impact of the dental program over time, preliminary evidence collected from individual experiences suggest both short- and long-term benefits.

It is widely recognized that oral health has significant impacts on overall health and well-being. Thanks to this new benefit, the state is likely to see overall health savings due to reductions in unnecessary emergency room care as well as improved chronic health outcomes.

While this dental benefit has already positively impacted thousands of WV Medicaid beneficiaries, many others remain unaware of new benefit’s existence, which signals the need for more robust outreach.

Read Kelly and Rhonda’s full blog post here.

The West Virginia Oral Health Coalition has put together an informational postcard on the dental benefit if you’d like to help get the word out! You can access it here.

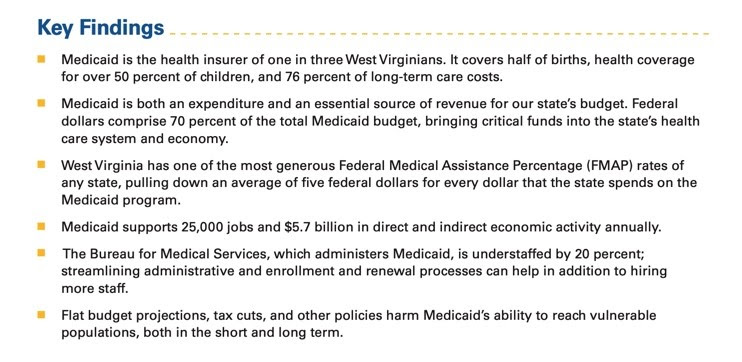

The WVCBP’s newest report explores the critical nature of Medicaid in West Virginia, both for individual and community health outcomes, and for the state’s economic well-being.

The report was written by the Center’s health policy analyst, Rhonda Rogombe, who begins by outlining the basics of Medicaid and its administration and goes on to explain the heightened importance of the program amid the COVID-19 pandemic, the positive economic impacts of the program, the fiscal challenges the program is currently grappling with that are only expected to worsen over time, and how these challenges can be meaningfully addressed.

You can read the full report here.

And you can listen to Rhonda talk about some of the details of her report in her recent interview here.

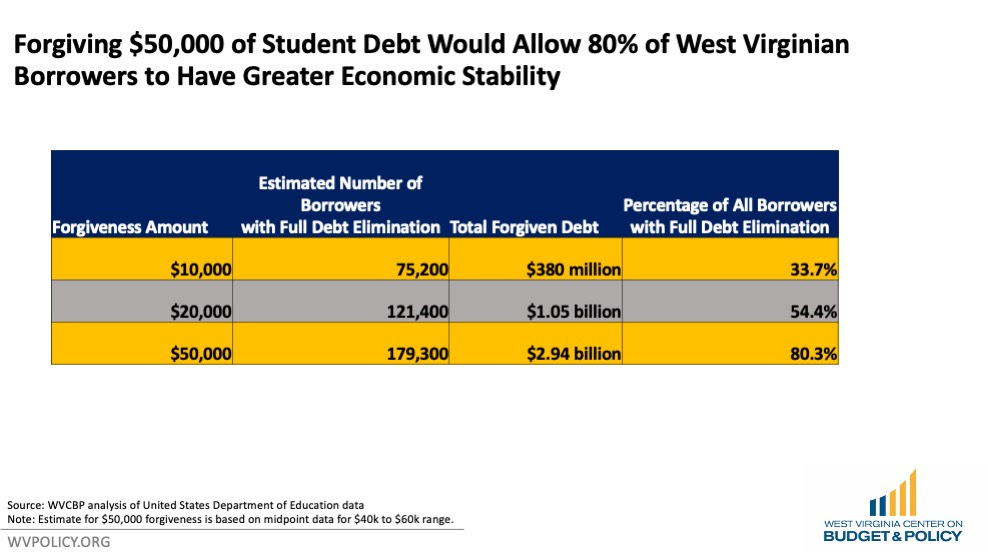

Federal student loan debt has more than tripled since 2007, jumping from $516 billion in 2007 to nearly $1.6 trillion in March of 2021. In our new blog post, Quenton explores the landscape of student loan debt in West Virginia, as well as what can be done to help relieve some of the burden.

Some quick figures:

– West Virginia borrowers hold $6.5B of student loan debt

– Roughly 223,000 West Virginians have federal student loans

– 33 percent of West Virginia borrowers are between the ages of 25 and 34; another 32 percent are between the ages of 35 and 49. These age ranges also have the largest share of debt.

West Virginians continue to face rising college tuition due to the state’s defunding of higher education. These rising costs likely contribute to the state’s high loan default rates. The most recent data from the Department of Education indicates that West Virginia has the fifth highest rate of default nationwide.

Debt is burdensome for people leaving college as they begin to transition into working adulthood. Numerous reports have documented how millennials in particular have delayed traditional milestones such as starting a family or buying a house as a result of their student loan debt.

Many elected officials, including President Joe Biden, have called for student loan forgiveness to varying degrees. Senator Elizabeth Warren’s plan to clear $50,000 in student debt could eliminate entirely the debt of 179,000 West Virginians.

Research suggests that student loan forgiveness could have far-ranging benefits for the social, physical, and economic wellbeing of our state. Borrowers have indicated that, sans debt, they would be more likely to purchase homes, open new businesses, start families, and more. With that said, student loan forgiveness is only part of the solution. Student loan forgiveness should be combined with increased higher education funding in order to secure West Virginia’s future.

Read Quenton’s full blog post.

| In early July, Gov. Jim Justice announced that the state had a budget surplus of $413 million. But when you take a closer look, this seemingly vast surplus turns out to be a mirage. A recent article with insight from our senior policy analyst Sean O’Leary explains why. Excerpt below: Nearly half of West Virginia’s $413 million surplus — $192 million — was income tax from the previous year. The money, which would normally have been accounted for in the previous year’s revenue, was collected late because of COVID-related extensions in filing deadlines. Moreover, the surplus is based strictly on how much higher revenue was than what the executive branch predicted when creating the budget. And officials lowered those predictions by $220 million from the previous year’s estimates, even before COVID-19 ravaged the national economy. West Virginia’s tax revenue was also boosted by over $12 billion of federal aid pumped into the state economy, including over $4 billion in direct stimulus checks, though it’s difficult to measure the exact impact that the stimulus checks, as well as enhanced unemployment and Paycheck Protection loans, had on individual and corporate spending. Still, lawmakers, as well as Justice, are celebrating the surplus and are using it to justify spending and future tax cuts based on the apparent windfall. Read the full article here, and Sean’s blog post on the same topic here. |

Earlier this year, our federal policymakers sent money to families so people can pay their rent and put food on the table, helped school districts protect teachers’ health and get kids back into the classroom, and boosted vaccine distribution—all of which will help accelerate our economy and deal with the immediate health and economic impacts of the pandemic.

Congress acted because we raised our voices together and demanded help. With short-term relief on the way, now Senator Manchin and Senator Capito need to look to our future and pass economic recovery legislation that ensures everyone can thrive, no matter what we look like or where we come from.

Our elected officials are drafting recovery legislation now, so it’s time to make yourself heard again. Tell them you want our government to support working families and invest in our economic recovery by making health care coverage more available and affordable, permanently expanding relief for struggling people, and ensuring children get the support they need to succeed.

Please join us in urging Senators Manchin and Capito to support the Build Back Better recovery agenda by sending them a letter here.

In the next several weeks, the first of $677 million will be distributed to county and city governments throughout West Virginia. The goal of this money is to support local efforts to recover from the widespread devastation caused by the COVID-19 pandemic, but how the money is spent will largely be up to the local government in question. With your help, we can create a list of priorities that center the needs of those most impacted, and a group of folks to advocate for the aid that is most needed.

We want to hear from YOU: how do you think your local government could spend this funding? What areas of your city have suffered the most from the pandemic? What kinds of investments will help your community in the long term?

Please complete our survey here to share your insight with us. There are no wrong answers, and please feel free to share the survey with anyone whose input you’d like to see considered!

The American Rescue Plan (ARP) authorized significant but temporary changes to the Child Tax Credit and this month, eligible families received the first of their monthly enhanced credits. Here are the four changes included in the ARP that might help you with the financial burden of raising a family:

1. The credit amount has been increased. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for children under age 6, and $3,000 for other children under age 18.

2. The credit’s scope has been expanded. Children 17 years old and younger, as opposed to 16 years old and younger, will now be covered by the Child Tax Credit.

3. Credit amounts will be made through advance payments during 2021. Individuals eligible for a 2021 Child Tax Credit will receive advance payments of the individual’s credit, which the IRS and the Bureau of the Fiscal Service will make through periodic payments from July 1 to December 31, 2021. This change will allow struggling families to receive financial assistance now, rather than waiting until the 2022 tax filing season to receive the Child Tax Credit benefit.

4. The credit is now fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

If any of these circumstances apply to you, we’d love to hear how your family will be impacted! Please let us know by taking our survey here.

Learn more about how the Child Tax Credit payments are helping West Virginians in this article or our recent Facebook Live.

RESULTS is a nonpartisan, nonprofit organization whose movement of advocates works together toward equity and the end of poverty.

The RESULTS Fellowship seeks to inspire and train new advocates in the movement to influence political decisions that will bring an end poverty. The Fellowship is an opportunity for young adults (age 20-35) to broaden their experience and knowledge in the operations and organization of Congress while advocating on key poverty issues, like global health and affordable housing. RESULTS provides training and support to speak powerfully, engage with the media, advocate directly to members of Congress, and mobilize your community. RESULTS has proven over the past 40 years that when people like you use their voices effectively, we can make progress towards the end of poverty. The RESULTS Fellowship is an unpaid Fellowship for individuals living in the United States.

Access further details and the fellowship application here.