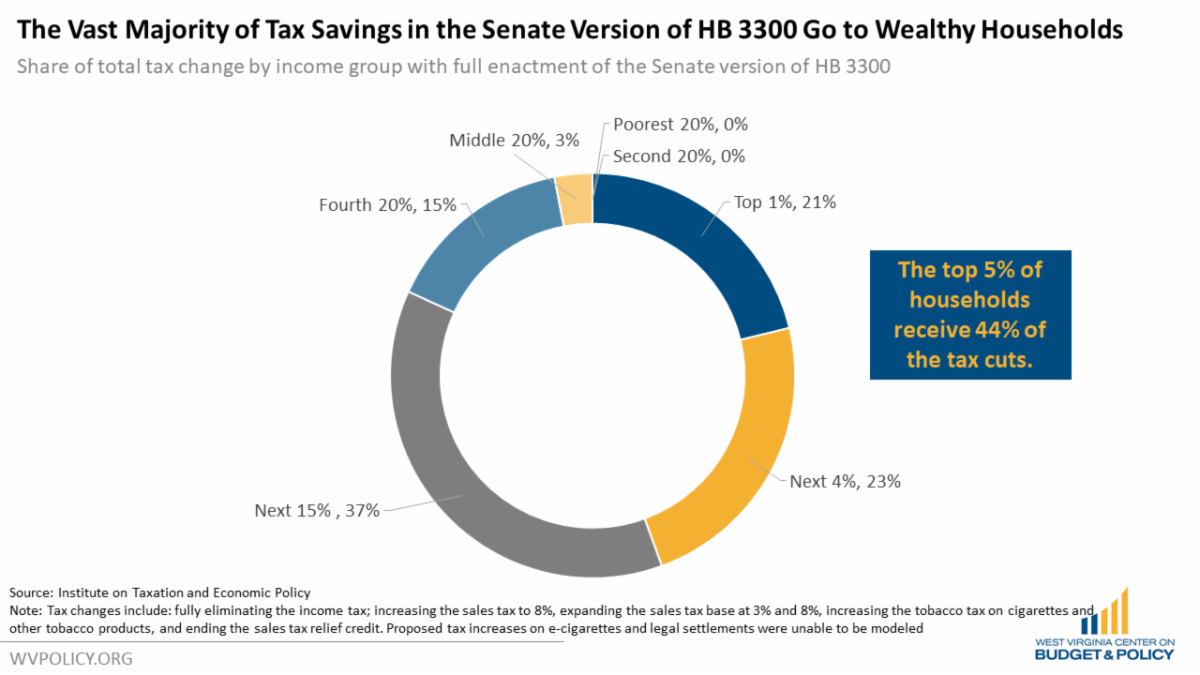

Wednesday night, the full WV Senate took up HB 3300, the House-originated personal income tax cut plan, and made a significant amendment before quickly passing the bill. Senators voted on the legislation without having had adequate time to fully discuss and comprehend its far-reaching implications — a reckless action given that the bill would impact every household in the state.

You can find the full analysis of the Senate-amended version of HB 3300 and what it means for our state in our newest blog post. The analysis highlights are as follows:

As of publication of this newsletter, the WV House has not yet taken up the Senate-amended version of HB 3300 to concur or refuse to concur. WVCBP will continue to monitor any further movement of the bill closely.

We welcome you to join us and send a letter urging legislators to prioritize investing in West Virginia’s families and communities over providing a tax cut to the state’s wealthiest here.

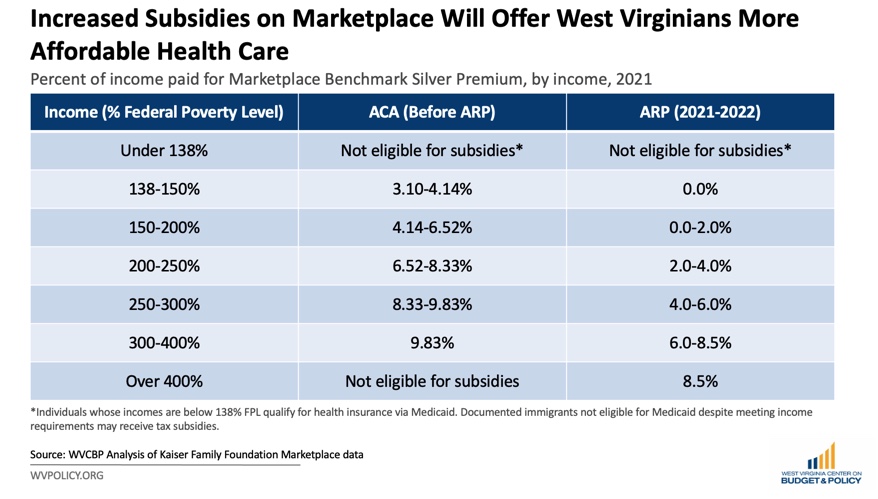

Just last month, the Affordable Care Act (ACA) celebrated its eleventh birthday. The ACA is the most extensive health care reform law in the United States since the passage of Medicaid and Medicare in 1965. The ACA has granted over 20 million Americans more affordable and accessible health insurance. Beyond that, it has touched the lives of nearly every patient, even those who already had private insurance. It has done a great deal to improve patient outcomes over its lifetime — from subtle changes, such as requiring calorie counts on menus, to the broad, sweeping changes like ensuring that people with pre-existing conditions do not pay higher premiums and allowing people under 26 to stay on their parents’ insurance. It allowed states to enroll significantly more people into Medicaid and created a marketplace for those without affordable health insurance elsewhere. West Virginia was one of the biggest benefactors of these changes, undergoing the nation’s most significant drop in uninsured individuals after its implementation.

Since 2010, the ACA has made significant changes to the nation’s health care infrastructure. But despite all its accomplishments, many Americans remain uninsured today. According to the Kaiser Family Foundation, insurance costs are the primary reason individuals forgo insurance. In response to the plateauing uninsured rate — further exacerbated and highlighted by the ongoing COVID-19 pandemic — the federal government passed the American Rescue Plan (ARP) in March of 2021. Among many provisions, it has made changes to the ACA that help more people access critical care, including:

These provisions are currently in place through 2022.

Learn more in Rhonda’s full blog post.

| In the next several weeks, the first of $677 million will be distributed to county and city governments throughout West Virginia. The goal of this money is to support local efforts to recover from the widespread devastation caused by the COVID-19 pandemic, but how the money is spent will largely be up to the local government in question. With your help, we can create a list of priorities that center the needs of those most impacted, and a group of folks to advocate for the aid that is most needed. We want to hear from YOU. How do you think your local government could spend this funding? What areas of your city have suffered the most from the pandemic? What kinds of investments will help your community long term? Let us know by filling out this survey. There are no wrong answers, and please share this survey with anyone whose input you’d like to see considered. We appreciate your thought and time! |

A bill passed by the full West Virginia House and now being considered by the full Senate, HB 2581, seeks to change how natural gas property is valued for property tax purposes, including allowing for additional expense deductions that would lower the appraised values of oil and gas wells, resulting in an overall tax cut for the industry.

According to the bill’s fiscal note, the total impact would be a loss of $9.1 million in property tax revenue, concentrated in the state’s gas producing counties. Since most property tax revenue funds local school districts, this loss of revenue would mean that the state would increase its share of the school aid formula by approximately $1.1 million.

With other tax cut proposals threatening both state and local government budgets, HB 2581 merely adds to West Virginia’s growing budget problems.

Learn more in Sean’s full blog post.

Find further insight from Sean and additional details of how changes to natural resource taxation under consideration this legislative session could impact local governments, check out this article.

HB 2017 started as a massive criminal sentencing rewrite which would have significantly increased incarceration rates and taxpayers’ burden without being developed with adequate input from stakeholders like prosecutors, public defenders, judges, advocates, or directly impacted people.

This week, the Senate Judiciary committee approved a strike-and-insert amendment in HB 2017 that directs the Sentencing Commission to consider the version of the 400-page criminal code rewrite that the House passed last week. While the Commission would be required to consider it, they would not not bound to adopt it.

The bill as amended passed the full Senate and went back to the House yesterday, where it was referred to the House Judiciary committee. We believe the bill is unlikely to pass this session.

This would be a huge — albeit potentially temporary — win for those attempting to prevent our criminal legal system from further regressing. If the original rewrite had been signed into law, it would have delayed the parole eligibility date or increased maximum prison sentences for more than 200 felony crimes.

WVCBP will continue to closely follow any further movement of the bill.

Despite the fact that needs-based harm reduction efforts are supported by the U.S. Centers for Disease Control and Prevention (CDC) and empirically proven to save lives and prevent the spread of disease, SB 334 — a bill that would severely restrict harm reduction programs statewide — has passed out of the full Senate and now awaits a passage vote by the full House. If the bill is adopted, it will have not only a severe moral cost, but a dramatic financial cost as well.

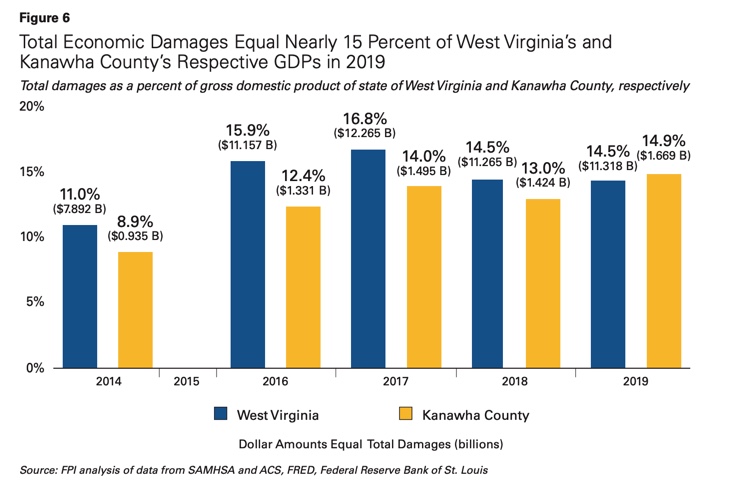

West Virginia has long been at the forefront of the overdose epidemic in the US. Since 2010, its death rate per 100,000 by overdose of any type of drug has led the nation. Our recent report, authored by economist Dr. Jill Kriesky, both shows the heavy economic toll this crisis has on West Virginia as a whole and shines a spotlight on Kanawha County, the county with the highest number of overdose deaths in the state.

Among other alarming findings, the report reveals that the overdose crisis cost West Virginia $11.3 billion & Kanawha County $1.7 billion in 2019 alone. These staggering amounts represent nearly 15 percent of the state & county gross domestic products, respectively.

The report includes a brief overview of harm reduction programs designed to address these enormous damages and what is known about their cost-effectiveness. A key staple of harm reduction efforts, syringe services programs, are cited as reducing HIV & Hepatitis C by nearly 50 percent. It is these same services that the West Virginia Legislature is looking to severely restrict through SB 334.

You can access our full report here, read a summary of its findings in a recent article here, and find further insight in an op-ed accompanying the report here.

If SB 334 were not enough, harm reduction is also facing attacks at the city-level. Earlier this week, Charleston City Council considered a proposed ordinance that, if adopted, would outlaw currently legal needs-based harm reduction programs like that run by Solutions Oriented Addiction Response (SOAR). The council voted to delay their vote on the ordinance until a decision is made at the state level. If SB 334 is not signed into state law, needs-based harm reduction may still become severely restricted in the city of Charleston.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of needs-based harm reduction services.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

We at the WVCBP wholeheartedly believe that needs-based harm reduction programs make our communities healthier, safer, and kinder. We would sincerely appreciate if you contacted your Council Member and expressed support for these life-saving programs.

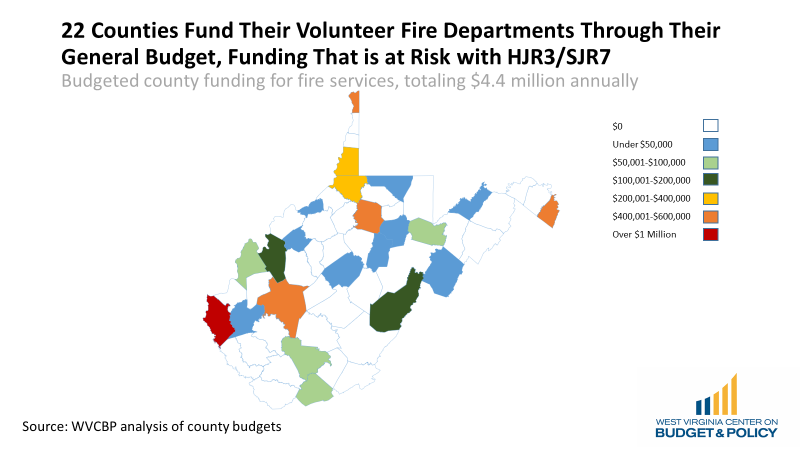

Last week, the full House passed HJR 3, and the resolution now awaits a passage vote in the Senate. This legislation seeks to take local property taxation authority away from locally elected officials and send it to Charleston, despite the fact that local governments receive over 99 percent of property tax revenue.

While proponents say this only gives a future legislature the authority to to reduce or eliminate business personal property taxes, it’s been made very clear that this is the ultimate intention, which could cost local governments as much as $500 million annually.

Local property taxes fund public schools and county services. While lawmakers often promise that a future legislature will make counties whole, there is no way to know if state revenues will be available in future years to do that, leaving local public services at great risk.

Urge your legislators to reject these proposals that would take taxing authority away from local governments & voters while setting the stage for expensive tax cuts & cuts to public services here.

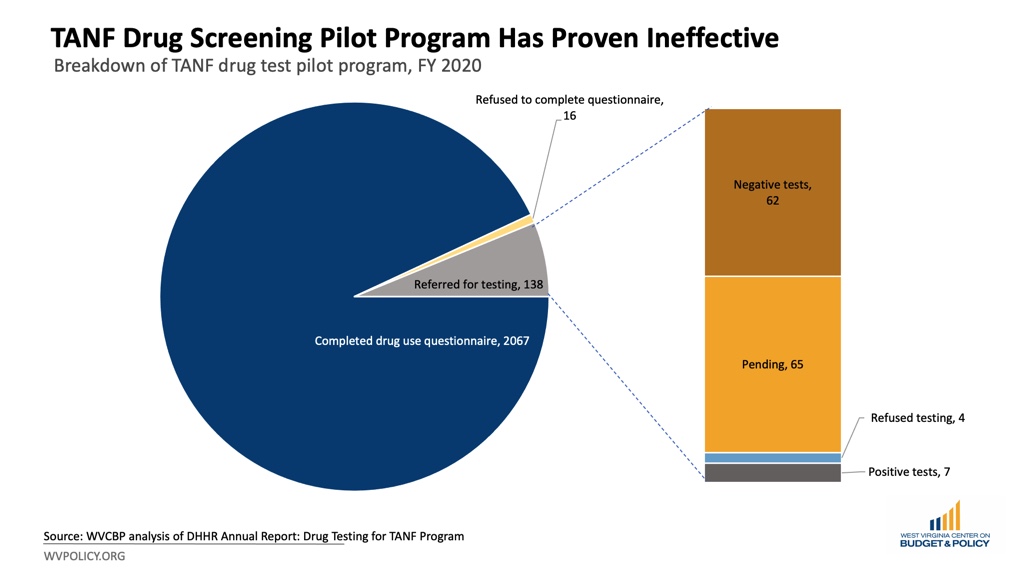

SB 387 has now passed the full Senate and the full House and will be sent to Governor Justice to be signed into law. This bill would make applicants who test positive for drugs or refuse a drug test ineligible for Temporary Assistance for Needy Families (TANF) assistance.

Our blog post from health policy analyst Rhonda Rogombé explains how such a policy choice will further stigma, harm vulnerable populations, and contradict public health best practices:

“Rendering benefits contingent on passing a drug test for individuals otherwise eligible for cash assistance does not meaningfully address substance use problems. Instead, it does quite the opposite — drug screening creates barriers for those who may otherwise seek treatment.

“In a state already riddled with budget shortfalls, dedicating resources to an initiative that further stigmatizes individuals with low incomes — while worsening their material conditions — contradicts the core mission of TANF and other social programs, as well as best practices for public health. Rather than punishing TANF recipients by extending the drug screening program, West Virginia must recommit to providing basic assistance to families. Redirecting funds toward these initiatives would better serve low-income families and help create a healthier West Virginia.”

Read Rhonda’s full blog post.

Please join us in calling the governor and urging him to veto this stigmatizing, ineffective policy.

WVCBP’s Summer Policy Institute (SPI) is an annual event for college students and young people interested in bettering West Virginia through policy change. SPI brings together highly qualified traditional and non-traditional college students and young people to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the convening, attendees work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

Applications for SPI are being considered through April 30. Further details and link to apply here.