Ten states, including West Virginia, have enacted proposals that cut personal or corporate income taxes at various points in the future, contingent on revenues reaching a certain level or growth rate. While using triggers is often portrayed as fiscally responsible, it is far from it. Lawmakers enacting these drawn out tax cuts typically do not have enough information to fully understand if the cuts will be responsible or desirable when they take effect, and the experiences of West Virginia and other states show that such cuts have the potential to cause deep and lasting damage to a state’s ability to provide basic public services to its people.

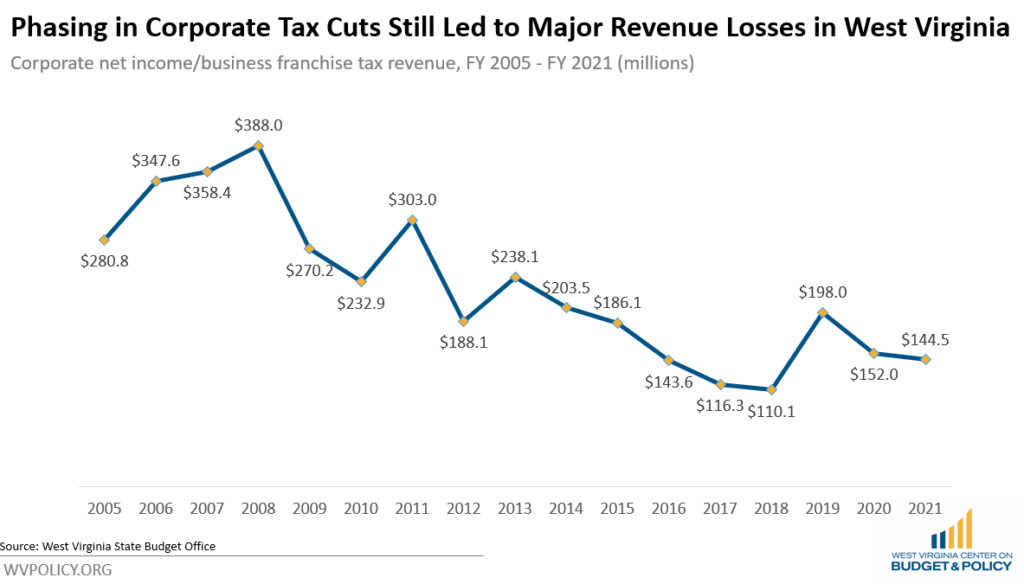

Between 2007 and 2015, West Virginia’s corporate net income and business franchise tax cuts were phased in via trigger mechanisms that relied on the balance of the state’s rainy day fund. The state tax department estimated that the tax cuts, once fully phased in, would cost $118 million annually, while advocates of the tax cuts argued that the lost revenue would be made up through the economic activity the tax cuts would create. Instead, the tax cuts failed to generate any growth, with West Virginia having the slowest job growth in the country over the past decade. And as the tax cuts phased in, they grew more expensive. Corporate net income/business franchise tax revenue dropped from a peak of $388.0 million in FY 2008 to $144.5 million in FY 2021, making the tax cuts more than twice as costly as initially projected. Over that same time period, the state’s higher education funding has been cut by 20 percent and public health department funding cut by 29 percent, adjusting for inflation.

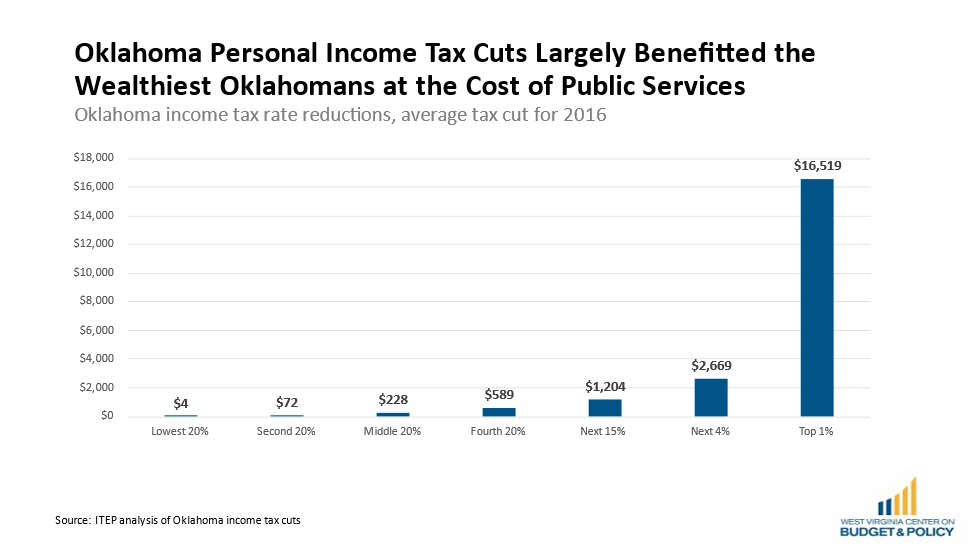

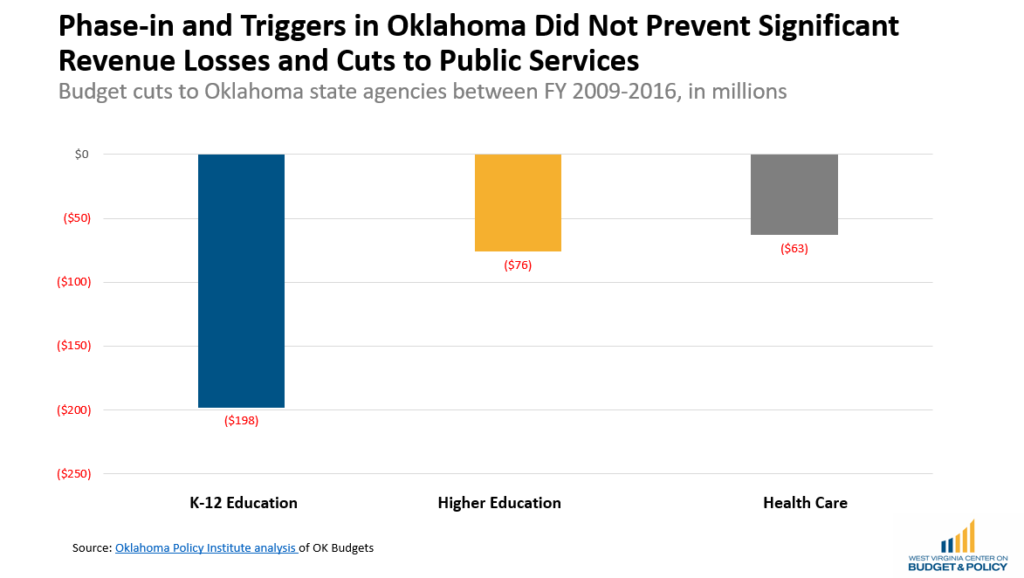

Outside of West Virginia, we can look to other states who’ve tried triggered tax cuts to see the shortsightedness and impact on public services. Oklahoma phased in personal income tax cuts between 2004 and 2016, reducing their top income tax rate from 6.65 percent to 5.0 percent, providing significant tax cuts for the wealthiest Oklahomans and very little for everyone else.

Promised economic growth in Oklahoma never materialized, revenues declined precipitously, and the FY 2016 budget was $896 million, or 11.4 percent, less than the FY 2009 budget after adjusting for inflation. State agencies saw their budgets slashed between 10 and 30 percent. The Oklahoma tax cuts also triggered the historic 2018 teachers’ strike. The cuts to education were so deep that 20 percent of the state’s public schools had to switch to a four-day school week. The state’s teachers went ten years, from 2008 to the 2018 strike, without a pay increase.

Triggered tax cuts are inherently flawed for several reasons. First, they are usually based on speculative, and often ultimately incorrect, information about projected revenues and spending. Lawmakers are frequently asked to approve future tax cuts with very little up-to-date information about future agency budget needs or a complete picture of what the tax cuts will cost once fully phased in. This problem would be magnified in West Virginia, where the governor’s FY 2022 budget proposal does not contain a six-year budget outlook for the first time in recent memory. Without this critical information, lawmakers cannot responsibly evaluate whether the proposed tax cuts will have negative impacts on their constituents or public services.

Triggered tax cuts offer no inherent benefit compared with deferring action on tax cuts until closer to the implementation date when policymakers can make a more informed decision about their affordability. Tax cuts can be quickly enacted when economic and revenue conditions are right. The only benefit to using triggered tax cuts is a political one — allowing lawmakers to claim credit for cutting taxes while avoiding responsibility for the consequences if the tax cuts result in slashes to constituent and public services like higher education and health care, as has happened in other states and West Virginia under triggered tax plans.