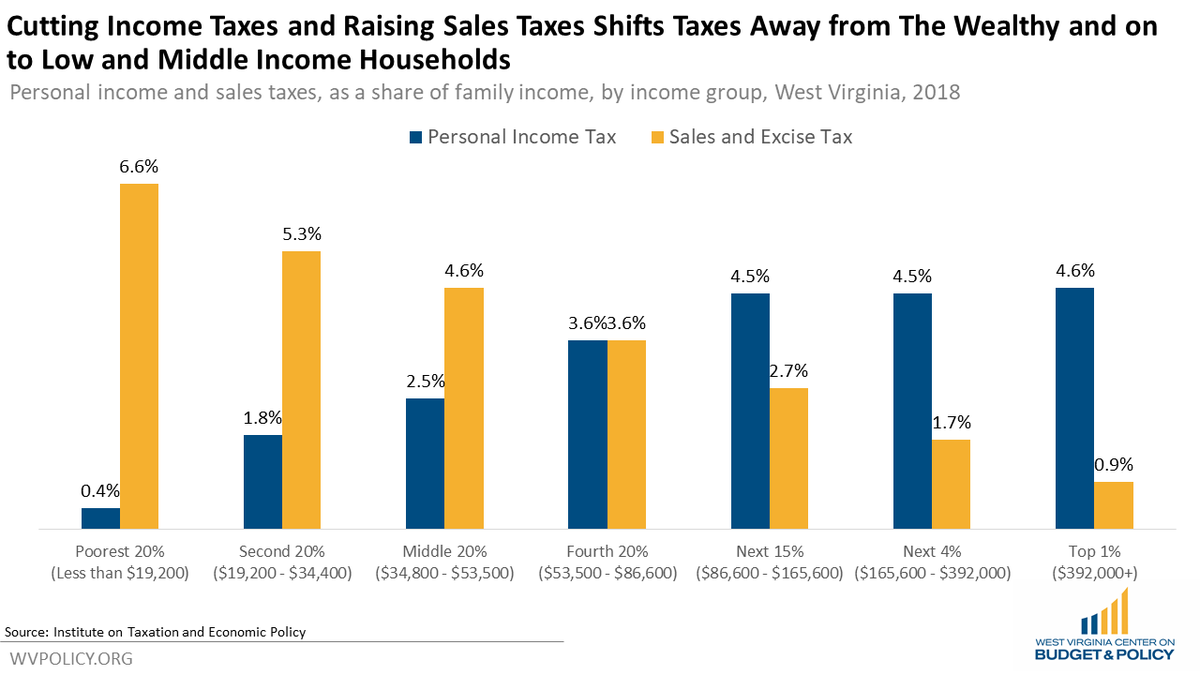

Yesterday, Governor Jim Justice unveiled his long-awaited proposal to reduce the state personal income tax. As currently structured, it would raise West Virginia’s sales tax to 7.9 percent, making it the highest state sales tax in the country, and effectively making our combined state and local sales tax rate 8.4 percent, higher than that of any of our surrounding states. This tax shift would constitute a windfall for high-income West Virginians, while shifting regressive sales taxes onto low- and middle-income families, those same families who have been hit hardest by the pandemic.

Worse, the proposed pay fors total $185 million less than the tax cuts, meaning that when combined with the Governor’s flat budget – which already doesn’t account for inflation – we are looking at budget cuts totaling 5 percent of our total base budget. This amid a pandemic, when public services are more important than ever.

From WVCBP executive director Kelly Allen:

“Governor Justice’s plan is as regressive as we feared it might be. While it gives huge tax cuts to the wealthiest West Virginians, the tax shifts would fall most heavily on the vast majority of West Virginians who are low- and middle-income. The plan also fails to fully offset the revenue losses of reducing the personal income tax, which means inevitable cuts to public services in the midst of an ongoing pandemic. We urge the Governor to highlight exactly what he intends to cut in order to balance the budget.”

Stay tuned for a formal analysis of the Governor’s proposal by the WVCBP in the coming days. In the meantime, you can find some further details in the West Virginia Public Broadcasting article here.

An additional point not to be overlooked: Our state legislators are being asked to consider this significant tax reform proposal without a complete picture of West Virginia’s future budget projections. That’s because this year, for the first time in recent memory, the Governor’s budget proposal did not include a six year outlook, which normally outlines spending plans for future years and is an essential tool for identifying expected inflation and growth in agency budgets. Learn more about the economic landscape of West Virginia and the implications of reducing the state personal income tax in Kelly and Sean’s new blog post.

Leading up to the legislative session, Sean had spent weeks outlining why eliminating/reducing the state personal income tax is misguided and truly harmful policy. You can find links to his numerous blog posts on this subject below:

Lastly, we welcome you to join us and send a letter of your own urging legislators to prioritize investing in West Virginia’s families and communities over providing a tax cut to the state’s wealthiest here.

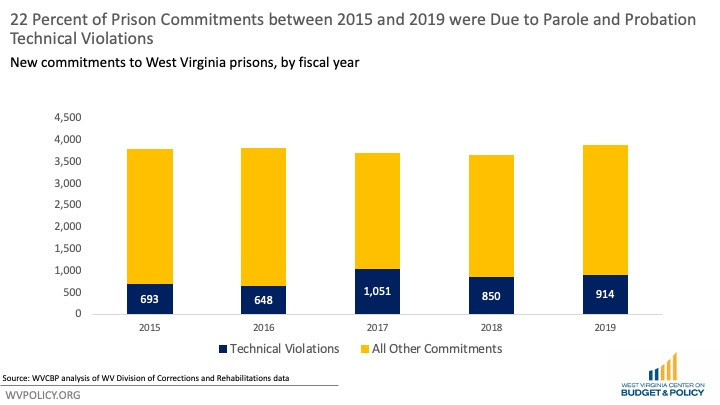

HB 2257 seeks to create a new form of extended supervision for people convicted of certain drug crimes for up to an extra 10 years, beginning after their normal parole or probation supervision ends. Such legislation would have a significant human and financial toll.

In FY 2019, almost 25 percent of the people who were sentenced to prison in West Virginia were arrested for parole and probation technical violations, costing the state millions. Undoubtedly, the extended supervision created by HB 2257 would lead to more parole and probation revocations, and would also serve to further burden people facing the already daunting task of reentry.

This legislation would be a step backward at a time when other states are making real progress toward criminal justice reform. Not a single other state has a provision that allows for 10 additional years of supervision on top of parole for drug crimes.

If the Legislature is serious about reducing recidivism, they should prioritize devoting more resources to reentry in West Virginia, including short- and medium-term housing, comprehensive health and drug treatment, and job training, rather than spending on increased supervision.

More on the repercussions of this bill in Quenton’s full blog post.

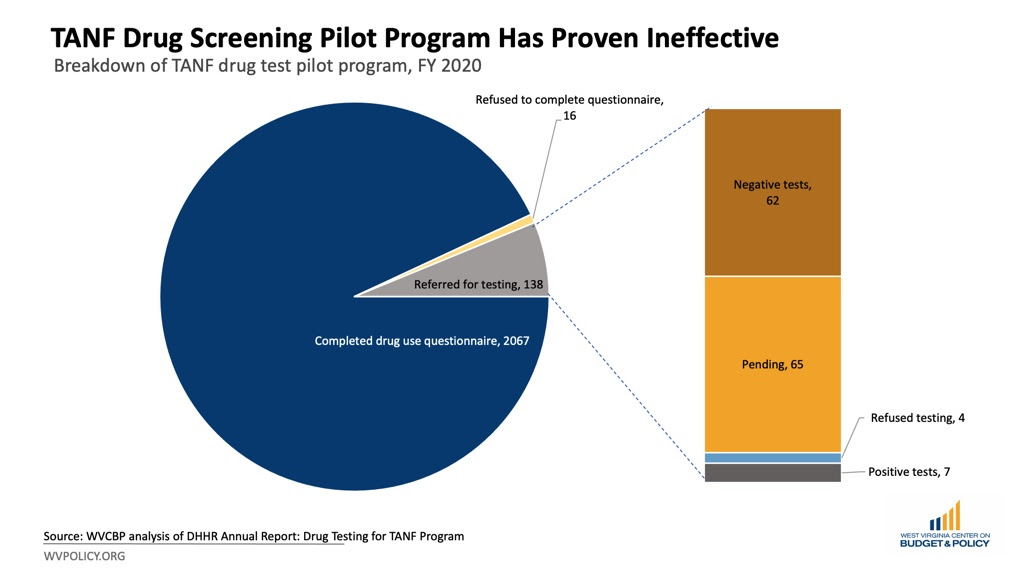

SB 387 passed out of the West Virginia Senate this week and is now heading to the House Health and Human Resources Committee. This bill would make applicants who test positive for drugs or refuse a drug test ineligible for Temporary Assistance for Needy Families (TANF) assistance.

A recent blog post from our health policy analyst Rhonda Rogombé explains how adoption of such policy would further stigma, harm vulnerable populations, and contradict public health best practices.

“Rendering benefits contingent on passing a drug test for individuals otherwise eligible for cash assistance does not meaningfully address substance use problems. Instead, it does quite the opposite — drug screening creates barriers for those who may otherwise seek treatment.

“In a state already riddled with budget shortfalls, dedicating resources to an initiative that further stigmatizes individuals with low incomes — while worsening their material conditions — contradicts the core mission of TANF and other social programs, as well as best practices for public health. Rather than punishing TANF recipients by extending the drug screening program, West Virginia must recommit to providing basic assistance to families. Redirecting funds toward these initiatives would better serve low-income families and help create a healthier West Virginia.”

Read Rhonda’s full blog post.

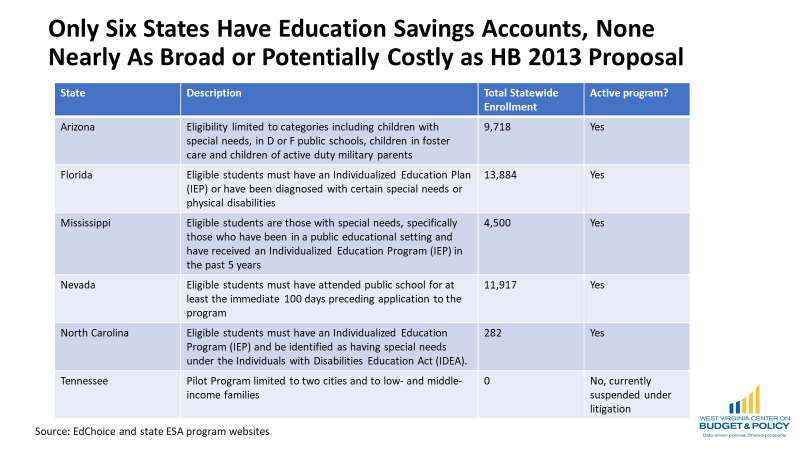

Yesterday, the West Virginia House passed HB 2013, the Hope Scholarship Program, by a narrow vote of 57-42. The legislation now moves to the Senate for consideration.

ESAs divert public education funding to private and nonpublic education programs by allowing families to apply for public education dollars to be put into a bank account to pay for personal education costs including homeschooling, tutoring, or private school tuition. The Hope Scholarship, the value of which is pegged to the per pupil’s state share of public education spending, would be worth approximately $4,600 in FY 2021.The program is much broader and potentially much more costly than any similar Education Savings Account (ESA) program in the country.

Of note, the average private school tuition in West Virginia is $6,068, meaning that there is little benefit to lower income households who don’t have $1,000 or more to make up the difference in tuition in addition to the hundreds of dollars in fees that private schools levy. Further, nine West Virginia counties do not have private schools at all, with most of the state’s private schools located in its more urban and wealthier counties, likely meaning that rural students and low-income students would be left out of the program.

Without income guidelines or enrollment caps as seen in earlier iterations of ESA bills, the costs of this program could grow quickly. This results in less public education funding for the vast majority of students who remain in the public school system. West Virginia’s legislative auditor estimated that the original bill could cost between $22 million and $33.5 million, coming out of the state’s K-12 education funding. Importantly, the auditor does note that the estimate is based on enrollment in other states with ESAs where eligibility is limited to students with special needs and, as such, the costs of West Virginia’s broad program could be significantly higher.

West Virginia is well below the national average in overall per-pupil education spending, and this bill will only result in fewer resources for the vast majority of students who remain in public schools.

Ignoring the impacts of socioeconomic factors in educational outcomes ensures that education reform will fail. West Virginia is currently one of only eight states that does not consider poverty when allocating funding.

Fully funding our public schools ensures opportunity for all, not a few.

We invite you to join us and contact your legislators urging them to oppose HB 2013. You can send them a quick letter here. It will only take a minute of your time.

For further details on why most West Virginia families do not benefit from ESAs, read our ESA Fast Facts sheet or watch our explainer video.

To learn more about additional bills being considered at the legislature that could have a sweeping impact on public education funding, check out Kelly’s blog post.

As Solutions Oriented Addiction Response’s (SOAR) harm reduction efforts come under threat, WVCBP reaffirms our full support of the organization’s life-saving work.

At the end of 2020, we published a blog exploring the surge in HIV and Hepatitis C cases in Kanawha County largely due to the sharing of needles to inject drugs, and how syringe services programs (SSPs) like those operated by SOAR play a critical role in reducing the spread of these diseases. SSPs are effective, cost-saving, and treat those in our community who inject drugs with the dignity that all folks deserve.

Despite the fact that harm reduction efforts are supported by the U.S. Centers for Disease Control and Prevention (CDC), SB 334 — a bill that would effectively ban harm reduction programs statewide — recently passed out of the WV Senate Health and Human Resources Committee. If the bill is adopted, it will have not only a severe moral cost, but a dramatic financial cost, as well. The increase in Hepatitis C and HIV cases in Kanawha County alone in a single year has an estimated health care cost of $47 million.

Read the latest on SB 334 from the media here and here.

Harm reduction is also facing attacks at the city-level. Charleston City Council will likely vote on a new ordinance that would make SOAR’s currently legal harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

In the wake of the CDC calling the HIV outbreak in the Kanawha Valley “the most concerning in the nation,” we partnered with the ACLU of WV and other community organizations to demand Charleston city leaders start listening to science and stop leading with fear. Read the full letter here.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

Again, we at WVCBP wholeheartedly believe that needs-based harm reduction programs make our communities both kinder and safer. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

Join the West Virginia Criminal Law Coalition and our special guest panel on March 30 at 6:30pm as we watch and discuss the new docuseries “Philly DA” ahead of its premiere.

“Philly DA” is a groundbreaking documentary series embedded inside the long-shot election and tumultuous first term of Larry Krasner, Philadelphia’s unapologetic District Attorney, and his experiment to upend the criminal justice system from the inside out.

You can view the trailer below.

The virtual event is being offered free of charge and is open to all. Find further details and registration here.

West Virginia households experienced one of the highest rates of hunger in the nation pre-COVID and the pandemic has only exacerbated hardship.

But despite the swiftness with which many other bills are moving this year at the state legislature, hunger relief legislation sits dormant.

From a recent Mountain State Spotlight article on the topic:

…while lawmakers are advancing a bill to drug test welfare recipients, measures that would directly address food insecurity are stalled in committees.

Del. Chad Lovejoy, D-Cabell, has introduced the Summer Feeding for All bill in the House for the past three years. The bill would require counties to survey how many kids are in need of food during summer break or during emergencies when kids are out of school, like in 2020 when the pandemic halted in-person learning.

Lovejoy said he believes feeding families should be a top priority at the statehouse, but, unfortunately, that’s not the reality in today’s legislature.

Read the full article here.

WVCBP’s Summer Policy Institute (SPI) is an annual event for college students and young people interested in bettering West Virginia through policy change. SPI brings together highly qualified traditional and non-traditional college students and young people to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the convening, attendees work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

Applications for SPI are being considered through April 30. Further details and link to apply here.