We’ve covered Governor Justice’s and legislative leadership’s goal of eliminating the state’s personal income tax from several angles over the past few weeks, showing that states without income taxes aren’t growing any faster than states with the highest income taxes, that eliminating the income tax would overwhelmingly benefit the wealthy, and that replacing the income tax with higher sales taxes would likely be anet tax increase for all but the wealthiest West Virginians, while still blowing a huge hole in the budget, making major budget cuts unavoidable.

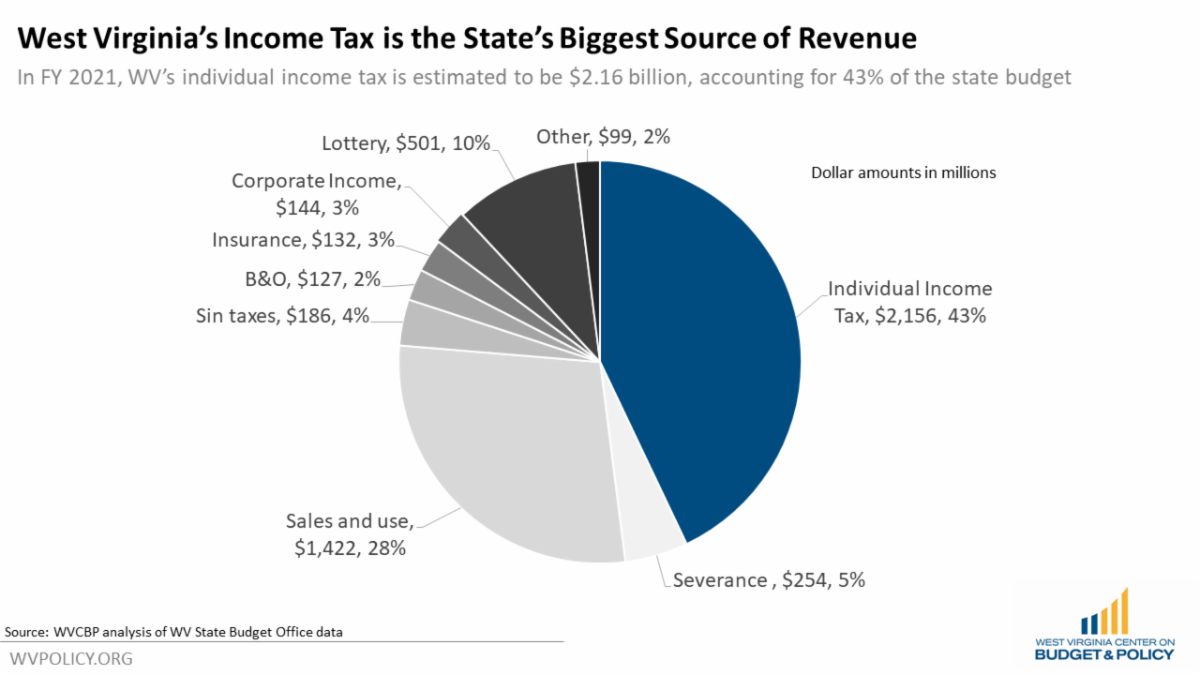

So just how major would those budget cuts have to be? In FY 2021, West Virginia’s income tax revenue is estimated to be $2.16 billion, or 43 percent of the state budget. As such, eliminating the income tax would require finding $2.16 billion, either through new taxes or budget cuts.

One potential source of revenue is the sales tax. As we showed last week, raising the sales tax to over 10 percent would raise about $1 billion. However, doing so would actually be a net tax increase for 60 percent of West Virginians.

But let us assume that 60 percent of West Virginians are okay with paying more in overall taxes in order to give the wealthy a tax cut. That still leaves a $1.16 billion budget hole.

We went through the budget and started cutting. See what we can come up with in Sean’s full blog post.

For more on why eliminating the personal income tax is bad policy, check out our previous blog posts here and here, and a related op-ed that draws on our findings here.

The COVID-19 pandemic has both underscored and exacerbated Black Americans’ health disparities across the United States. While this pattern has garnered national attention, West Virginia has been less successful in identifying and quantifying similar patterns, in part because Black West Virginians comprise less than 4 percent of the population, or roughly 64,500 people — well below the national average of 13 percent.

However, the most recent data from before the pandemic indicates longstanding inequities, with 10.1 percent of Black West Virginians uninsured, compared to just 8.1 percent of their white counterparts. This discrepancy means Black residents are more vulnerable to the virus and health inequities as health care remains out of reach.

In several counties, including Boone, Marshall, and Wyoming Counties, the uninsured rate for Black residents exceeded 20 percent. Experimental data from the US Census Bureau’s Household Pulse Survey estimates that West Virginia’s statewide Black uninsured rate has jumped to approximately 16 percent over the course of the public health crisis. Addressing the gap between Black and white insurance rates benefits not only Black West Virginians, but everyone, ensuring wellness through the pandemic and beyond.

Read Rhonda’s full blog post.

The week has finally arrived!

Our summit exploring the significance of poverty before, during, and after incarceration began on Wednesday and will run through tomorrow, Jan. 30. In addition to a wide variety of panels, the summit is offering skill-building workshops as well as ample opportunity for participants to connect with one another. The conference features national and state-level experts, including people who have been directly impacted by the criminal justice system.

Our hope is that every participant leaves feeling more informed about the problems and solutions, more equipped to take action, and more connected. Together, we are a powerful force for change.

This summit is being hosted by the West Virginia Criminal Law Reform Coalition, of which WVCBP is a proud member.

If you’ve tuned in to any of the sessions so far, we thank you for your time, energy, and willingness to engage. If you have yet to join us, there is still time! Find more details on the summit landing page, follow the event on Facebook, and register here.

As Solutions Oriented Addiction Response’s (SOAR) harm reduction efforts come under threat, WVCBP reaffirms our full support of the organization’s life-saving work.

At the end of 2020, we published a blog exploring the surge in HIV and Hepatitis C cases in Kanawha County largely due to the sharing of needles to inject drugs, and how syringe services programs (SSPs) like those operated by SOAR play a critical role in reducing the spread of these diseases. SSPs are effective, cost-saving, and treat those in our community who inject drugs with the dignity that all folks deserve.

Currently, SOAR’s work is deemed 100% legal in Charleston. Over the next couple weeks, Charleston City Council will likely vote on a new ordinance that would make SOAR’s current harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

Again, we at WVCBP wholeheartedly believe that SOAR’s work makes the Charleston community both kinder and safer. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

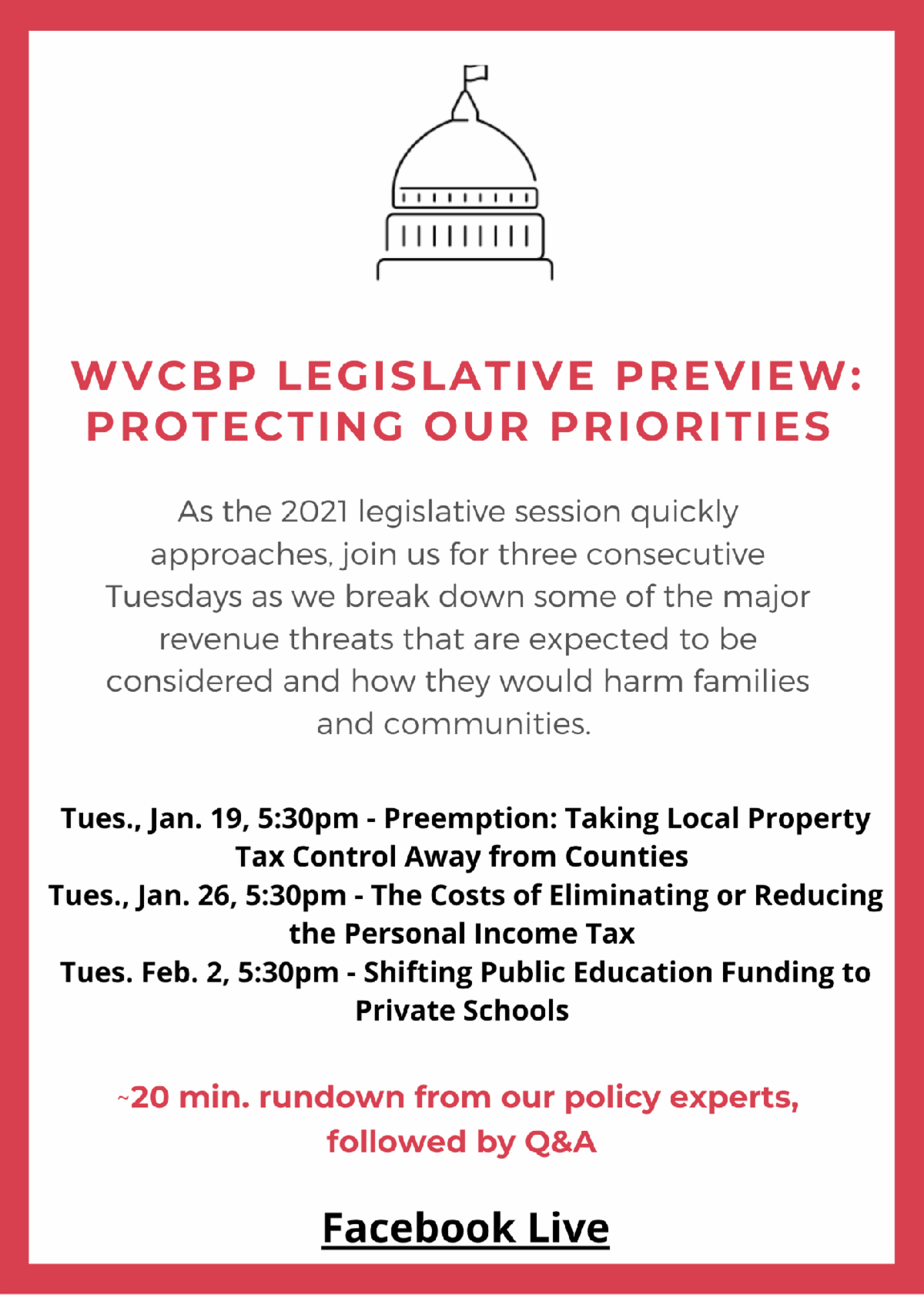

We started out our Legislative Preview Facebook Live series last week with a conversation on the expected threats to the business personal property tax and the impact such threats would have on our counties. We continued this past Tuesday with Part 2 of 3 of the series, which dove into the catastrophic potential of eliminating the state personal income tax.

If you couldn’t tune in to those conversations, you can find the recordings here and here.

We hope to see you next Tuesday for the final leg of our Legislative Preview!

Join us for our 8th annual Budget Breakfast!

Due to COVID-19 considerations, this year’s event will be held virtually via Zoom.

WVCBP’s analysis of the Governor’s 2022 proposed budget will start at 8:00am, followed by keynote panel presentation and time for Q&A.

Our keynote panelists, Rep. Don Hineman and Duane Goossen, will highlight the failed Brownback tax experiment in Kansas and why West Virginia lawmakers should avoid going down the same path. Don Hineman is a Republican member of the Kansas House of Representatives, representing the 118th District. He has served since 2009. He was the Majority leader from 2017 to 2019. Duane Goossen is the former Kansas Secretary of Administration and the Director of the Kansas Division of the Budget. Goossen has served as the Secretary of the Kansas Department of Administration since 2004 and Director of the Kansas Division of the Budget since 1998. Goossen also served in the Kansas House of Representatives 1983 to 1997.

While attendees are welcome to join the webinar at no cost, we hope you will consider supporting the WVCBP’s work and contributing to our annual fundraiser by donating the usual cost of an in-person ticket ($50).

You can find registration here.

We hope to see you there!

We are now accepting applications for the summer of 2021! Priority will be given to applications received by February 26, 2021.

WVCBP seeks a summer policy associate for an internship to work on issues associated with our research and advocacy priorities. Our summer policy associates work closely with WVCBP staff, coalition partners, and stakeholders in an immersive experience in research and advocacy for evidence-based solutions, policies, and practices surrounding issues that impact low- and moderate-income West Virginians.

The WVCBP internship program’s mission is to partner our organization with highly motivated undergraduate and graduate students committed to building shared prosperity through policy change. Our internship program prepares students for potential employment in the non-profit policy world by training them to conduct rigorous data and policy analysis or outreach and advocacy while developing effective communications strategies.

Find the full job posting and instructions to apply here.