Today the West Virginia legislature wraps up its first week of work on passing a state budget. The most notable accomplishment was the Senate passage of SB 1005 which would raise the tobacco tax by 45-cents/pack. The bill was read for the first time in the House today.

During the Senate debate on the measure, Senator Ron Miller (D-Greenbrier) tried to amend the bill to increase the tax by an additional 55-cents with the extra revenue to be earmarked to fund a state Earned Income Tax Credit. Watch clip of Senator Miller’s floor speech here.

Next week the legislature will continue its work on proposals that were part of Governor Tomblin’s special session call. While the state desperately needs additional revenue, the governor’s tax increases disproportionately ask more from low-income people than the wealthy. Read Sean’s blog post for more information.

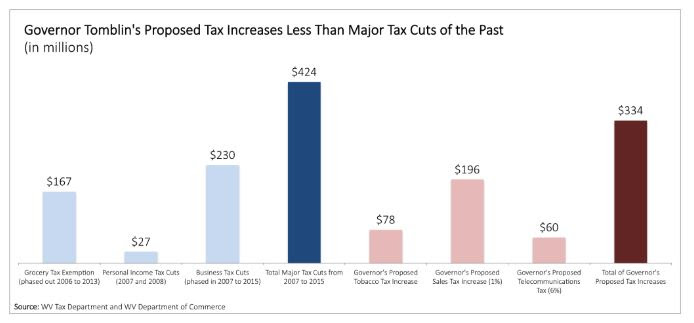

The governor’s ideas to fill the budget gap total less than the major tax cuts of the past. Beginning in 2007, West Virginia enacted a number of major tax cuts, including phasing out the grocery tax on food and the business franchise tax, reducing the corporate net income tax rate from 9 to 6.5 percent, and making some cuts to the personal income tax. All these cuts, along with a drop in energy prices, have helped blow a huge hole in the state’s budget. Here’s more in Ted’s blog post.

At a time when most states are restoring funding to higher education that was cut during the Great Recession, a new report shows that West Virginia is going in the opposite direction, with troubling consequences. The result is skyrocketing tuition increases, over 42% since 2008, making college harder and harder to afford, especially for low-income families.

Here’s more in today’s Charleston Gazette-Mail.

This week we welcomed our two summer interns, Tara Holmes and Jesús Ballesteros.

Tara is a PhD student in Cultural Analysis and Theory at Stony Brook University in New York. Her research interests include analyzing and critiquing the effects of neoliberalism on marginalized populations, particularly working-class women and women of color. She is a native of Sissonville, West Virginia. Tara’s work as a Summer Policy Associate will have her focusing on paid sick days and family leave policies as well as gathering data for the 2016 State of Working West Virginia report.

Jesús is currently double majoring Computer Science and Computer Engineering at WVU Tech in Montgomery, WV. Last year he worked on a research project of parallel computing and is currently a teacher assistant tutoring students on programming classes. He is a native of Spain. His work this summer as a Summer Research Associate will include designing a website containing historical information on West Virginia budgets and funding priorities.

This week, the Labor Department issued its final rule updating overtime regulations, which will automatically extend overtime protections to millions of workers in its first year of implementation.

The rule extends overtime protections to workers earning less than $913 per week or $47,476 annually for a full-time worker, and established a mechanism to update the threshold every three years.

Here’s more in Sean’s blog post.

It’s not too late to register for the annual Try This conference in Buckhannon taking place June 3-4.

Here’s what’s in store:

Go here to register and/or learn more.