The West Virginia Coal Association announced it intends to push for a cut in the state’s coal severance tax rate, from its current rate of 5% to 2%, as an attempt to jumpstart the state’s ailing coal industry. This is the latest in a series of attempts to give coal a tax break under the justification of increasing coal production and employment in the state. While past attempts have taken the form of credits and other schemes, this effort is a straightforward cut in the severance tax rate. But with the state budget already in a precarious position, is a tax cut the solution to coal’s problems, or will it lead to even more trouble for West Virginia?

It’s clear that the coal industry is struggling, particularly in southern West Virginia. The state’s coal production is expected to be down 39% from 2008 to 2015, while nearly 50 coal companies have declared bankruptcy nationwide. But while giving coal a tax break sounds like a quick fix to help turn the industry around, it’s unlikely to do much to help increase production or employment, while doing some serious damage to the state budget.

There are a number of factors at play affecting West Virginia’s coal industry that offering a severance tax break just won’t overcome. Chief among those is the fact that there is little evidence that the severance tax plays a big role in determining production and employment. Instead, reserve location, market demand, and logistics all play a much greater part in driving production and employment. That’s why when the Wyoming Legislature modeled the effect of a substantial severance tax cut for coal, it found only a minor increase in production but a large decrease in revenues. And last year, in West Virginia, the West Virginia Bureau of Business and Economic Research (BBER) found that the various proposed tax incentives for coal would offer only small increases in production. As BBER director economist John Deskins put it, “It would be hard for a 5% price change to overcome those logistical systems that these companies have put in place over years and years.”

The coal industry often argues that the state’s severance tax makes West Virginia uncompetitive, however, coal seams are getting thinner and it’s more expensive to mine coal here than in other states, particularly those out West, severance tax or no severance tax. In fact, of the top 10 coal producing states in 2013, West Virginia had the lowest coal mine productivity, meaning that it is much more labor intensive, therefore expensive, to mine coal from seams in West Virginia, than in any other state.

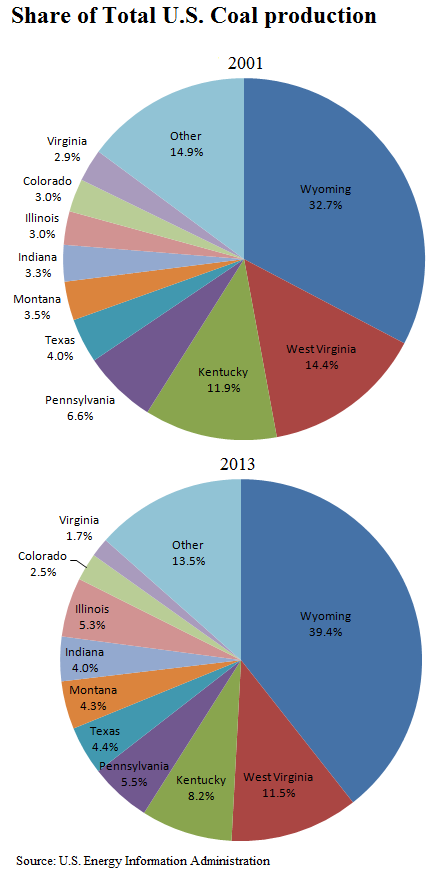

While Central Appalachian states like West Virginia have been hamstrung by thinning seams and lower productivity, they has been losing market share to western states, in particular Wyoming. West Virginia has seen its share of total U.S. coal production decline from 14.4% in 2001 to 11.5% in 2013, while Wyoming’s has increased from 32.7% to 39.4%. So while the industry points to the lack of severance tax in Pennsylvania, and a lower severance tax in Kentucky as evidence of West Virginia’s uncompetitiveness, those states have seen their market shares decline as well in the face of higher productivity out West.

In fact, while West Virginia has lost coal market share to Wyoming, it has happened even as Wyoming coal faces both higher severance and overall taxes. West Virginia’s effective severance tax on coal is 4.25%, compared to Wyoming’s rate of 5%, while overall taxes in West Virginia on coal total 6.5%, well below Wyoming’s rate of 10.6%. Even with taxes nearly 40% lower in West Virginia, it isn’t enough to overcome Wyoming’s productivity advantage.

In fact, while West Virginia has lost coal market share to Wyoming, it has happened even as Wyoming coal faces both higher severance and overall taxes. West Virginia’s effective severance tax on coal is 4.25%, compared to Wyoming’s rate of 5%, while overall taxes in West Virginia on coal total 6.5%, well below Wyoming’s rate of 10.6%. Even with taxes nearly 40% lower in West Virginia, it isn’t enough to overcome Wyoming’s productivity advantage.

But beyond competition from coal in other states, West Virginia coal faces even stiffer competition in its own backyard from natural gas. Booming natural gas production, which is subject to the same 5% severance tax in West Virginia as coal, has hurt the coal industry as well. The Marcellus and other shale plays have led to a glut of natural gas, driving energy prices down, making gas-fired electricity often a better deal than coal. In fact, natural gas topped coal as the nation’s largest source of electricity for several months in 2015. And again, a cut in the state’s severance tax will do little to help make coal more competitive with natural gas.

So while a cut to the severance tax will do little to aid the coal industry, it would spell disaster for the state budget. The severance tax on coal produced a little over $311 million in FY 2015, including both the state and local share. Cutting the severance tax rate from 5% to 2% would have cost nearly $220 million, digging an even deeper financial hole than the state already finds itself in.

The severance tax is important to West Virginia’s budget, and it’s important that we keep it. While the coal industry has long provided important benefits to the state and local economies, it also has created its share of costs, to the point where it can cost the state and taxpayers more than it provides. The severance tax is one of the only ways we have to account for the costs created by the coal industry. And while the coal industry is struggling, it doesn’t mean it should be let off the hook with a dubious tax cut.