West Virginia families sending their kids to in-state colleges and universities could take another hit according to today’s Charleston Gazette. West Virginia University is considering a nearly 10 percent increase in tuition which has already increased 29 percent over the past five years. Last week, West Virginia State University announced a seven percent increase, and officials at Marshall University are trying to figure out the best way to fund for their budget gap without passing the costs along to students.

Higher-education administrators are faced with tough choices due to shrinking state funding. State leaders decided that tax giveaways to businesses took priority over maintaining funding for higher education, and now West Virginia families and students are paying the price.

This is something to keep in mind as legislators meet on Monday, May 4 to consider more ways to overhaul the state’s tax system. What will their priorities be? You can listen in to the discussion here by clicking House Government Org. Here’s the committee’s agenda.

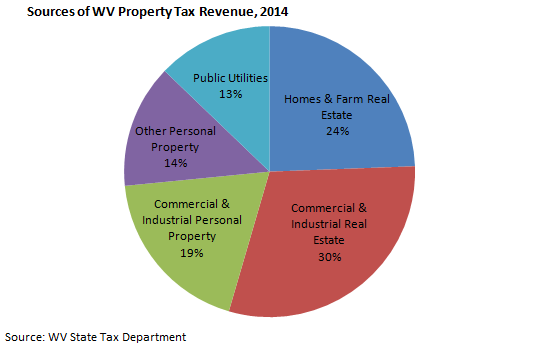

While West Virginia students are paying more to get their degrees, state businesses could get another break if legislators decide to lower their property taxes. Businesses in West Virginia already pay property taxes at a rate less than the national average. Take a look at the pie chart below to see who would pick up the slack if businesses get a break on their taxes.

Much more in Sean’s blog post about West Virginia’s current system which provides equal treatment of all property, and the probable motivation behind a possible overhaul.

Start your summer off with the Try This Conference in Buckhannon, June 5-6. Enjoy two idea-packed, inspiring days with like-minded West Virginians! Registration goes up by $50 tomorrow so register today!