With Tax Day approaching and West Virginians across the state filing their taxes, it’s a good time to remember what our contributions pay for and why it is important that our tax system is fair, transparent, and provides adequate resources to fund the public services and investments that allow our communities to thrive.

At the local, state, and federal level, tax dollars are pooled together and invested in the public services that are essential to building shared prosperity. Taxes make it possible to do the important things together that we cannot do alone. Without taxes, we wouldn’t have a public K-12 education system or public universities and community colleges. We wouldn’t have roads and bridges, sidewalks and parks. Without taxes, we wouldn’t have public health professionals to respond to and mitigate the pandemic and other public health threats. We wouldn’t have a safety net of unemployment insurance, health care, and food assistance for when we fall on hard times.

Together, our taxes get a lot done. In West Virginia, our tax dollars allow us to invest in critical areas including:

Education: K-12 education for 250,000 students; higher education for 73,000 two- and four-year public college and university students; merit- and needs-based higher education financial aid; worker and vocational training.

Health Care: health insurance for over 600,000 individuals, including people with disabilities, pregnant women and new mothers, low-income families, and the elderly through Medicaid; public health services; mental health services; substance use disorder treatment and services; dental care; disability services.

Human Services: foster care and adoption system; domestic violence protection; housing; nutrition assistance; support for low-income families; veterans’ services; senior services.

Infrastructure: roads and bridges; water and sewer systems; public transportation; communications.

Environmental Protection: protecting land, air, and water; state parks; land conservation and preservation; remediation; pollution control.

Public Safety and the Legal System: the court system, public defenders, and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety.

Community Development: job development; tourism; agricultural development; arts and culture; libraries.

West Virginia collected about $5.0 billion in tax revenue in its General Revenue Fund in FY 2021. 45.2 percent of general revenue tax collections came from the personal income tax; 30.8 percent came from the sales tax; 6.4 percent came from the corporate net income tax; 5.5 percent came from the severance tax; and the remaining came from the tobacco tax, insurance tax, and other smaller taxes and fees.

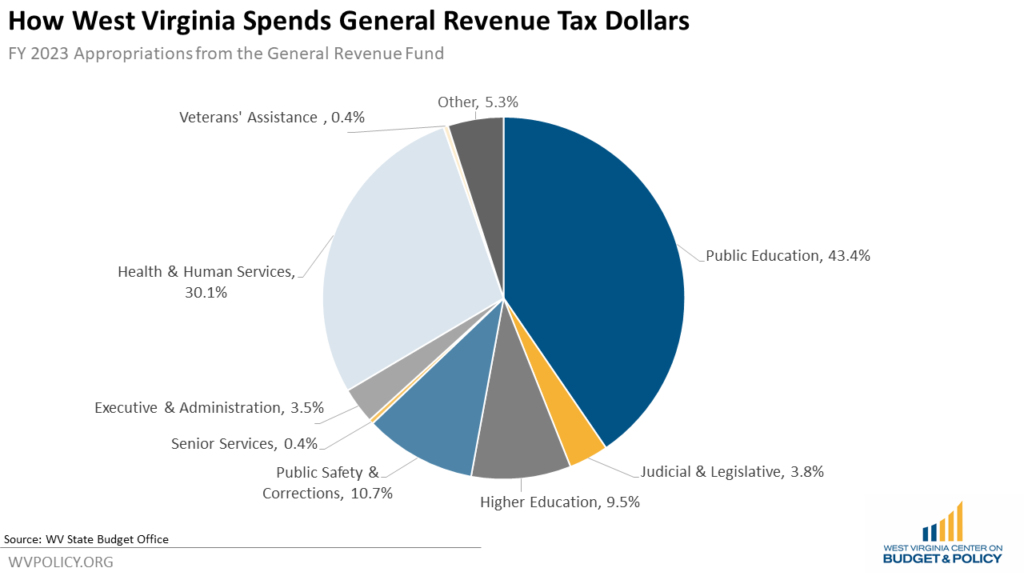

For FY 2023, nearly two-thirds of West Virginia’s general revenue tax collections will be invested in K-12 education and health and human services, including Medicaid. Over 10 percent will be allocated to public safety and corrections, and 9.5 percent to higher education.

The existence of all of these public services makes clear why taxes matter, and why any tax reform should be done cautiously and with care not to undermine important public investments or make the system less equitable. Shifting from income taxes to sales taxes or cutting taxes on out-of-state corporations (again) and energy producers are not good tax reforms. Not only would these changes make the tax system even more reliant on middle- and low-income families, they would also leave us with less revenue to invest in building a strong and prosperous state that works for everyone. We all benefit from the services and investments made possible by taxes, and with them we can make West Virginia a better place to live, work, and raise a family.