Legislative leadership appears poised to pass yet another round of corporate tax cuts that will hurt working families, our schools and colleges, and push more money out-of-state to large corporations. It doesn’t have to be this way. Lawmakers could instead put their efforts toward investing in our communities, our health, our education, and the workers who build the economy.

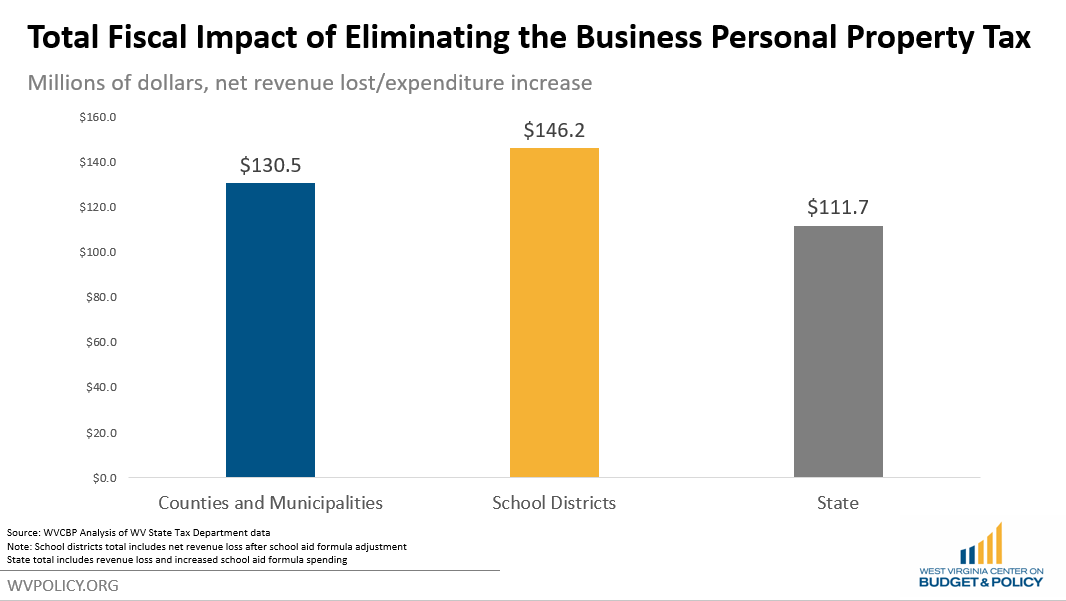

Over the past couple of years (and in prior decades) some lawmakers and corporate lobbyists have pushed to eliminate the business personal property tax, which covers inventory, machinery and equipment, tools, and fixtures (such as built-in shelving), and also includes a local property production tax on natural gas and oil production.

Altogether, this tax raises about $400 million each year that mostly goes toward paying for schools. There have also been proposals to eliminate the tax for only “industrial” personal property, which can include manufacturing, coal mining, and natural gas and oil extraction and processing (think proposed Appalachian Storage Hub). Local governments collected about $130 million in industrial personal property taxes in 2017.

Read more in Ted’s op-ed in the Charleston Gazette-Mail this week.

Learn more about the governor’s proposed budget as well as the impact of cuts to the state’s Business Personal Property Tax as the 2020 Budget Breakfast January 15!

Would you like to sponsor this year’s event? Each sponsorship level comes with tickets. Learn more here.

Our keynote speaker is Sian Mughan, assistant professor in the School of Public Affairs at Arizona State University. Her research interests include local government finance, fiscal federalism, criminal justice policy, and institutions. Some of her research has shown how tax and budgetary structures impact equity outcomes, while other papers focus on how fiscal stress in local governments leads to revenue seeking behavior by actors in state criminal justice systems.

Sian will discuss the business personal property tax and her study, “Estimating the Manufacturing Employment Impact of Eliminating the Tangible Personal Property Tax: Evidence from Ohio”, to help us understand how proposed cut to West Virginia’s tax could harmfully impact our budget and how we fund our school systems.

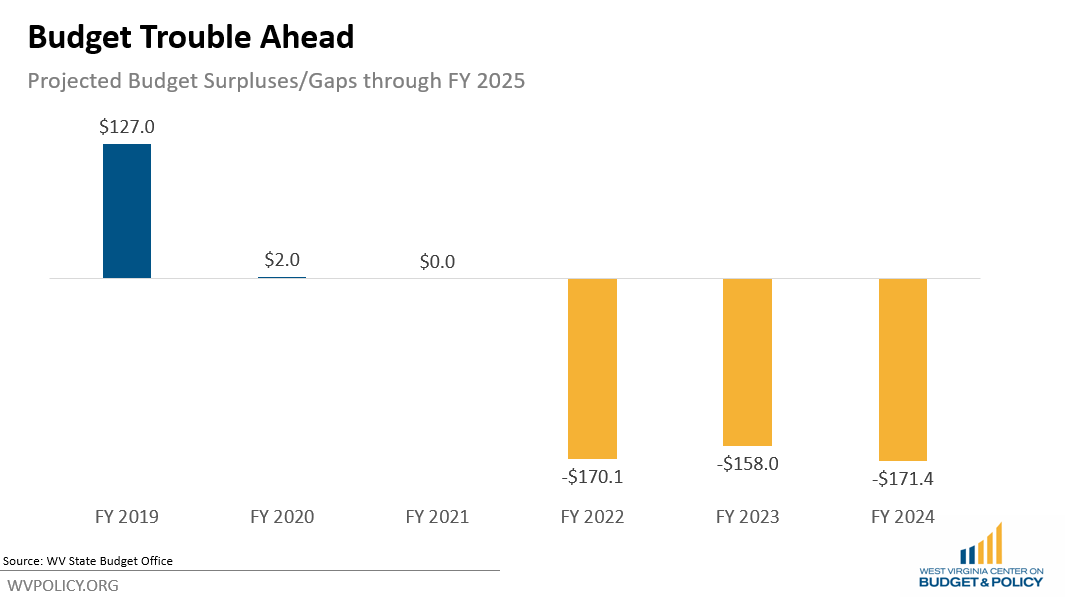

The governor’s proposed FY 2021 budget has officially been released, with very little in changes from the FY 2020 budget. Read more in Sean’s blog post.

With revenues stagnating, there is very little in new spending initiatives in the governor’s proposed budget, while relying on some one-time budget maneuvers to avoid deep spending cuts.

Overall, the proposed FY 2021 base budget (spending from the general revenue and lottery funds) totals $5.02 billion, a decrease of about $74 million from the FY 2020 base budget.

Learn more at Wednesday’s Budget Breakfast about how this year’s budget will impact our schools, roads, colleges and universities.

The 2019 State of Working West Virginia will be released on Monday, January 13 as part of the Many Roads Home campaign. This year’s report focuses on West Virginia’s immigrants, and the important role they have played in the state’s history and in its future.

The Many Roads Home Campaign project will illustrate the personal stories of how immigrants, both old and new, came to call West Virginia home. It will be launched with a press conference on Monday, January 13 at noon in the governor’s conference room. The project is a collaboration of the ACLU-WV, the American Friends Service Committee and the WV Center on Budget and Policy.

Poor oral health is widespread in West Virginia. It significantly affects the employability of our workforce, contributes to higher emergency room utilization, and is often both an indicator of and a contributor to other chronic health conditions. According to a 2014 report, only 40 percent of West Virginians have dental insurance. While Medicaid expansion has made significant strides in giving thousands of low-income West Virginians health coverage, dental benefits (other than emergency extractions) are not covered for adult Medicaid beneficiaries, leaving out a critical component of health care for the approximately 300,000 adults over the age of 21 who rely on Medicaid.

Read more in our report released this week.

Investing a small amount of money to cover oral health benefits for adults who rely on Medicaid provides substantial long-term gains for West Virginia, including better health outcomes, lower emergency room costs, and greater employability of our workforce. Without offering dental benefits in Medicaid, dental coverage will continue to be unaffordable and out of reach for many vulnerable West Virginians.