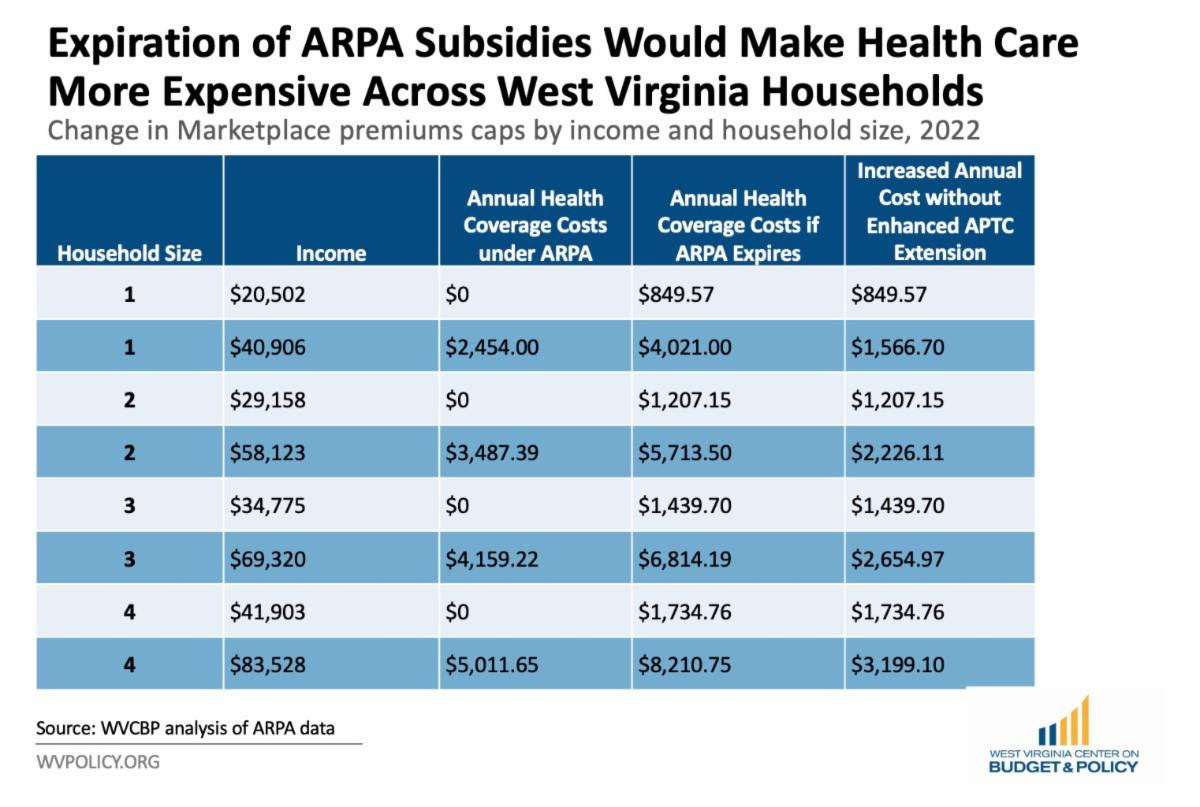

As one piece of the federal response to the pandemic, Congress passed the American Rescue Plan Act (ARPA), which increased income-based health care subsidies, known as advanced premium tax credits (APTCs). These credits help make health insurance premiums more affordable to Americans at all income levels. While the increased APTCs have played a critical role in helping people across the country – including 23,000 West Virginians – access health care, they will sunset at the end of 2022 without further action from Congress. Their expiration would cause severe and unnecessary price shocks, just as West Virginians are dealing with other rising costs.

A recent analysis by the Urban Institute found that if Congress does not extend the enhanced APTCs, an estimated 3.9 million people nationally will become uninsured in 2023, as their health insurance costs would become unaffordable. This estimate includes 11,000 West Virginians, which represents a 34 percent drop in the overall size of the state Individual Marketplace.

Ensuring that West Virginians can access affordable health coverage is good for families and our economy. Failing to extend the supports that made health coverage more affordable through the American Rescue Plan Act would increase West Virginia’s uninsured rate and make it harder for individuals and families to meet their basic needs. Congress should act swiftly through a broad economic reconciliation package to extend the subsidies that have made health coverage accessible and affordable for tens of thousands of West Virginians.

Read Rhonda’s full blog post.

The American Rescue Plan Act’s enhanced Child Tax Credit (CTC) provided eligible families with up to $300 per child per month beginning in July 2021. Despite the expanded credit’s incredible effectiveness at reducing child poverty, Senator Manchin blocked its extension and it expired at the end of 2021. Child poverty nationwide increased by over 40 percent shortly thereafter. A recent article, featuring insight from the WVCBP, further highlights the impact of the enhanced CTC. Excerpt below:

The Brookings Institution’s Global Economy and Development program released a study detailing the effects of the expanded child tax credit earlier this month. The authors noted common uses for the child tax credit and how the program impacted financial security.

According to the report’s authors, 70% of families who received the child tax credit used the money on routine expenses such as housing and utilities. Other common uses include clothing and other essential items (58%), food (56%), emergencies (49%), and paying off debt (42%).

The authors also note no significant changes in employment between households because of the child tax credit during the six months that payments were issued.

“We tracked employment trends for both CTC-eligible and ineligible households, and we could find no statistically significant differences in the employment trend,” co-principal investigator Leah Hamilton said.

U.S. Sen. Joe Manchin, D-W.Va., has shared opposition toward extending the child tax credit, telling Business Insider in January there needs to be a work requirement with the program. Hamilton said there is no proof that such a requirement would be beneficial.

“We can’t find any evidence that people would use the credit to reduce their work. If anything, it is helping people work more by allowing them to afford child care,” she said. “Some might argue that might be an unnecessary bureaucratic hurdle that’s solving a problem that doesn’t exist, but creating hurdles for families that really do need this credit right now to put food on the table, pay bills, keep the lights on, and all of the really essential things that many families used it on.”

Read the full article.

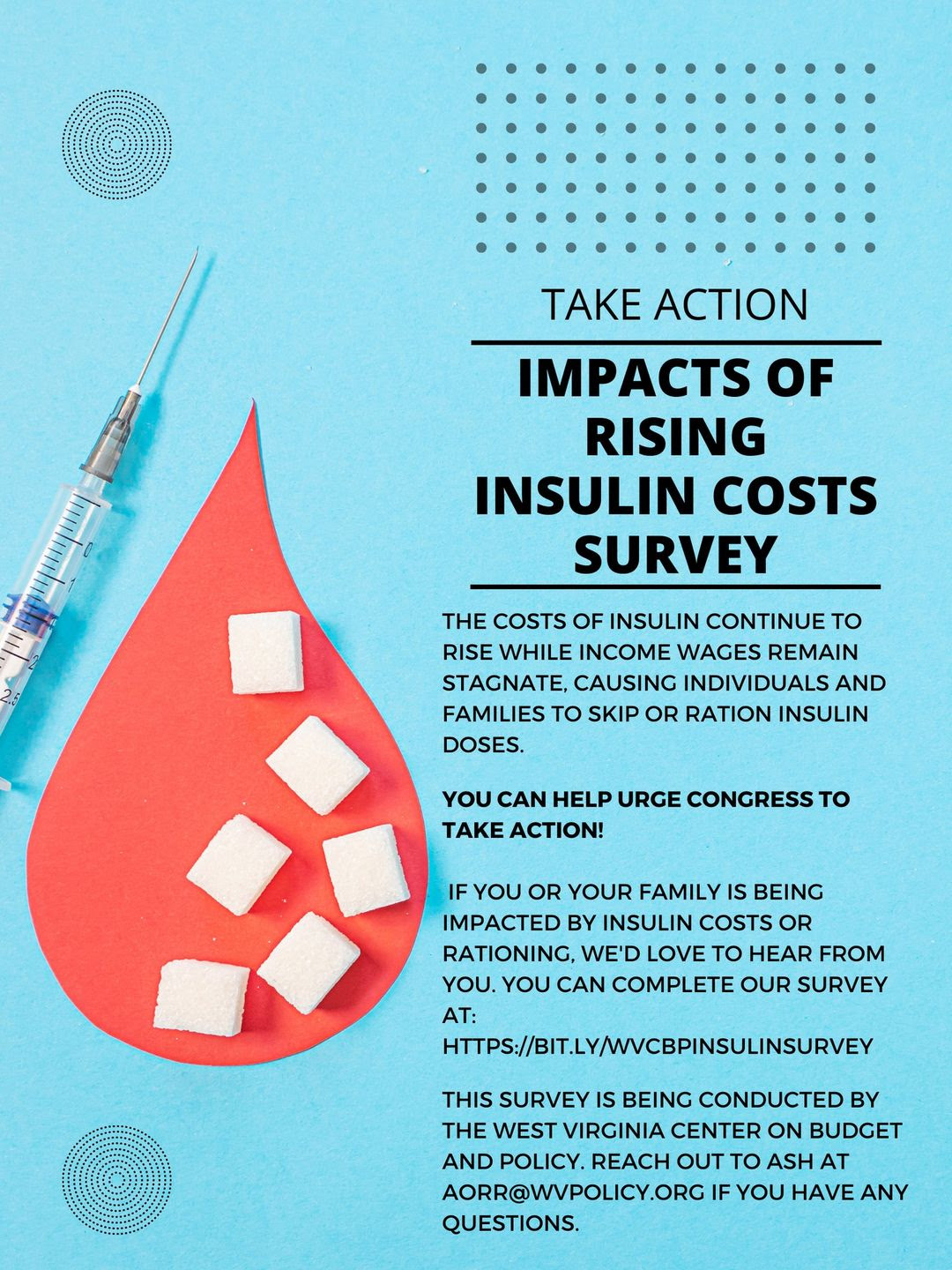

The costs of insulin continue to rise while income wages remain stagnant, exacerbating pressure on individuals and families to skip or ration insulin doses in order to make ends meet.

You can help us in our fight to urge Congress to take action! If you or your family is being impacted by insulin costs or rationing, please consider completing our survey and aiding us in our advocacy– we appreciate your time and insight.

Just a few spots left in our Summer Policy Institute 2022 cohort!

The Summer Policy Institute (SPI) is an annual convening hosted by the WVCBP and the American Friends Service Committee that brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the institute, participants work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

This year’s SPI theme is “Growing a West Virginia that Works for Everyone.”

Due to ongoing public health considerations, SPI 2022 will take place virtually via Zoom from July 28-30. Find further details and instructions to apply in the flyer below and on our event landing page here. There is no cost to attend. Please don’t hesitate to reach out to our team at summerpolicyinstitute@gmail.com with any questions.

The application deadline has been extended to May 15. People of all ages are welcome to apply, so please feel free to share with any folks you think may be interested!

Applications for Appalachian Prison Book Project (APBP)‘s 2022-2023 Education Scholarship are live!

Four, $3,000 scholarships will be awarded to individuals who have been released from a West Virginia Department of Corrections and Rehabilitation (WVDCR) state prison or federal prison (BOP) in West Virginia and who will be beginning or continuing their undergraduate or graduate education at a college or university in West Virginia.

This is an incredible opportunity for justice-impacted folks in the Mountain State who want to further their education. Please share with anyone you think may be interested and eligible! Application submission deadline is July 15, 2022.

You can find full details and instructions to apply here.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

The impact on children and families since the expiration of the enhanced Child Tax Credit has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make the enhanced Child Tax Credit permanent is as urgent as ever.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) expired.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.