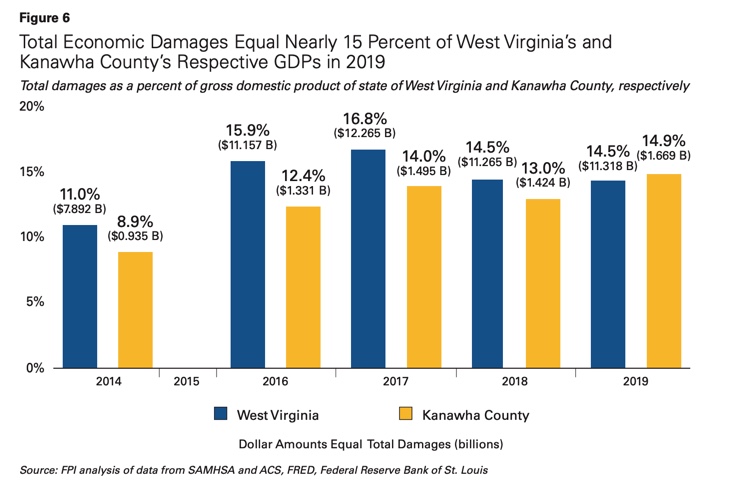

West Virginia has long been at the forefront of the overdose epidemic in the US. Since 2010, its death rate per 100,000 by overdose of any type of drug has led the nation. Our new report both shows the heavy economic toll this crisis has on West Virginia as a whole and shines a spotlight on Kanawha County, the county with the highest number of overdose deaths in the state.

The report, authored by economist Dr. Jill Kriesky, reveals that the overdose crisis cost West Virginia $11.3 billion & Kanawha County $1.7 billion in 2019 alone. These staggering amounts represent nearly 15 percent of the state & county gross domestic products, respectively.

A major portion of the study examines the dollars spent on treating and addressing the diverse array of harms that stem from WV’s current addiction crisis. These include Hep B & C, HIV, endocarditis, neonatal abstinence syndrome, and the foster care crisis.

The report concludes with a brief overview of harm reduction programs designed to address these enormous damages and what is known about their cost-effectiveness. A key staple of harm reduction efforts, syringe services programs, are cited as reducing HIV & Hep C by nearly 50%.

You can read the full report here.

Despite the fact that harm reduction efforts are supported by the U.S. Centers for Disease Control and Prevention (CDC), SB 334 — a bill that would severely restrict harm reduction programs statewide — recently passed out of the full Senate and will now be considered by the House Health and Human Resources committee and the House Judiciary committee. If the bill is adopted, it will have not only a severe moral cost, but a dramatic financial cost as well, as suggested by our new report.

Read the latest on SB 334 from the media here.

Harm reduction is also facing attacks at the city-level. Charleston City Council will likely vote on a new ordinance that would make Solution Oriented Addiction Response’s (SOAR) currently legal harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

We at the WVCBP wholeheartedly believe that needs-based harm reduction programs make our communities healthier, safer, and kinder. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

On Monday, WVCBP released a new issue brief that explores the facade of West Virginia’s current budget stability, the state’s concerning economic outlook, and how proposals to slash the state income tax would make a fraught budget situation even worse. Excerpts below:

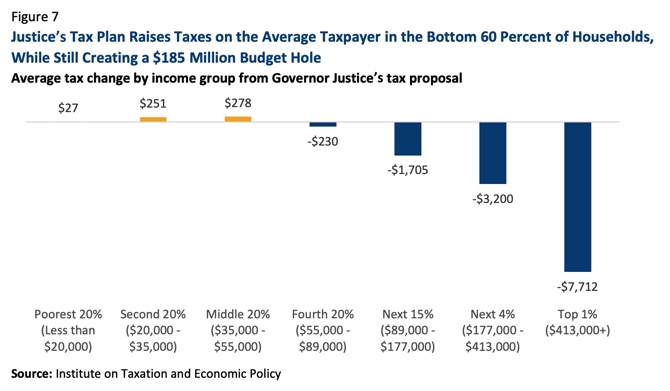

Governor Jim Justice has proposed what he describes as a “flat” budget for FY 2022, with only minor changes from the FY 2021 budget. While the state budget remained stable during the COVID-19 pandemic, that stability relied on tapping reserves, federal stimulus funding, and other temporary measures. The future budget picture remains troubling, with projected revenues far below initial estimates, while the reserves the state has been relying on to balance the budget are being depleted. In addition, the governor is proposing a major tax overhaul that would both increase overall taxes on the average low- and middle-income household and create an immediate $185 million budget gap.

Key Findings:

Read Sean’s full issue brief here.

Read Sean’s recent blog post on Gov. Justice’s proposed tax plan here and the latest from the media here.

Lastly, we welcome you to join us and send a letter urging legislators to prioritize investing in West Virginia’s families and communities over providing a tax cut to the state’s wealthiest here.

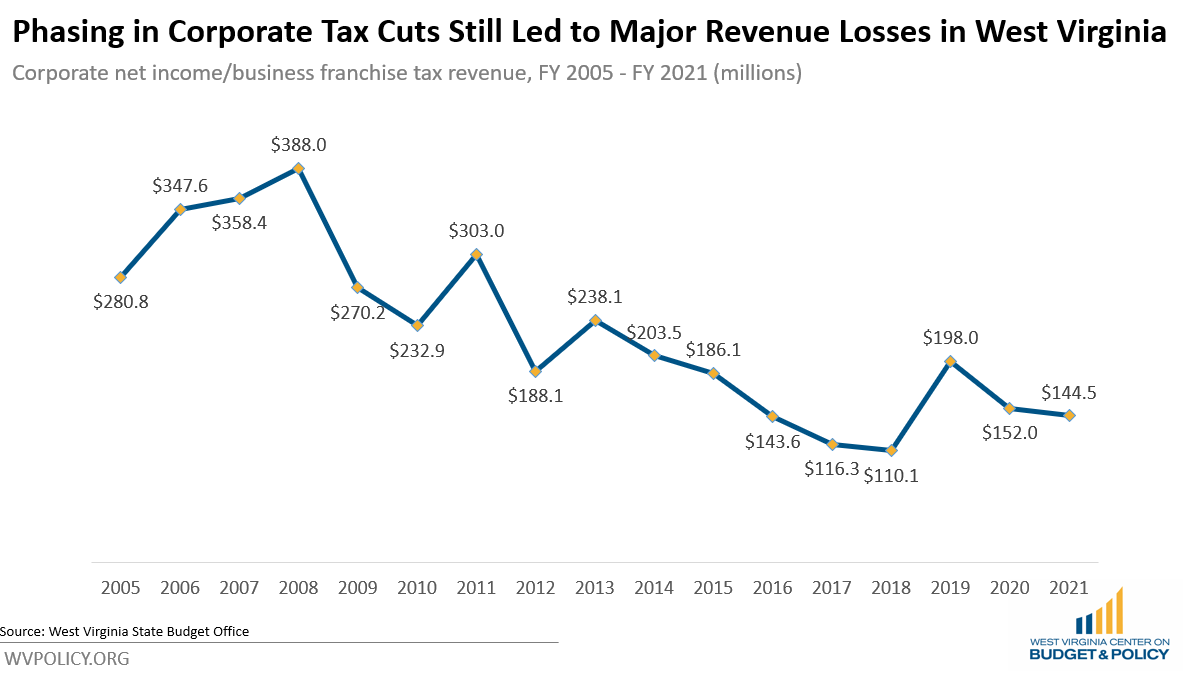

Ten states, including West Virginia, have enacted proposals that cut personal or corporate income taxes at various points in the future, contingent on revenues reaching a certain level or growth rate. While using triggers is often portrayed as fiscally responsible, it is far from it. Lawmakers enacting these drawn out tax cuts typically do not have enough information to fully understand if the cuts will be responsible or desirable when they take effect, and the experiences of West Virginia and other states show that such cuts have the potential to cause deep and lasting damage to a state’s ability to provide basic public services to its people.

Between 2007 and 2015, West Virginia’s corporate net income and business franchise tax cuts were phased in via trigger mechanisms that relied on the balance of the state’s rainy day fund. The state tax department estimated that the tax cuts, once fully phased in, would cost $118 million annually, while advocates of the tax cuts argued that the lost revenue would be made up through the economic activity the tax cuts would create. Instead, the tax cuts failed to generate any growth, with West Virginia having the slowest job growth in the country over the past decade. And as the tax cuts phased in, they grew more expensive. Corporate net income/business franchise tax revenue dropped from a peak of $388.0 million in FY 2008 to $144.5 million in FY 2021, making the tax cuts more than twice as costly as initially projected. Over that same time period, the state’s higher education funding has been cut by 20 percent and public health department funding cut by 29 percent, adjusting for inflation.

Read Kelly and Sean’s full blog post.

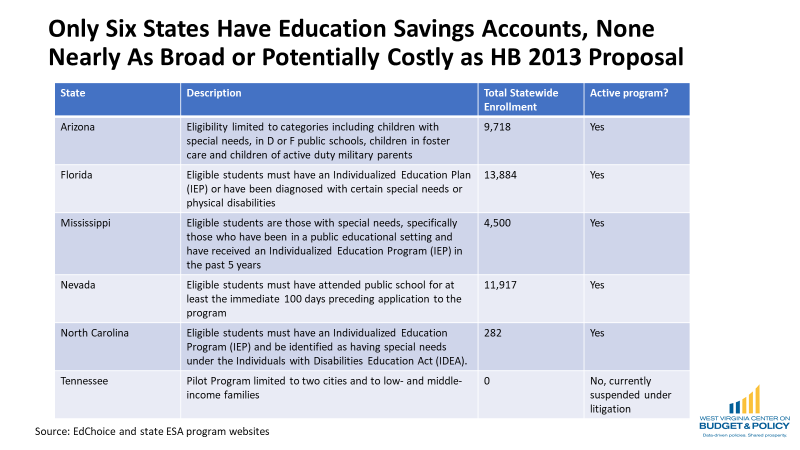

As of this week, HB 2013 (the Hope Scholarship Program) has passed out of both the full Senate and the full House. The bill now awaits signature from Governor Jim Justice. WVCBP executive director Kelly Allen’s statement, released Wednesday, is as follows:

“Today the WV Senate passed HB 2013, the Hope Scholarship program, which will be the broadest and likely most costly Education Savings Account program in the country. If signed into law, the program will divert hundreds of millions of dollars of education funding to families who have already made the choice to send their children to private school or homeschool — and away from our public schools, where the vast majority of our state’s students will learn with fewer resources.

“Instead of investing in all our state’s students by adequately funding our public schools, this redirects resources to families who already have school choice. We urge Governor Justice to veto this fiscally irresponsible legislation.”

West Virginia is well below the national average in overall per-pupil education spending, and this bill will only result in fewer resources for the vast majority of students who will remain in public schools.

Ignoring the impacts of socioeconomic factors in educational outcomes ensures that education reform will fail. West Virginia is currently one of only eight states that does not consider poverty when allocating funding.

Fully funding our public schools ensures opportunity for all, not a few.

We invite you to join us and contact Gov. Justice urging him to oppose HB 2013. You can send him a quick letter here. It will only take a minute of your time.

For further details on the costs of the Hope Scholarship and why most West Virginia families do not benefit from ESAs, read our blog post, check out our ESA Fast Facts sheet, or watch our explainer video.

To learn more about additional bills being considered at the legislature that could have a sweeping impact on public education funding, check out Kelly’s blog post.

A recent Mountain State Spotlight article, featuring insight from WVCBP senior policy analyst Sean O’Leary, explores the ongoing controversy surrounding Gov. Justice’s CARES Act spending and how a provision included in the American Rescue Plan may impede the governor’s plans for new stimulus spending. Excerpt below:

West Virginia will get billions in funding through the American Rescue Plan, including another $1.25 billion that goes directly to the state to spend. On top of this, $677 million will go directly to local governments in the state.

While the new plan allows federal money to be used to fill revenue losses caused by COVID-19, it also includes a provision that has angered the governor: a restriction on using these new stimulus funds directly or indirectly to offset tax cuts.

The frustration goes back to Justice’s “buckets,” a term the governor uses to refer to allocating unspent money.

“I’m really big into buckets,” Justice said at his 2021 State of the State Address, when he first laid out his priority of reducing and eventually eliminating West Virginia’s income tax.

Over the last month, Justice has mentioned the idea of putting federal stimulus money in buckets to cover revenue shortfalls, as well as promoted a plan to get rid of West Virginia’s income tax. This has created some concerns that he may intend to use coronavirus stimulus money to cover the tax cuts.

Sean O’Leary, senior policy analyst for the West Virginia Center on Budget and Policy, said it [the American Rescue Plan restriction] was a smart provision.

“You don’t want to be using a one-time temporary infusion of federal funding to pay for what would be an ongoing, permanent tax cut,” he said.

Read the full article here.

HB 2257, which passed out of the full House and is now being considered in the Senate, seeks to create a new form of extended supervision for people convicted of certain drug crimes for up to an extra 10 years, beginning after their normal parole or probation supervision ends. Such legislation would have a significant human and financial toll.

In FY 2019, almost 25 percent of the people who were sentenced to prison in West Virginia were arrested for parole and probation technical violations, costing the state millions. Undoubtedly, the extended supervision created by HB 2257 would lead to more parole and probation revocations, and would also serve to further burden people facing the already daunting task of reentry.

This legislation would be a step backward at a time when other states are making real progress toward criminal justice reform. Not a single other state has a provision that allows for 10 additional years of supervision on top of parole for drug crimes.

If the Legislature is serious about reducing recidivism, they should prioritize devoting more resources to reentry in West Virginia, including short- and medium-term housing, comprehensive health and drug treatment, and job training, rather than spending on increased supervision.

More on the repercussions of this bill in Quenton’s full blog post here and a recent article here.

“Throughout this country’s history, young Black people have been denied access to the halls of power. West Virginia is no exception. It’s time we let them show us the way by opening the door for them and not just settle for the face in the room, but give them access to the tools and support for real power and success.” – Crystal Good, folk reporter and activist

In partnership with ACLU WV, Crystal Good and Dr. Shanequa Smith bring you Young, Gifted, and Black, an event uplifting West Virginia’s Black policy researchers and advocates, including WVCBP’s very own Quenton King and Rhonda Rogombé.

Join us on March 23, 2021 at 7 PM.

Facebook event and registration here.

You can read more from Crystal on Black representation in the West Virginia policy sphere here.

Join the West Virginia Criminal Law Coalition and our special guest panel on March 30 at 6:30pm as we watch and discuss the new docuseries “Philly DA” ahead of its premiere.

“Philly DA” is a groundbreaking documentary series embedded inside the long-shot election and tumultuous first term of Larry Krasner, Philadelphia’s unapologetic District Attorney, and his experiment to upend the criminal justice system from the inside out.

You can view the trailer here.

The virtual event is being offered free of charge and is open to all. Find further details and registration here.

WVCBP’s Summer Policy Institute (SPI) is an annual event for college students and young people interested in bettering West Virginia through policy change. SPI brings together highly qualified traditional and non-traditional college students and young people to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the convening, attendees work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

Applications for SPI are being considered through April 30. Further details and link to apply here.