Crises like the coronavirus outbreak create a double challenge for state governments. Demand for vital public services escalate just as the revenues to support those services take a major downturn.

West Virginia is already in a tight budget situation, with resources stretched thin. Before the effects of the crisis were really felt, the state revenues for the current fiscal year were already $18.7 million below estimates, with little growth anticipated in the coming fiscal year. The state is already facing multiple years of budget gaps, including $170 million FY 2022 $158 million in FY 2023, under current projections.

There is no doubt, with factories and restaurants closing, layoffs occurring, and most economic activity at a standstill, state revenues will see a dramatic decrease in the coming months. Sales, personal income, and corporate income tax revenue are all likely to decline as people cut back on spending and businesses of temporarily or permanently close their doors and employees see reduced hours or lost jobs. Gas taxes will likely also be affected with greatly reduced travel. Some states, like Alaska, Colorado, and Hawaii, have already begun revising their revenue estimates downward in response to the crisis.

Without adequate revenues, West Virginia will be forced to cut back on their investments in health care, the safety net, and countless other services at a time when they are needed most. Which means West Virginia will need to take action to find additional resources.

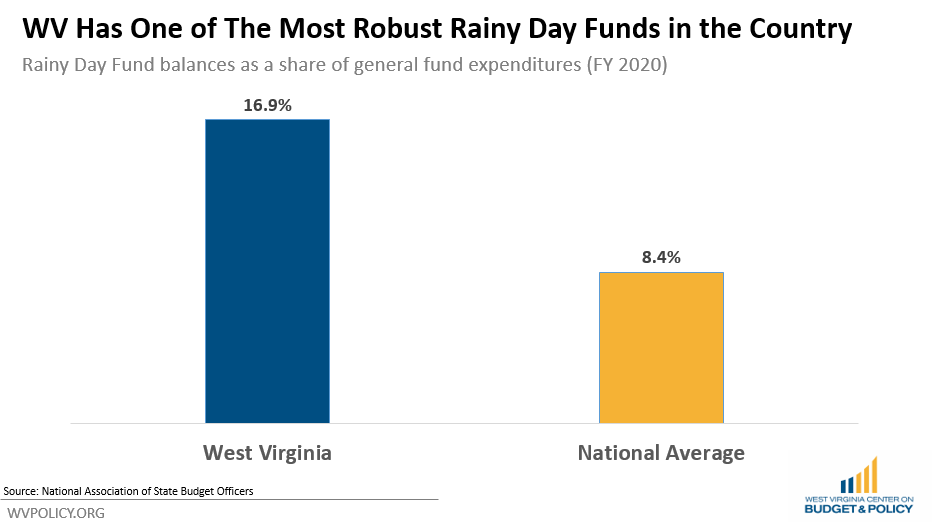

The first and most simple place to find resources is the state’s Rainy Day Fund. Unlike the federal government, West Virginia must balance its state budget. That means any decline in revenue must be offset by spending cuts. Tapping into the Rainy Day Fund would allow the state to keep providing vital services in the face of a sharp decline in revenue. West Virginia currently has $858 million in its Rainy Day Fund, one of the most robust funds in the country. The governor also has a $42 million surplus in the Civil Contingent Fund.

Beyond tapping the Rainy Day Fund, West Virginia could look at progressive ways to raise revenue, reinforce funding needs, replenish reserves, and generally improve tax structures. If West Virginia needs additional revenue to keep vital services and institutions operating, then taxing individuals and families who are managing to collect high incomes even during these difficult times is the best way to raise those revenues. These options include higher rates on large incomes or investment income, taxes on inherited fortunes, mansion taxes, and taxes on profitable corporations. For example, scaling back the personal exemption for high income earners would raise $19 million, while reinstating the estate tax would raise $20 million.

While searching for revenue, the state could look to reverse or freeze current tax rate reductions, such as the recent cuts B&O taxes for coal-fired electric plants ($12.6 million), the severance tax cut on low-producing oil and natural gas wells ($4.5 million), and the severance tax cut for steam coal ($60 million). The state could also delay new tax credits that haven’t cost the state revenue yet, but could grow costly in the near future, including the Downstream Natural Gas Manufacturing Investment Tax Credit, the Natural Gas Liquids Economic Development Tax Credit, and the recently expanded North Central Appalachian Coal Severance Tax Rebate Act.

West Virginia should use these resources to protect and enhance the highest-priority services to support the physical and economic well-being of those most in need, like Medicaid, unemployment insurance, and public health services.

The state should avoid attempting any tax cut stimulus. West Virginia must balance its budget, therefore the state is extremely limited in its ability to pursue any short-run economic stimulus through its tax codes. Any broad-based state tax cut large enough to meaningfully boost consumer spending will require offsetting budget cuts that are likely to cancel out—or worsen—the benefits of that increased spending. However, tax policies that deliver very targeted benefits to families most in need, particularly refundable tax credits like the Earned Income Tax Credit and Child Tax Credits, can be effective and are worth pursuing, particularly if made immediately available, if the resources are available.

In the months ahead, West Virginia will have to balance urgent emergency needs with limited state resources. The proactive options here will give the state some much needed breathing room.