A primary function of West Virginia’s jail system is to house pre-trial defendants, but despite recent bail reform, jail incarceration is surging and this growth is burdening the counties responsible for paying the costs.

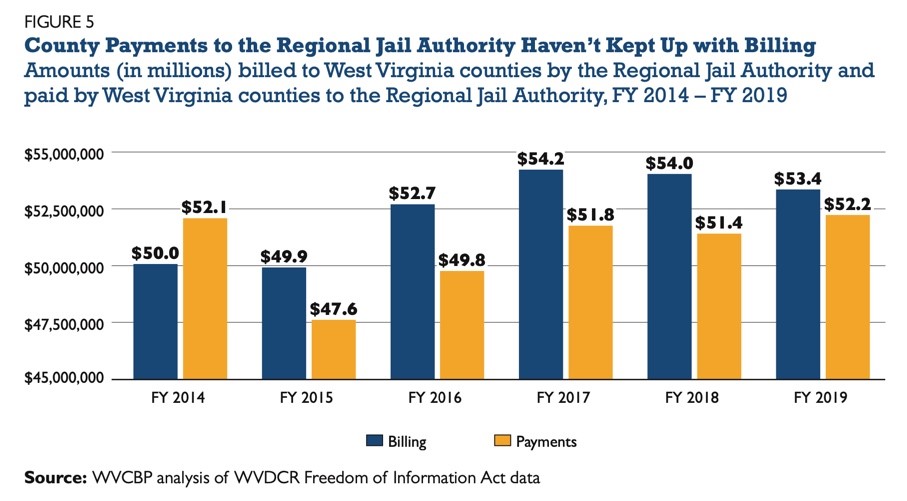

County spending on jails is rising along with rising jail population, but between 2014 and 2019, jail billing rose nearly seven times faster. This displays the significant and growing gap between the true costs of jail incarceration and counties’ ability to pay.

This gap is propelling a burgeoning jail debt crisis with the potential to cripple county budgets, especially now as the pandemic recession pushes many county budgets into deficit due to falling tax revenues. And unless West Virginia policymakers pursue significant reforms to the county jail system, the crisis is expected to persist.

Read Quenton’s full issue brief.

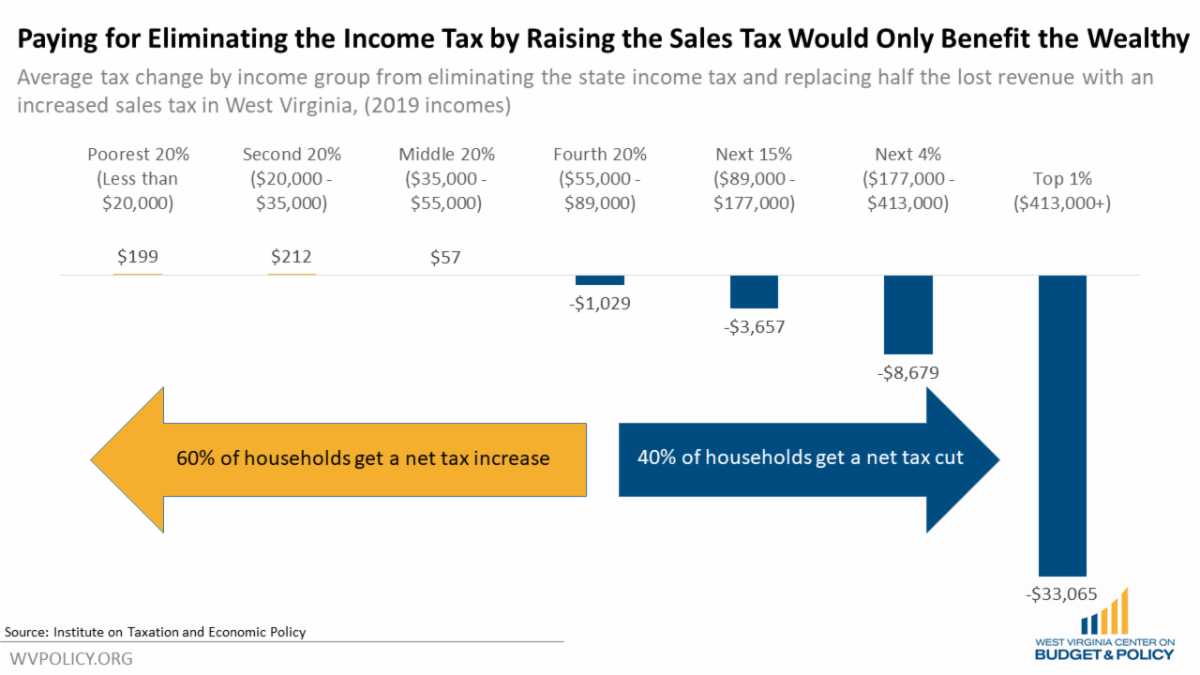

West Virginia’s Governor Justice and top lawmakers have expressed support for eliminating or reducing the state’s income tax during the upcoming legislative session.

The personal income tax is the state’s largest source of tax revenue, providing the state with $1.95 billion in FY 2020, which accounts for 43 percent of the state’s general revenue fund.

The personal income tax is usually the fairest source of revenue collected by state and local governments. A well-designed income tax can ensure that wealthier taxpayers pay their fair share, allow for lower rates on low- and middle-income families, and provide a counterweight to less balanced taxes.

Eliminating the income tax would not necessarily make West Virginia a “low tax” state. When a state eliminates this tax, only two possibilities follow. It either accepts funding cuts to public services or it makes up for revenue losses by increasing other taxes that disproportionately burden low- & middle-income residents, such as the sales tax.

To learn more about how cutting the income tax would near-exclusively benefit the wealthiest West Virginians at the expense of all others, read Sean’s full blog post.

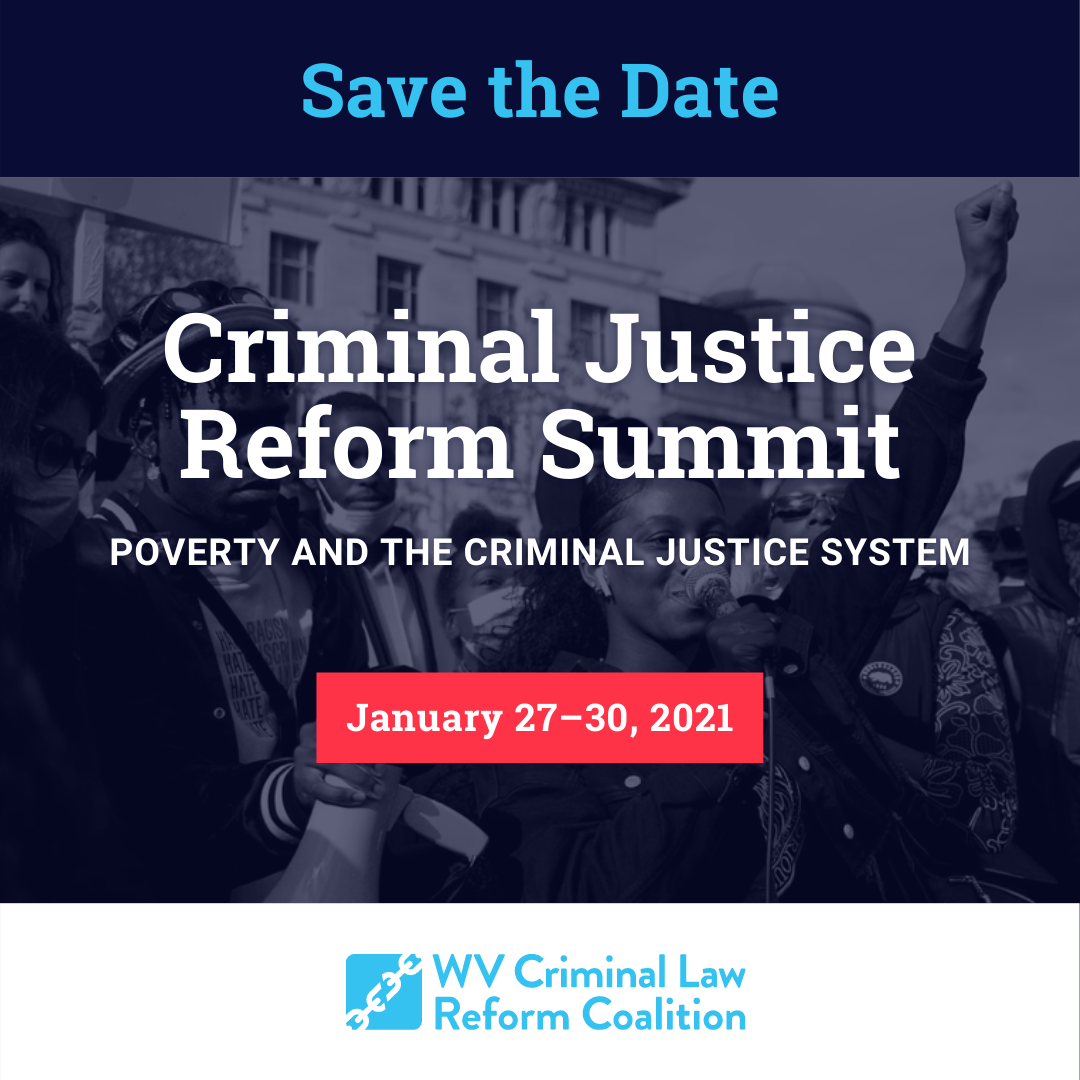

Registration is live!

Over the course of four days, participants at the West Virginia Criminal Justice Reform Summit will attend sessions exploring the significance of poverty before, during, and after incarceration. In addition to a wide variety of panels, there will be skill-building workshops as well as ample opportunity for participants to connect with one another. The conference will feature national and state-level experts, including people who have been directly impacted by the criminal justice system.

Our hope is that every participant leaves feeling more informed about the problems and solutions, more equipped to take action, and more connected. Together, we are a powerful force for change.

This summit is being hosted by the West Virginia Criminal Law Reform Coalition, of which WVCBP is a proud member.

Find more details on the summit landing page, follow the event on Facebook, and register here.

There can be no rationalization for the actions that we saw Wednesday in Washington D.C. Violent extremists, incited by the President of the United States, attempted to subvert the outcome of our presidential election, undermined our democracy, and put countless lives in danger when they stormed the U.S. Capitol.

We are relieved that democratic order was restored, but deeply saddened to see once again the extremity of the divisions that exist within our country. WVCBP affirms our commitment to using research and analysis to support informed public dialogue and policy in West Virginia. We believe that government is a force for good and plays an essential role in our society, bringing people together to address large problems we could not solve on our own and improving the quality of life for all. But in order for government to fulfill its purpose and be the agent of positive change that it has the power to be, it must be allowed to operate without the interference of violence and lies. We condemn the actions of insurrectionists this week at the U.S. Capitol, and we look forward to continuing to work within our country’s and state’s established legal institutions to advance equity and social justice in our communities.

WVCBP’s criminal justice policy analyst, Quenton King, was interviewed recently for a Charleston Gazette-Mail article exploring COVID outbreaks in West Virginia’s regional jails. Read an excerpt below:

Since Dec. 1, there have been COVID-19 outbreaks in five of West Virginia’s regional jails and at least four correctional centers.

During that time, at least 833 inmates in the 10 regional jails throughout West Virginia tested positive for the virus, and three outbreaks in three separate jails exceeded 190 cases — two outbreaks exceeded 250 cases.

During the whole month of December, and so far in January, the regional jails have operated at no fewer than 1,300 inmates above their listed capacity, despite efforts earlier this year to lower inmate populations because of the pandemic, as well as a new bail reform law for magistrates that went into effect this summer.

“Every jail outbreak is a time bomb,” said Quenton King, criminal justice policy analyst for the West Virginia Center on Budget & Policy. “We keep getting lucky. I say ‘lucky,’ and that’s with five inmates and one staff death. It could be a lot more. The odds just aren’t in our favor.”

Of note, while correctional officers are included in Phase 1-B of West Virginia’s COVID-19 vaccination plan, there remains no plan for the vaccination of incarcerated people, leaving them at extreme risk of obtaining the disease.

Read the full article here.

Join us for our 8th annual Budget Breakfast!

Due to COVID-19 considerations, this year’s event will be held virtually via Zoom.

WVCBP’s analysis of the Governor’s 2022 proposed budget will start at 8:00am, followed by keynote panel presentation and time for Q&A.

Our keynote panelists, Rep. Don Hineman and Duane Goossen, will highlight the failed Brownback tax experiment in Kansas and why West Virginia lawmakers should avoid going down the same path. Don Hineman is a Republican member of the Kansas House of Representatives, representing the 118th District. He has served since 2009. He was the Majority leader from 2017 to 2019. Duane Goossen is the former Kansas Secretary of Administration and the Director of the Kansas Division of the Budget. Goossen has served as the Secretary of the Kansas Department of Administration since 2004 and Director of the Kansas Division of the Budget since 1998. Goossen also served in the Kansas House of Representatives 1983 to 1997.

While attendees are welcome to join the webinar at no cost, we hope you will consider supporting the WVCBP’s work and contributing to our annual fundraiser by donating the usual cost of an in-person ticket ($50).

You can find registration here.

We hope to see you there!