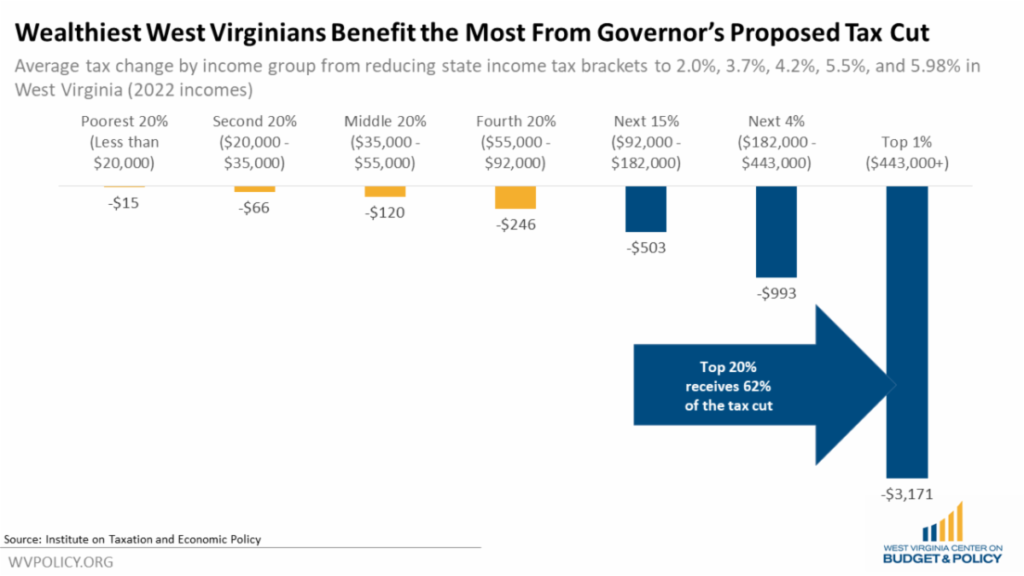

This week, the details of Governor Justice’s newest personal income tax cut proposal were revealed. Like previous failed attempts to cut the income tax in recent years, Gov. Justice’s latest proposal would give the bulk of the tax cut to the wealthiest West Virginians while depriving the state of resources to address real needs and make necessary one-time investments. The proposal will be considered during next week’s special session.

Gov. Justice’s proposal would reduce total income tax collections by 10 percent, costing the state over $250 million in lost revenue per year, a number that would grow over time as the income tax is one of the state’s most reliable sources of revenue growth.

Middle- and low-income households would receive only meager tax savings compared to the wealthy. Middle-income West Virginians, with incomes between $35,000 and $55,000, would receive an average tax cut of just $120, compared to an average tax cut of $3,171 for the wealthiest one percent of West Virginians, or those with incomes over $443,000. On average, the wealthiest 20 percent of West Virginians would receive 62 percent of the total $250 million tax cut, with the wealthiest one percent of West Virginians receiving 14 percent of the tax cut.

Gov. Justice appears to be relying on the state’s current budget surplus to finance this tax cut. However, using a one-time source of revenue – in this case a one-year budget surplus – to fund a permanent, ongoing tax cut could quickly cause budget problems for the state. This is of particular concern since West Virginia’s current surplus is largely the result of lowered revenue estimates, a strong national recovery from the pandemic, billions in federal aid, and high inflation and energy prices. With the current surplus the result of “surprising inexplicable patterns” in revenue collections, as stated by Revenue Secretary Dave Hardy, it would be inexplicable to use the temporary surplus to finance a permanent tax cut.

Read Sean’s full blog post.

Tell your legislators to reject tax cuts that overwhelmingly benefit the wealthy here.

This recent proposal from Gov. Justice comes mere months after his own budget office “warned legislators that the current surpluses should not be interpreted as having any bearing on the state’s long-term economic health.” A recent article featuring Sean’s insight dives further into the details of this contradiction. Read it here.

Another recent article, including insight from WVCBP executive director Kelly Allen, provides further details about Gov. Justice’s newest proposal, the upcoming special session, and the current landscape of competing tax cut interests in West Virginia. Read it here.

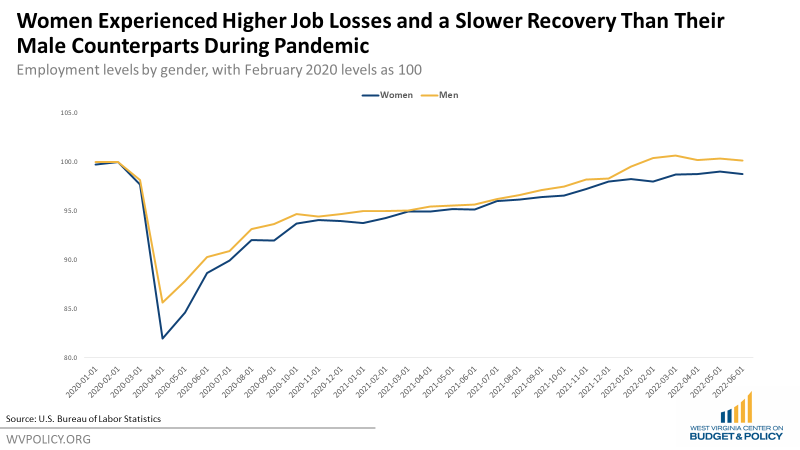

While it has been nearly two and a half years since the COVID-19 pandemic began, women have still yet to return to their pre-pandemic employment levels, down 900,000 jobs in June 2022 compared with February 2020. Over the same period, men have reached and now exceed their pre-pandemic employment levels. Women also saw larger total job losses than men at the peak of the pandemic. While the deeper and longer-lasting job loss impacts of the pandemic on women are likely due to a number of factors, the disproportionate share of caregiving that women shoulder plays a significant role.

The job loss impacts of the pandemic are expected to negatively impact women for years to come. In addition to economic insecurity, periods of joblessness – more likely to have impacted women than men over this period – have negative impacts on wage growth and promotions. Additionally, resume gaps can impact one’s ability to be competitive for new jobs. One study found that women who are working feel less comfortable asking for raises or promotions than they did pre-pandemic. All of these challenges could have ongoing impacts on women’s earnings and family economic security.

Several state-level policies should be considered to address the challenges that women have faced in reaching their pre-pandemic employment levels and ensure that they do not fall behind their male counterparts in job opportunities and wage growth. First and foremost, the state should invest more funding in child care subsidies and child care provider infrastructure, which would grow the child care workforce and allow more parents to work in other industries. West Virginia lawmakers could use a portion of the FY 2022 surplus or American Rescue Plan Act funds to improve its child care system. Policies like paid family and medical leave and fair scheduling policies would also target some of the specific barriers that those with caregiving responsibilities face by ensuring that workers have paid, job-protected time off to care for a new child or seriously ill family member, as well as advanced notice of work schedules to better balance caregiving responsibilities.

Additionally, taking steps to close the gender pay gap would help address the pandemic’s negative impact on women’s wage growth and job opportunities. Some tangible policies include strengthening salary transparency laws and prohibiting employers from asking prospective candidates about their salary histories. Both of these policies would help ensure women are paid a fair market salary rather than being punished for having a resume gap or being paid unfairly at a prior job.

Read Kelly’s full blog post.

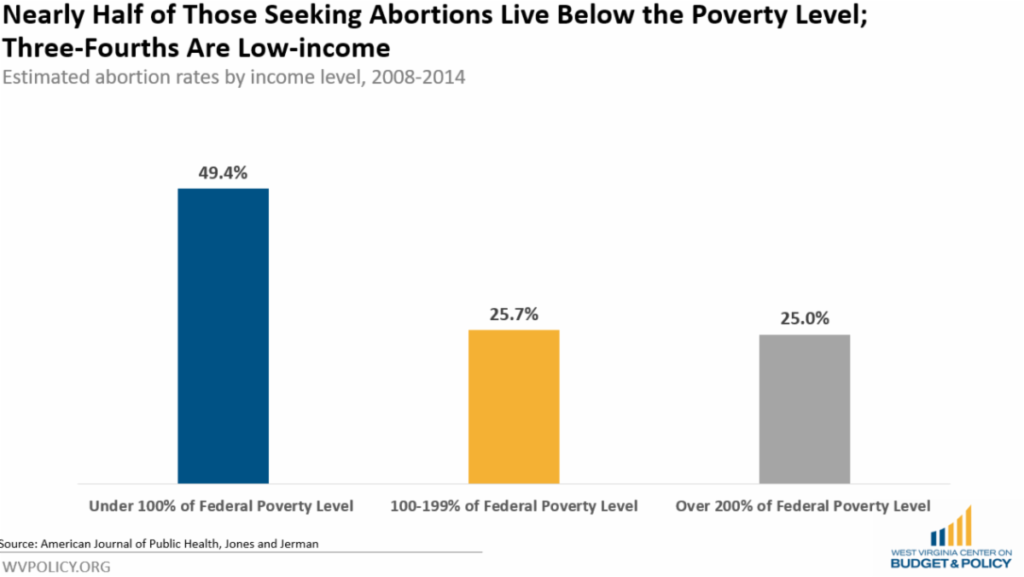

This week, a Kanawha County Circuit Court Judge issued a temporary injunction preventing West Virginia’s pre-Roe abortion ban from being enforced. In the wake of Roe’s overturn, the last remaining abortion provider in the state had ceased providing abortion services for fear of criminalization. As as a result of this new ruling, they will now resume providing abortion care for as long as it remains legal. A recent article includes further details. Excerpt below:

West Virginia’s only abortion clinic pressed forward Tuesday with scheduling abortions, even as the state’s attorney general went to the Supreme Court to try to stop it.

A Charleston judge on Monday blocked enforcement of the state’s 150-year-old abortion ban, freeing the Women’s Health Center of West Virginia to begin scheduling abortion patients. Executive Director Katie Quiñonez said Tuesday her staff planned to begin performing abortions as early as next week.

“We’re determined to continue doing so for as long as we’re able,” she said in a statement. She called Monday’s decision “a sigh of relief.”

The same day, Attorney General Patrick Morrisey said his office had filed a motion to the state Supreme Court asking it to block the decision from going into effect while his office proceeds with an appeal.

West Virginia has a state law on the books dating back to the 1800s making performing or obtaining an abortion a felony, punishable by up to a decade in prison. It provides an exception for cases in which a pregnant person’s life is at risk.

During Monday’s court hearing, lawyers for the Women’s Health Center argued that the old law is void because it has not been enforced in more than 50 years and has been superseded by a slew of modern laws regulating abortion that acknowledge West Virginian’s right to the procedure. One example is West Virginia’s 2015 law, which allows abortions until 20 weeks.

Kanawha County Circuit Court Judge Tera L. Salango agreed, granting a preliminary injunction against the ban. The judge said the recent laws enacted by the state legislature “hopelessly conflict with the criminal abortion ban” and that it would be “inequitable” to allow conflicting laws to remain on the books.

The clinic has been posting on social media and sending out information in its email newsletter to let people know they can once again schedule abortions. They have also reached out to clinics in surrounding states where West Virginians have been traveling for abortions after the Supreme Court ruling, letting them know West Virginians now have abortion access in their home state.

But [Quiñonez] said operations won’t just go back to the way they were before the clinic had stopped performing abortions. She said the staff has been upfront with patients booking appointments that they are open for abortions again pending further court action, like the state’s appeal. The West Virginia Legislature could also decide to take up abortion during a special session in coming weeks to clarify the old law or pass new bans or restrictions.

Read the full article here.

Read our recent blog post detailing why the right to abortion is an economic justice issue here.

Beginning in July 2021, most households with children had received monthly enhanced Child Tax Credit (CTC) payments of $250- 300 per child. However, the enhanced CTC included in the American Rescue Plan Act (ARPA) was temporary and expired at the end of 2021.

The impact on children and families since the expiration of the enhanced CTC has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make a robust CTC permanent is as urgent as ever.

Recently, a new proposal to expand the CTC was announced by Senator Mitt Romney. While we are excited to see bipartisan interest in enhancing the credit and while the proposal does improve some elements of the current law, it also has serious shortcomings – primarily, it does not make the full credit available to the lowest-income families (a notable divergence from the now-expired enhanced CTC that was included in the ARPA). Further, it proposes problematic offsets that would prove detrimental to low-income families.

A blog post from our colleagues at the Center on Budget and Policy Priorities provides further insight into the proposal’s pros and cons. You can read it here.

The costs of insulin continue to rise while income wages remain stagnant, exacerbating pressure on individuals and families to skip or ration insulin doses in order to make ends meet.

You can help us in our fight to urge Congress to take action! If you or your family is being impacted by insulin costs or rationing, please consider completing our survey and aiding us in our advocacy– we appreciate your time and insight.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.