Today’s Daily Mail reports on a study from the Marshall University Center for Business and Economic Research, warning that West Virginia’s high tax burden on the natural gas industry could hurt the development of the natural gas industry. Reading carefully, one may notice a lot of “maybes” “mights” and “coulds” in the report’s conclusions. Let’s take a closer look, and see if there is another point of view.

First off, the study’s author, Dr. Calvin Kent, states, “West Virginia places more taxes and fees on natural gas production than most of the other states which were studied.” However, more taxes doesn’t necessarily translate into a higher tax burden. And the report doesn’t actually determine if the taxes do create a heavier burden. Taxes almost always have exemptions, credits, and varying effective rates that affect their burden. Just listing the types of taxes and their statutory rates doesn’t tell you anything about the actual tax burden. Saying that they could create more of a burden is just as true as saying that they may not.

For example, we’ve looked at

severance taxes, showing that while West Virginia has a statutory 5 percent rate on the production value of coal, oil, and natural gas, various exemptions, credits, and limits gave the state an effective rate of 3.2 percent in 2007. Using the rate of 5 percent to compare West Virginia’s burden to other states would be inaccurate.

So while its inconclusive if West Virginia’s tax burden is actually any higher than other states for the natural gas industry, has it had any negative effect on the industry? The report says that it is too early to determine if the state’s taxes are creating a barrier to the development of the Marcellus Shale. But it certainly didn’t hurt last year. In

2010, West Virginia led the country in the number of new wells drilled. And, despite the lack of a severance tax, Pennsylvania drilled less than half (833) the number of new wells as West Virginia (1,896).

Another interesting way the report’s conclusions are framed can be found in the following phrase, “There are many factors which determine location, but, holding other things equal, state and local taxes will be an influential factor.” What does holding other things equal mean? It means holding equal all the things that

matter more to businesses than taxes. Sure, if the costs of labor, transportation, utilities, materials, and equipment were all equal, and the distribution of gas was even and the geography the same in every state with drilling, then taxes would be an influential factor. But that is not the case and never will be the case.

For example, just consider differences in labor costs. I’ve shown

before that even minor differences in wages between states can offset major differences in taxes. For example, a 5% decrease in total business taxes paid in West Virginia would be offset by only a $0.15 increase in average hourly wages.

Let’s compare West Virginia and Pennsylvania again. There are about 13 construction and extraction occupations identified by the occupational employment statistics system from the

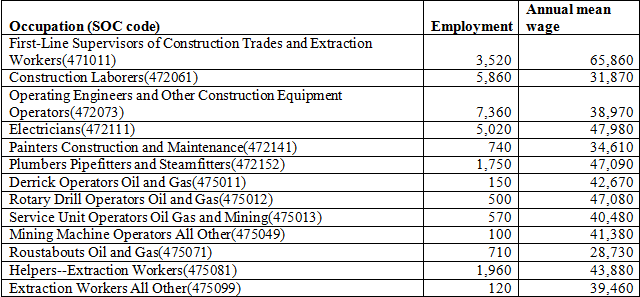

BLS as working in the natural gas industry. Here are the employment and wage numbers for West Virginia in 2010.

WV Employment and Wages in Construction and Extraction Occupations

Source: Bureau of Labor Statistics

While not every employee listed works in the natural gas industry, the list covers the employees most associated with the industry. Overall about $1.22 billion in wages were paid to these employees in 2010.

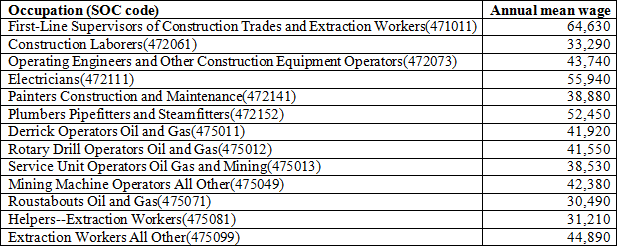

But West Virginia is a low cost-of-living state. Businesses, like those in the natural gas industry, can pay lower wages to employees in West Virginia. Just take a look at the average annual wage for the natural gas occupations in Pennsylvania.

PA Wages in Construction and Extraction Occupations

Wages in Pennsylvania are generally higher for most of the occupations associated with the natural gas industry, but not shockingly higher. But what would happen if the average Pennsylvania wages were applied to the number of employees by occupation in West Virginia. Businesses would be paying about $1.287 billion in wages, about $64.8 million more than they actually paid. And that is actually less than the amount the natural gas industry paid in severance taxes in West Virginia in 2010 (about $55.6 million). None of this is to say that lawmakers should pursue a race to the bottom on taxes, wages, and regulations, it just reflects a better understanding of the cost of doing business.

Finally, the report state’s that, “Experience shows that taxes and other fees do play a part in where drilling, extracting and manufacturing of gas transpires. The natural gas field does not respect state boundaries. By placing wells near state borders, gas from one state can be easily transported to another. Gas processing and manufacturing businesses usually gather near drilling sites, and for that reason close parity, particularly with surrounding states, is desirable.”

That experience, however, seems to be more an article of faith rather than actual experience. This

report looked at the experiences of Montana and Wyoming in the late 1990s. At the time, energy exploration and production was flat in both states, energy prices were low, and both were looking for ways to jump-start the economy.

Montana lowered production tax rates and added new incentives for new production. Wyoming issued two studies that found that tax incentives would not stimulate activity, and decided to eliminate a severance tax reduction passed the previous year. As a result, the overall tax rate on the oil and gas industry was 50% higher in Wyoming than in Montana.

So how did higher taxes affect the industry in Wyoming compared to Montana? Between 2000 and 2006, Wyoming added over $10 billion in production value, while Montana only added $2 billion. New drilling continues at a faster pace in Wyoming and the state is a leading energy producer. The report concludes that there is little evidence to suggest the industry fled Wyoming to move to Montana to avoid the high tax burden.

Wyoming’s finances benefited as well, as revenue grew by 335% from 2000 to 2006, compared to 280% in Montana. The Department of Revenue in Montana concluded that new tax incentives cost the state $515 million in lost revenue from 2003 to 2007.

The main message? Tax policy is only one of many factors that influence the natural gas industry’s exploration and production, and a small one at that.

In the final analysis, the Marshall study doesn’t show that West Virginia’s tax burden is higher than other states, nor does it show that a high tax burden significantly influences the industry when deciding where to produce. Focusing too much on tax policy distracts from other important issues that need our attention. We need to focus more on how the state can mitigate environmental impacts, boost employment of in-state residents, and how we can be

better positioned once the energy boom ends and the resources are depleted.