Over the next week, Congress and West Virginia’s federal delegation are expected to make major decisions on the elements of the budget reconciliation package. This period will determine whether critical worker and family supports are passed in tandem with a hard infrastructure package.

Congress acted swiftly to enact pandemic relief because we raised our voices together and demanded help. With short-term relief now reaching families, Congress must look to our future and pass economic recovery legislation that ensures everyone can thrive, no matter what we look like or where we come from.

This fall we have a once-in-a-lifetime opportunity to address the challenges that families have faced alone for far too long, to improve West Virginians’ lives, and create a stronger, fairer economy that works for all of us– not just those at the top.

Moving the packages together is critical, as West Virginia workers and families need supports in accessing child care and home care services, having paid time off for a new child or serious illness, and extensions of the groundbreaking expansions of the Child Tax Credit. Together, these packages will ensure that West Virginians will have both access to good jobs and the resources to balance work and family responsibilities.

You can take action today to help push this package across the finish line by sending a letter to your federal representatives here.

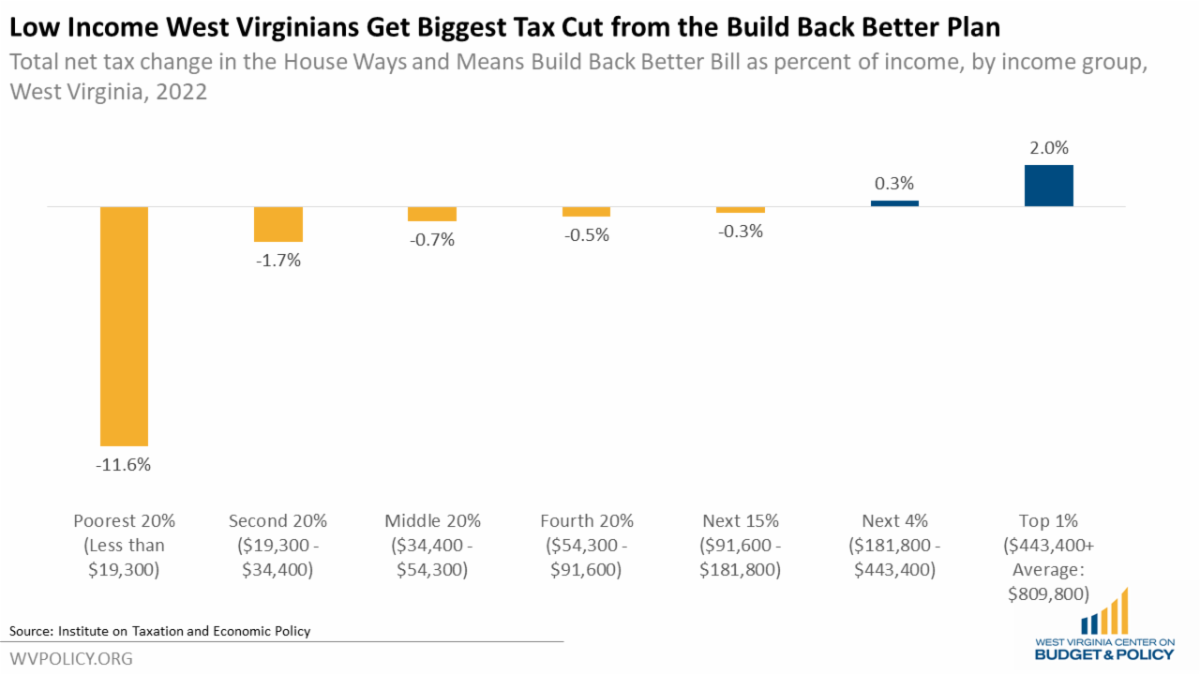

In addition to broad benefits from the programs contained in the budget package, West Virginians would also broadly benefit from the tax changes contained in it. From Sean’s new blog post:

The combination of tax changes in the Build Back Better bill recently approved by the House Ways and Means Committee would result in a tax cut for the average taxpayer in all income groups except the wealthiest 5 percent in West Virginia, according to a new report from the Institute on Taxation and Economic Policy. The bill would make the federal tax system more progressive, by raising taxes overall on the richest 5 percent of Americans and foreign investors, while cutting taxes overall for other income groups- and that is before accounting for the broad benefits of the programs that would be funded through these tax changes including paid family and medical leave, investments in the child care and home health workforces, and more.

The Build Back Better bill raises $2.1 trillion over 10 years through increases to individual income taxes, corporate income taxes, and taxes on tobacco and nicotine. The vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts — expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) — would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Read Sean’s full blog post here.

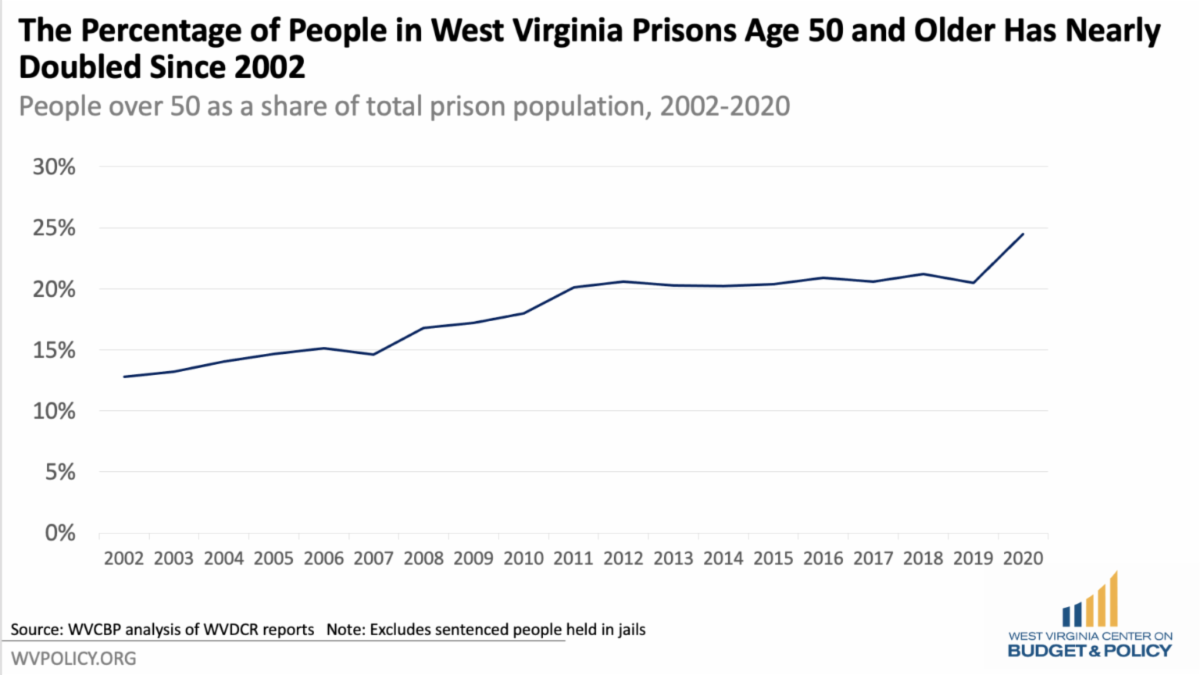

According to the Bureau of Justice Statistics, the number of people incarcerated in prisons who were age 55 or older increased 400% between 1993 and 2013 nationwide, with those age 55 or older making up 10 percent of the total prison population in 2013. West Virginia has seen a similar trend in recent years. According to the West Virginia Department of Corrections and Rehabilitation, the percentage of people age 50 and older in West Virginia prisons has nearly doubled over the past 17 years, from 12.8 percent in 2002 to 20.5 percent in 2019 (while the national Bureau of Justice Statistics breaks down age groups with 55 as a cutoff, West Virginia’s state data uses age 50).

As of on June 30, 2020 after the state had taken proactive measures to reduce prison population by releasing some people in prisons and reducing jail intakes, the percentage of people who were 50 and older in prisons in West Virginia had jumped to its highest share—24.5 percent—nearly double the percentage of that in 2002. It is difficult to analyze the increase without knowing the backgrounds and underlying offenses of the people who were discharged early from prisons and those who remained. But at the surface, the share of the population that was in prison months into the pandemic was older than ever before and at higher risk of severe COVID-19 complications.

Read Quenton’s full blog post here.

West Virginia faces a pivotal moment as we begin to emerge and recover from the COVID-19 pandemic and recession. While the pandemic brought many of its own unique challenges that have been addressed by prompt local, state, and government action, an important takeaway that was highlighted during the pandemic was that there are also longstanding, structural challenges to the economic mobility and well-being of our people — challenges that the pandemic did not cause. For that reason, simply returning to the pre-pandemic economy and system is not an option. In order to move our state forward and create a West Virginia that allows all in the state to thrive, we must implement policies that ensure everyone can achieve shared prosperity with the resources needed to balance work, care for family, feel a sense of community, and meet their basic needs.

Earlier this summer, the WVCBP released our Blueprint for an Equitable Recovery. This week we highlighted the family and economic security recommendations to ensure that all West Virginia families can thrive.

Read the full report here.

This week WVNS-TV interviewed the WVCBP’s Kelly Allen and Child Tax Credit (CTC) recipient Becky Dillon about the life-changing impacts of the CTC expansion in West Virginia. From the story:

The pandemic changed life for millions of Americans across the nation. Utility and food bills increased with more time spent at home, causing more financial stress for millions of families. Here in the Mountain State, one woman said Congressional action made a huge difference.

“Ask them how much a gallon of milk costs, do you know?” Becky Dillon said. “If you don’t know, good. You don’t have to worry about it. I know because I have to worry about it.”Dillon has been working from home since the start of the pandemic and her 10-year-old daughter learns remotely. She said utility bills and household expenses increased because of more time spent at home. She said she is able to pay those bills because of the Child tax Credit expansion passed by Congress in March of 2021.

Learn more about how the expanded Child Tax Credit is benefiting West Virginia families in our full statement here and check out the full WVNS-TV interview here.

Earlier this week, the WVCBP’s Rhonda Rogombe sat on a panel with Amy Jo Hutchison of Rattle the Windows and the Coalition on Human Needs to talk about the urgent need for family care supports in our state.

For too long, the economy hasn’t worked for too many West Virginia families who struggle between finding and keeping work, paying rent and bills, and caring for kids, older relatives, and family members with disabilities. And the COVID-19 pandemic has only made matters worse.

Things can and should be better. Already, benefits such as the expanded Child Tax Credit have proven their ability to help families stay afloat and create jobs in West Virginia. And we now have a golden opportunity in Congress to establish an “infrastructure of care” – one that ensures people have the resources they need to care for their families, keep a roof over their heads, and sustainably return to work.

If you missed it live, you can check out the webinar recording here.

To get a sense of a state’s values, one often need look no further than its tax system.What a state spends its tax dollars on and how it acquires those tax dollars typically reveals a lot about the priorities of its people—what they care about and what they stand for. In theory, it’s a direct reflection of their collective values.

And in West Virginia, we’ve seen perennial efforts to shift who pays taxes from the highest-income earners and corporations onto low- and middle-income families. Over the past two decades, state taxes paid by individuals and families increased while taxes paid by businesses declined. At the same time, low- and middle-income families have been paying a greater share of their income in taxes than wealthier West Virginians. This has come with either flat or less investment in public programs and services that benefit us all.

Join us on Thursday, September 30 at 2:00pm for a webinar that dives into West Virginia’s tax system, who pays, and how we can protect current programs and services while growing the pie for everyone. Register here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.