More than 91,000 children live in poverty in West Virginia. At 25.5%, West Virginia has the 4th-highest child poverty rate in the country. The cost of child poverty is high. According to a report from the National Academies of Sciences, Engineering and Medicine, child poverty costs the U.S. between $800 billion and $1.1 trillion a year, due to lower productivity when poor children become adults and increased costs due to higher crime and poor health. Children living in poverty face lower educational achievement, maltreatment and other obstacles that affect them for the rest of their lives.

With the long-term costs of child poverty so high, nearly any funding aimed at reducing child poverty would likely end up saving money. But exactly how much money are we talking about?

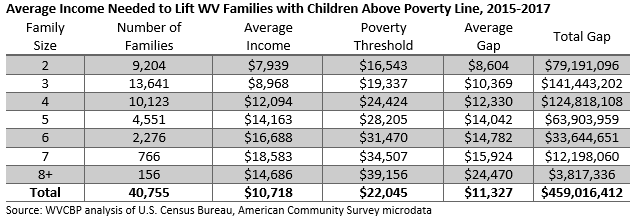

One of the simplest ways to estimate how much it would cost to end child poverty is to measure how much money poor families with children would need to boost their incomes above the federal poverty line. According to the U.S. Census Bureau, there are approximately 40,755 families with children living in poverty in West Virginia. These families would need an average of $11,327 to boost their incomes above the poverty line. In total, the income needed to lift these families out of poverty would be about $459 million.

While $459 million may sound like a lot, particularly for a small state like West Virginia, the state has spent much more than that on a number of dubious tax cuts. The business and sales tax cuts of the past decade have cost the state at least $425 million per year, with little to show for, and just this past session the legislature passed a severance tax rebate bill that already will cost $100 million for a single coal company, on top of a $60 million coal severance tax rate cut.

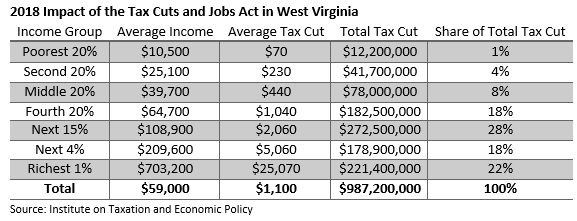

In addition, on the federal side, the Tax Cut and Jobs Act cut federal income taxes on West Virginians by $987 million in 2018. But of that amount, $400 million went to the wealthiest 5% of West Virginians in the state, or those making more than $158,000 per year. Those in the bottom 20%, making less than $18,900, received only $12 million total in tax cuts. In other words, child poverty in West Virginia could nearly be erased for the cost of the federal tax cuts going to the top 5% in the state.

There are a myriad of ways to get that $459 million needed into the hands of poor families. According to the National Academies of Sciences, Engineering and Medicine report on child poverty, simply expanding existing programs that encourage work but also provide direct assistance, including increasing the Earned Income Tax Credit (EITC) and child and dependent care tax credits for working families, and expanding housing vouchers and the Supplemental Nutritional Assistance Program would cut the childhood poverty rate in half within 10 years. As our blog post earlier this week showed, the Working Families Tax Relief Act, which expands both the EITC as well as the Child Tax Credit (CTC), is estimated to reduce child poverty by 28%.

Another approach suggested in the report is to expand the earned income and child care tax credits, raise the minimum wage and eliminate restrictions on immigrant families’ access to government aid, along with a $2,700 yearly allowance for each child. This, too, also cut child poverty in half. Canada recently adopted the Canada Child Benefit (CCB), a new initiative that provides families up to the equivalent of about $4,300 U.S. dollars per year for each child age 6 to 17 and $5,100 per child under 6. The CCB closely resembles the Child Tax Credit in the United States, but is is more than twice the size of the expanded CTC, and does not exclude families for not earning enough. Families also receive the CCB monthly, while they receive the CTC once a year when they file their tax returns. Replacing the CTC the equivalent of the CCB in the United States, would raise median incomes, lower inequality, and cut the number of U.S. children living below the poverty line by more than half.

Lifting children out of poverty improves not only their quality of life, but improves the economic future and quality of life of everyone. The costs of child poverty are steep, but we can avoid them. We simply need to prioritize poor children above tax cuts for big businesses and the wealthy.