Last week, Governor Tomblin issued a proclamation to call the legislature into a special session to address the state’s impeding budget crisis on Monday. This announcement came on the heels of a recent downgrade in the state’s bond rating from Standard & Poor’s Rating Service.

Due to a lack of consensus between the legislature (mostly the House leadership) and the governor on how best to close an estimated $270 million budget gap (this does not include cuts and reductions already baked into the Governor’s budget proposal, which takes this number above half a billion dollars), the governor included not only three bills to raise taxes but also a bill to give him authority to furlough state employees in case of a fiscal emergency. Along with Governor Tomblin’s budget bill, he also included in the call a supplemental appropriation bill to transfer $38 million in various funds and tap the Rainy Day Fund for $29 million to close part of the budget gap for the current fiscal year.

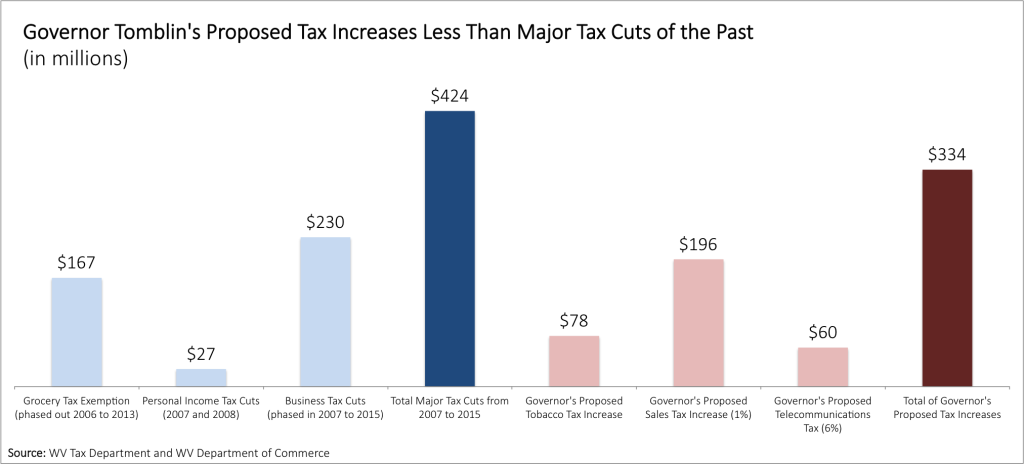

The tax increases proposed by the governor include: 1) raising the tax on tobacco products – including a 45 cent increase in the state’s cigarette tax, increasing the wholesale tax on other tobacco products from 7 to 12 percent, and establishing a new tax of 7.5 cent per milliliter on electronic cigarettes; 2) applying a sales tax on telecommunications services and ancillary services; and 3) raising the sales and use tax rate by no more than one percentage point. The tobacco taxes increase is expected to raise $78 million, the sales tax on telecommunications services would raise $60 million, and the sales tax rate increase to 7% from 6% would raise $196 million for a total of $334 million.

As Sean pointed out yesterday, these three tax proposals all hit low- and moderate-income families much harder than those at the top, and make our state and local tax system even more regressive and upside down. The good news, as Sean points out, is that there are much better options to close the revenue gap that include asking the wealthy to pay their fair share. The bad news is that these options were not included in the governor’s proclamation and will most likely not be considered. Making things even worse, it seems likely that the only revenue proposal that might pass is raising the tobacco tax by 45 cents per pack (instead of $1 increase that would not only raise more revenue but do more to prevent youth smoking, early deaths, and control health care costs).

While many legislators have signed “no tax” increase pledges and, alternatively, there are many others who believe that passing additional tax increases would significantly increase the state’s tax base, it is important to recognize that Governor Tomblin’s proposed tax increases would total less than the major tax cuts of the past. Beginning in 2007, West Virginia enacted a number of major tax cuts, including phasing out the grocery tax on food and the business franchise tax, reducing the corporate net income tax rate from 9 to 6.5 percent, and making some cuts to the personal income tax (increasing the homestead exemption and establishing a low income family tax credit).

According to the West Virginia Department of Commerce, the business tax reductions totaled more than $230 million in 2015. Overall, the major tax cuts of the past ten years add up to at least $424 million while the governor’s proposed tax increases total only $334 million. While the tax cuts of the past were somewhat balanced between difference income groups, the governor’s proposals all hit low- and middle-income families much harder.

The irony of the state’s current budget crisis is that the tax cuts of the past are roughly the size of the state’s current budget gap. These is why we warned years ago that eventually these tax cuts would come home to roost.

As the legislature continues to meet over the next week or so to iron out the FY 2017 budget, it is imperative that they take a fiscally responsible approach that includes additional revenue to meet the needs of our state’s citizens. The state cannot continue its dubious path of cutting its way to prosperity. Legislators need to explore options that ensure the wealthy pay their fair share and that provide the necessary resources for essential services and programs. Through these public investments we can create a shared prosperity that makes West Virginia a better place to live, work and raise a family.