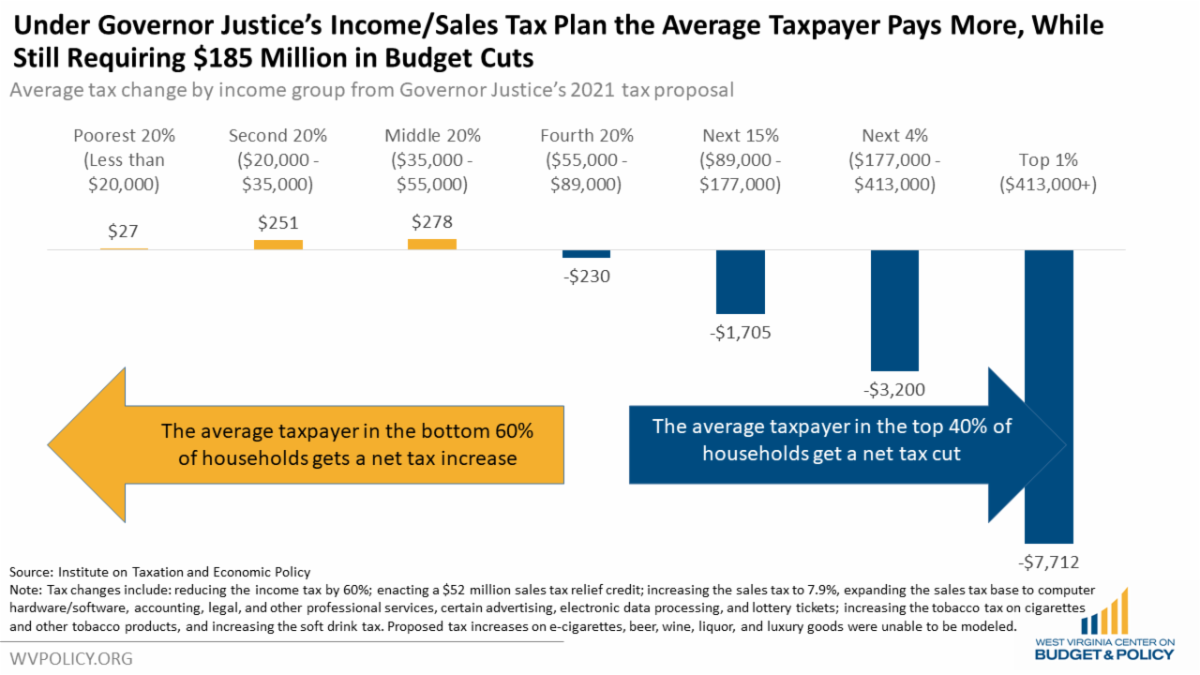

Last week, Governor Justice unveiled his proposal to make sweeping changes to the state’s tax system, including a substantial cut to the state’s personal income tax, while raising a variety of sales and other taxes. The tax reform would create a dramatic change in who pays state taxes in West Virginia, shifting the responsibility onto working families to make room for tax breaks for the wealthy. Altogether, these changes would lower General Revenue Fund collections by an estimated $185 million in the first full year of implementation, all but guaranteeing that the state will have to make painful budget cuts, while increasing overall taxes on the average taxpayer in the bottom 60 percent of households in West Virginia.

As currently structured, Justice’s tax plan would raise West Virginia’s sales tax to 7.9 percent, making it the highest state sales tax in the country, and effectively making our combined state and local sales tax rate 8.4 percent, higher than that of any of our surrounding states. This tax shift would constitute a windfall for high-income West Virginians, while shifting regressive sales taxes onto low- and middle-income families, those same families who have been hit hardest by the pandemic.

Read Sean’s full blog post here and his recent interview on the proposed tax overhaul here.

An additional point not to be overlooked: Our state legislators are being asked to consider this significant tax reform proposal without a complete picture of West Virginia’s future budget projections. That’s because this year, for the first time in recent memory, the Governor’s budget proposal did not include a six year outlook, which normally outlines spending plans for future years and is an essential tool for identifying expected inflation and growth in agency budgets. Learn more about the economic landscape of West Virginia and the implications of reducing the state personal income tax in Kelly and Sean’s blog post.

Leading up to the legislative session, Sean had spent weeks outlining why eliminating/reducing the state personal income tax is misguided and truly harmful policy. You can find links to his numerous blog posts on this subject below:

Lastly, we welcome you to join us and send a letter of your own urging legislators to prioritize investing in West Virginia’s families and communities over providing a tax cut to the state’s wealthiest here.

This week, U.S. Congress passed the American Rescue Plan, a robust legislative package that provides critical relief helping families to stay afloat. This legislation is the kind of action the country needs at this moment, when unemployed workers are still struggling to pay their bills, millions of families are falling further behind on rent and at risk of facing homelessness, and parents are worrying about how they will feed their children.

From WVCBP executive director Kelly Allen:

“The passage of the American Rescue Plan is a victory for the economic security of West Virginia families. At the one-year mark of the COVID-19 public health and economic crisis, it has become increasingly clear that economic recovery isn’t going to happen overnight, particularly for low- and middle-income households and people of color, who have faced the deepest and longest impacts from the pandemic.

“We have more work to do to build a more equitable future that works for everyone. We look forward to working with West Virginia’s congressional delegation to convey the importance for our people and our economy of enacting permanent policies that will reduce the longstanding inequities that were exacerbated by the COVID-19 public health and economic crisis.”

You can read our full statement here and an article with further legislation details here.

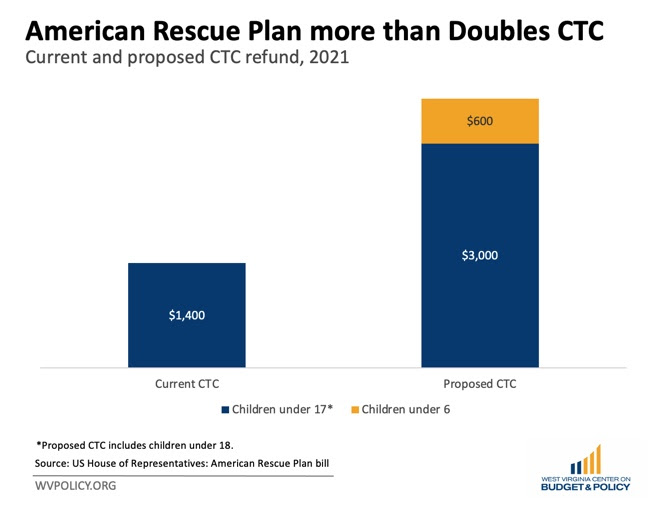

As mentioned above, U.S. Congress recently passed the American Rescue Plan, a $1.9 trillion coronavirus relief package. Our newest blog explores how the expanded child tax credit (CTC) included in the plan will work to significantly reduce childhood poverty in West Virginia.

The American Rescue Plan prioritizes relief for families with children by temporarily expanding the CTC, both in terms of who receives it and how much money families can receive. The current proposal offers families with children under 18 up to $3,000 per child, plus an extra $600 per child under six. This expansion more than doubles the size of the credit, making it an incredible tool for alleviating financial hardship for many families.

This moment is pivotal for low- and moderate-income families in West Virginia. ITEP estimates that these changes to the CTC will lift more than 38,000 children out of poverty, including 12,000 children experiencing deep poverty. Overall, this proposal reduces childhood poverty in West Virginia by over 50 percent. This policy is especially significant for West Virginia’s children of color, particularly Black children, who are more likely than their white counterparts to experience poverty. In 2018, Black West Virginians earned about $7,200 less than their white counterparts, a racial income gap of about 27 percent. The proposal addresses structural racial inequality by modifying the CTC to allocate more money to more families in the bottom quintiles.

Read Rhonda’s full blog post.

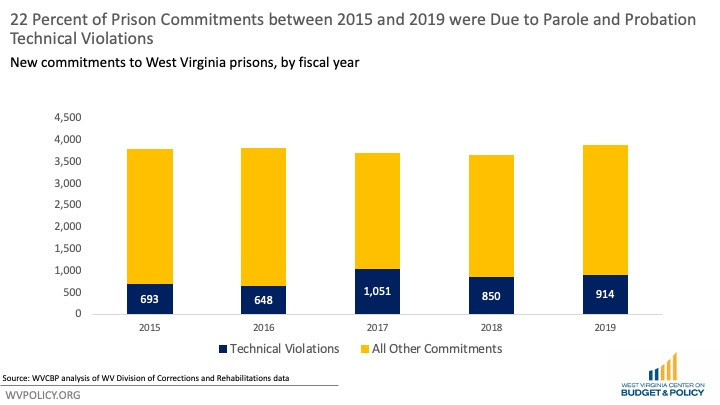

HB 2257, which passed out of the House last week and is now being considered in the Senate, seeks to create a new form of extended supervision for people convicted of certain drug crimes for up to an extra 10 years, beginning after their normal parole or probation supervision ends. Such legislation would have a significant human and financial toll.

In FY 2019, almost 25 percent of the people who were sentenced to prison in West Virginia were arrested for parole and probation technical violations, costing the state millions. Undoubtedly, the extended supervision created by HB 2257 would lead to more parole and probation revocations, and would also serve to further burden people facing the already daunting task of reentry.

This legislation would be a step backward at a time when other states are making real progress toward criminal justice reform. Not a single other state has a provision that allows for 10 additional years of supervision on top of parole for drug crimes.

If the Legislature is serious about reducing recidivism, they should prioritize devoting more resources to reentry in West Virginia, including short- and medium-term housing, comprehensive health and drug treatment, and job training, rather than spending on increased supervision.

More on the repercussions of this bill in Quenton’s full blog post here and a recent article here.

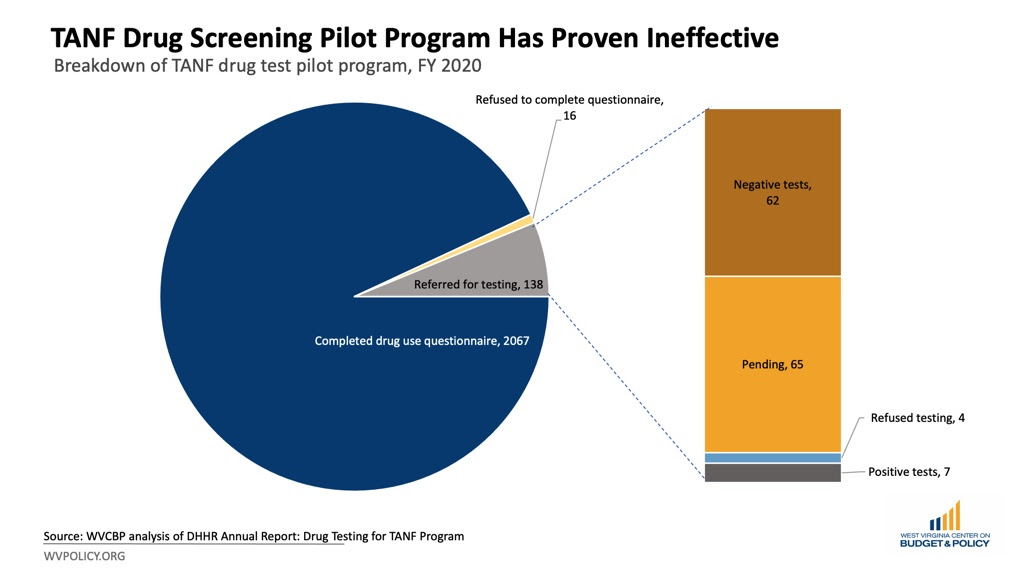

SB 387 passed out of the House Health and Human Resources Committee last week and is now scheduled to be considered by the full House. This bill would make applicants who test positive for drugs or refuse a drug test ineligible for Temporary Assistance for Needy Families (TANF) assistance.

A recent blog post from our health policy analyst Rhonda Rogombé explains how adoption of such policy would further stigma, harm vulnerable populations, and contradict public health best practices.

“Rendering benefits contingent on passing a drug test for individuals otherwise eligible for cash assistance does not meaningfully address substance use problems. Instead, it does quite the opposite — drug screening creates barriers for those who may otherwise seek treatment.

“In a state already riddled with budget shortfalls, dedicating resources to an initiative that further stigmatizes individuals with low incomes — while worsening their material conditions — contradicts the core mission of TANF and other social programs, as well as best practices for public health. Rather than punishing TANF recipients by extending the drug screening program, West Virginia must recommit to providing basic assistance to families. Redirecting funds toward these initiatives would better serve low-income families and help create a healthier West Virginia.”

Read Rhonda’s full blog post.

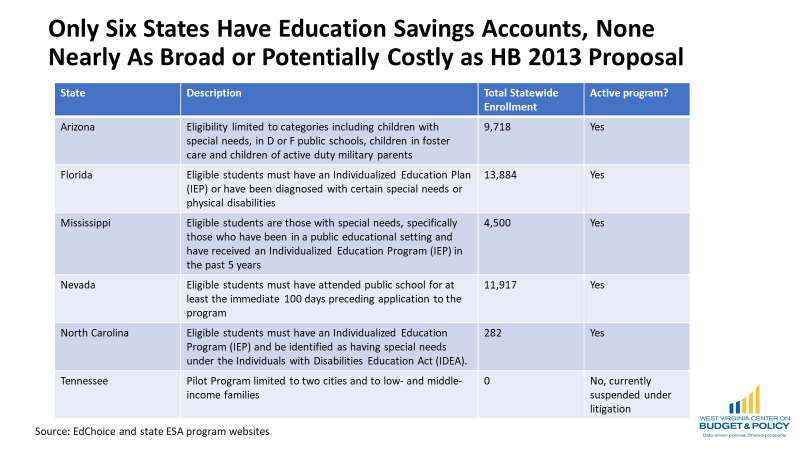

As of this week, HB 2013 (the Hope Scholarship Program) has passed out of both the Senate Education committee and the Senate Finance committee, despite unanswered questions about the legislation’s long-term costs. The bill now moves to the full Senate for consideration.

ESAs divert public education funding to private and nonpublic education programs by allowing families to apply for public education dollars to be put into a bank account to pay for personal education costs including homeschooling, tutoring, or private school tuition.The Hope Scholarship, the value of which is pegged to the per pupil’s state share of public education spending, would be worth approximately $4,600 in FY 2021. The program is much broader and potentially much more costly than any similar Education Savings Account (ESA) program in the country.

Of note, the average private school tuition in West Virginia is $6,068, meaning that there is little benefit to lower income households who don’t have $1,000 or more to make up the difference in tuition in addition to the hundreds of dollars in fees that private schools levy. Further, nine West Virginia counties do not have private schools at all, with most of the state’s private schools located in its more urban and wealthier counties, likely meaning that rural students and low-income students would be left out of the program.

Without income guidelines or enrollment caps as seen in earlier iterations of ESA bills, the costs of this program could grow quickly. This results in less public education funding for the vast majority of students who remain in the public school system. West Virginia’s legislative auditor estimated that the original bill could cost between $22 million and $33.5 million, coming out of the state’s K-12 education funding. Importantly, the auditor does note that the estimate is based on enrollment in other states with ESAs where eligibility is limited to students with special needs and, as such, the costs of West Virginia’s broad program could be significantly higher.

West Virginia is well below the national average in overall per-pupil education spending, and this bill will only result in fewer resources for the vast majority of students who remain in public schools.

Ignoring the impacts of socioeconomic factors in educational outcomes ensures that education reform will fail. West Virginia is currently one of only eight states that does not consider poverty when allocating funding.

Fully funding our public schools ensures opportunity for all, not a few.

We invite you to join us and contact your legislators urging them to oppose HB 2013. You can send them a quick letter here. It will only take a minute of your time.

For further details on why most West Virginia families do not benefit from ESAs, read our ESA Fast Facts sheet or watch our explainer video.

To learn more about additional bills being considered at the legislature that could have a sweeping impact on public education funding, check out Kelly’s blog post.

As Solutions Oriented Addiction Response’s (SOAR) harm reduction efforts come under threat, WVCBP reaffirms our full support of the organization’s life-saving work.

At the end of 2020, we published a blog exploring the surge in HIV and Hepatitis C cases in Kanawha County largely due to the sharing of needles to inject drugs, and how syringe services programs (SSPs) like those operated by SOAR play a critical role in reducing the spread of these diseases. SSPs are effective, cost-saving, and treat those in our community who inject drugs with the dignity that all folks deserve.

Despite the fact that harm reduction efforts are supported by the U.S. Centers for Disease Control and Prevention (CDC), SB 334 — a bill that would severely restrict harm reduction programs statewide — recently passed out of the full Senate and will now be considered by the House Health and Human Resources committee and the House Judiciary committee. If the bill is adopted, it will have not only a severe moral cost, but a dramatic financial cost, as well. The increase in Hepatitis C and HIV cases in Kanawha County alone in a single year has an estimated health care cost of $47 million.

Read the latest on SB 334 from the media here.

Harm reduction is also facing attacks at the city-level. Charleston City Council will likely vote on a new ordinance that would make SOAR’s currently legal harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

Again, we at WVCBP wholeheartedly believe that needs-based harm reduction programs make our communities both kinder and safer. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

| Join the West Virginia Criminal Law Coalition and our special guest panel on March 30 at 6:30pm as we watch and discuss the new docuseries “Philly DA” ahead of its premiere. “Philly DA” is a groundbreaking documentary series embedded inside the long-shot election and tumultuous first term of Larry Krasner, Philadelphia’s unapologetic District Attorney, and his experiment to upend the criminal justice system from the inside out. You can view the trailer here. The virtual event is being offered free of charge and is open to all. Find further details and registration here. |

SB 272 was passed this week by both chambers of the West Virginia Legislature and will soon be signed into law by Governor Justice. This bill legally redefines what it means to be an “employee” vs. an “independent contractor” and puts many current employees at-risk of being reclassified as independent contractors, meaning they could be denied workplace benefits and protections.

Further details from a recent article on the topic:

People classified as employees are entitled to protection under occupational and labor laws, insurance and other state benefits, including employers withholding state and federal taxes.

Independent contractors bear the brunt of the work of collecting and paying taxes, and they don’t get certain legal protections, like Workers’ Compensation or unemployment benefits, in exchange for the work they do.

…

The bill West Virginia passed is similar to model legislation drafted by the American Legislative Exchange Council, more commonly referred to as ALEC. The group is a conservative-leaning non-profit organization known for writing model legislation for state lawmakers to use throughout the country.

West Virginia Center on Budget and Policy Executive Director Kelly Allen said the bill legally sanctions worker misclassification and would be “the worst bill for workers’ rights enacted in the country.”

“West Virginia’s workers already have the ability to work as independent contractors if they so choose,” Allen said. “What this bill does is upend the employer-employee relationship and allow businesses to unilaterally shift risk and costs onto workers, taking away basic labor protections like minimum wage, unemployment insurance, and workers’ compensation. It disadvantages responsible business owners, encourages a race to the bottom, and will result in less good jobs and economic security for West Virginians.”

Read the full article here.

WVCBP’s Summer Policy Institute (SPI) is an annual event for college students and young people interested in bettering West Virginia through policy change. SPI brings together highly qualified traditional and non-traditional college students and young people to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the convening, attendees work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

Applications for SPI are being considered through April 30. Further details and link to apply here.