Last week, Governor Justice approved the FY 2022 budget passed by the legislature at the end of session. While the fate of the budget was up in the air for most of the session as the legislature attempted to eliminate the income tax, by the time the session came to a close, only a few bills had passed that required offsetting changes to the budget. Despite the governor proposing a “flat” budget with little new investment, the legislature made a number of cuts throughout the budget, leaving $72.7 million unappropriated. While most of these cuts are expected to be restored using the anticipated surplus at the end of FY 2021, the cuts will be built into future base budgets.

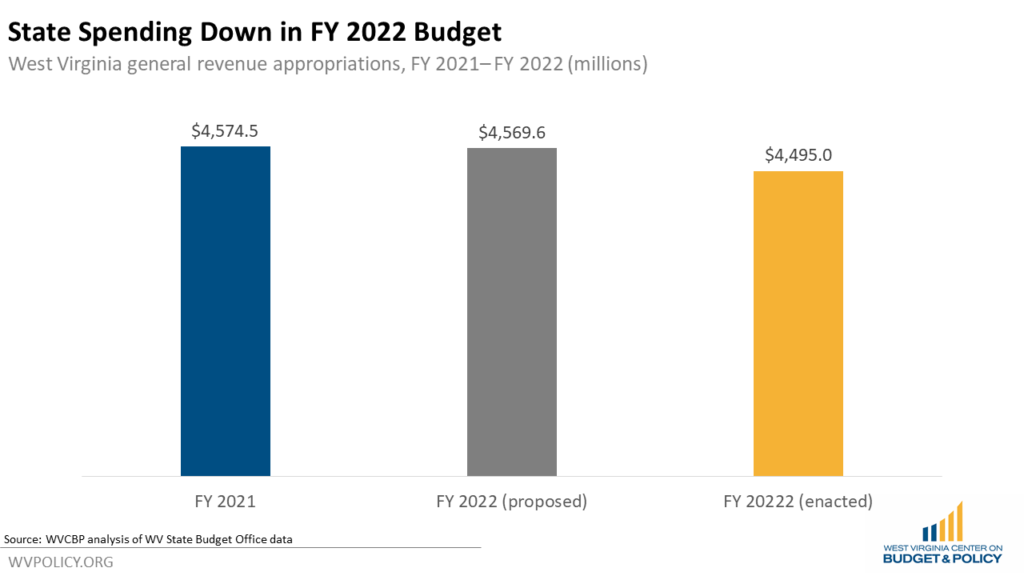

Overall, general revenue spending in the final FY 2022 budget is $74.6 million below the governor’s proposed budget, and $79.5 million below the FY 2021 budget.

A few areas of the budget saw minor increases as compared to the governor’s proposal. Under the Department of Health and Human Resources, the legislature increased funding for sexual assault response and prevention programs by $550,000 and increased funding for Health Right Free Clinics by $500,000. Public Defender Services also saw a $1.6 million increase for pay raises. In addition, the state’s share of the school aid formula increased by $2.6 million over the governor’s proposal, due to changes in projected local property tax collections.

The biggest changes from the governor’s proposal apply to the Governor’s Office, Medicaid, and higher education. $19.5 million was cut from the Governor’s Civil Contingent Fund, with $17.5 million due to be replaced with anticipated surplus funding for the Milton Flood Wall. $2.5 million was cut from general revenue funding for Medicaid and replaced with a one-time transfer from the Attorney General’s Consumer Protection Fund. $30.2 million was cut from higher education, including two- and four-year institutions. The cuts to higher education include a 1.5 percent across the board cut that is due to be replaced with anticipated surplus funding. But notably, of those cuts, $2 million cut from WVU and Marshall is not replaced with surplus funding.

With all of the cuts, the final budget leaves $72.7 million unappropriated, but the reasoning for that action is unclear. Both the House and Senate versions of the income tax elimination plans relied on unappropriated surpluses to trigger tax cuts. Since neither plan survived the legislative process, the legislature may be building surpluses to pay for future tax cuts. However, even more heavily than the governor’s proposed budget, the finalized budget relies on one-time transfers and other temporary measures.

The future budget picture remains troubling, with projected revenues far below initial estimates while the reserves the state has been relying on to balance the budget are being depleted. As the state emerges from the pandemic, budget cuts threaten to undermine the state’s recovery. Instead of cutting the budget and tapping reserves to make room for potential tax cuts, we should be looking for ways to both meet current needs and invest in our people and communities to build a stronger, more equitable economy.

UPDATE

Click here for a spreadsheet comparing the base budget line item appropriations for FY 2021, the governor’s proposal for FY 2022, and the final enrolled version for FY 2022.