Yesterday, the state Senate passed SB 576, which would allow natural gas producers to force unwilling landowners to allow drilling on their property. But beyond empowering natural gas producers over landowners in the state, the bill was amended to include what is effectively a cut in the severance tax rate for natural gas production.

The amendment to SB 576 creates a tiered severance tax rate for natural gas, with the tax rate tied to the price of natural gas. But unlike the governor’s proposed tiered natural gas severance tax proposal, which would only increase severance tax rates if the price of gas increased, this amendment would result in a tax cut for natural gas for the next several year.

The amendment to SB 576 replaces the 5 percent severance tax on natural gas with a tiered rate based on price. Natural gas would receive a tax cut from 5 percent to 4 percent when the price of natural gas is under $2.50/MCF. The rate changes to 5 percent when the price is between $2.50 and $4.00/MCF and can go up to 9 percent when the price is at or above $10.00/MCF.

This new severance tax system would result in a tax cut for the natural gas industry for the next several years, and despite the potential higher rates, the rate is not likely to exceed 5 percent for the foreseeable future. The last time the average price of natural gas produced in West Virginia was above $4.00/MCF was in FY2014, when the price averaged an estimated $4.12/MCF, and natural gas severance tax collections peaked at $161 million. Since then, the price of natural gas has plummeted, and for FY 2016, the price of natural gas produced in West Virginia averaged an estimated $1.08/MCF.

This new severance tax system would result in a tax cut for the natural gas industry for the next several years, and despite the potential higher rates, the rate is not likely to exceed 5 percent for the foreseeable future. The last time the average price of natural gas produced in West Virginia was above $4.00/MCF was in FY2014, when the price averaged an estimated $4.12/MCF, and natural gas severance tax collections peaked at $161 million. Since then, the price of natural gas has plummeted, and for FY 2016, the price of natural gas produced in West Virginia averaged an estimated $1.08/MCF.

According to the Tax Department, the current price of natural gas produced in West Virginia is $2.00/MCF, which under SB 576, would drop the severance tax rate from 5 percent to 4 percent in FY 2017. The reduced rate would cost the state about $21 million in tax revenue, furthering the state’s budget crisis. The price of natural gas would have to increase by 25 percent to bring the severance tax rate back up to its current rate of 5 percent. According to the federal Energy Information Agency, the national price of natural gas is projected to increase by 2.03 percent per year from 2017 to 2050. At that rate it would be 2029 before the severance tax would be restored to its current 5 percent rate, and would not reach the threshold to increase it beyond 5 percent in the next 30 years.

Currently, the State Tax Department has natural gas severance tax collections projected through 2022. Based on those projections, the severance tax change in SB 576 would cost the state a total of $175 million between FY 2017 and FY 2022.

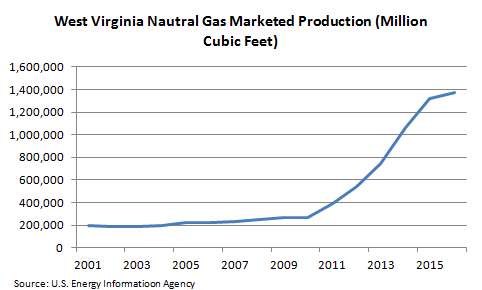

It also should be noted that natural gas production in West Virginia has had no problem quintupling in recent years with a 5 percent severance tax rate. And production has continued to reach record heights even as prices have plummeted.

With its current budget problems, the last thing West Virginia should be doing is lowering its severance tax on natural gas extraction given our state’s looming budget crisis. The severance tax is a highly exportable tax that has very little impact on local production growth or jobs. Instead the state should be ensuring that we are adequately taxing our non-renewable minerals to help diversify and grow our economy.