The economic impact of the COVID-19 pandemic has been felt strongly in West Virginia. In just a matter of weeks, the state lost 92,000 jobs and the unemployment rate spiked to 15.9 percent. As West Virginia has begun to reopen, some jobs have returned, but the unemployment rate remains above 10.0 percent, more than double its pre-pandemic rate of 4.9 percent.

With tens of thousands of West Virginians losing jobs and income, many are struggling to pay rent or make mortgage payments, even after receiving federal aid related to the pandemic.

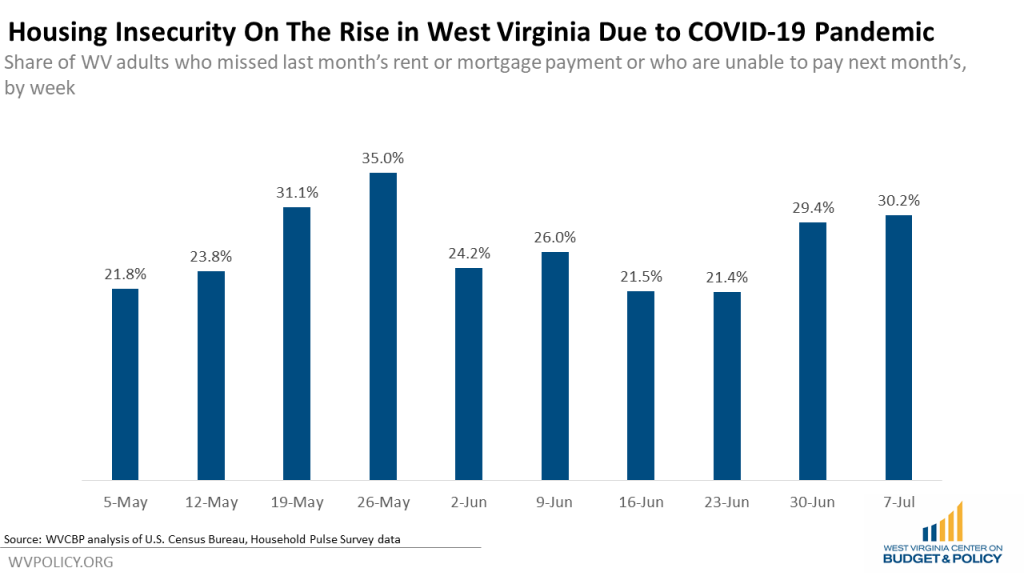

According to the U.S. Census Bureau Household Pulse Survey, for the first week of July, over 30.0 percent of West Virginian adults either missed last month’s rent or mortgage payment, or have slight or no confidence that their household can pay next month’s rent or mortgage on time. That number has only grown as the pandemic has continued. West Virginia had the 10th highest rate of housing insecurity among all 50 states in July.

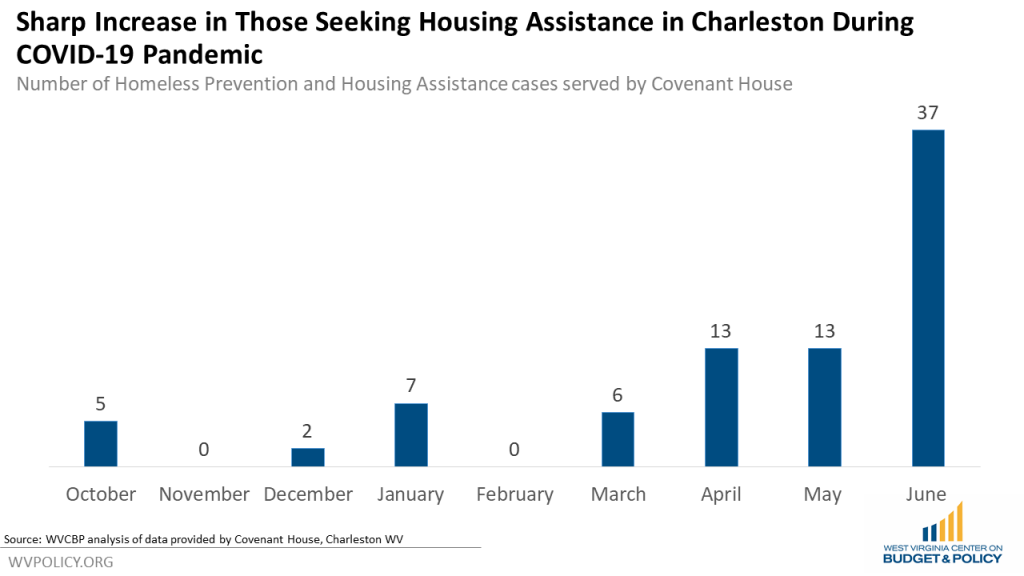

The rise in housing insecurity is also evident in the increasing number of West Virginians seeking support. The number of Homeless Prevention and Housing Assistance cases served by the Covenant House in Charleston, West Virginia has dramatically spiked, from six cases in March to 37 cases in June. Spending by the Covenant House on those programs increased from $7,861 in March to $19,747 in June.

The Families First Coronavirus Response Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, both enacted in March, included important measures to shore up household incomes and reduce hardship, including expanded unemployment benefits and direct stimulus payments. These elements have been noticeably impactful in terms of boosting the economy and enabling affected families to pay their bills.

However, the relief measures enacted so far are temporary even though the economic fallout from the crisis will likely last years. While those measures are protecting some households for the moment, renters who cannot afford to pay rent continue to accrue debt that may cause a wave of evictions once that relief ends. Without adequate relief measures that lift struggling households’ incomes and rental assistance for those who can’t afford housing, we could soon see large numbers of evictions.

With housing insecurity on the rise just as these relief measures expire, housing support should be a key part of the next federal relief package, including significantly increased funding for homelessness services, eviction prevention, and housing vouchers.

Substantial additional resources are needed for rental assistance to enable more struggling households to pay rent, including past missed payments, for as long as they need that help. In addition, the homelessness services system needs more resources to quickly secure housing for people evicted from their homes, revamp its services and facilities in order to facilitate social distancing and other health protocols, and provide safe non-congregate shelter options whenever possible.

The next relief package should be robust enough, and last long enough, to ensure that families can make ends meet and are ready to re-engage in the economy fully when it is safe to do so.