West Virginia is experiencing an imprisonment crisis, with an incarceration rate higher than that of any country in the world. Thousands of West Virginians are released from prison every year, and these returning citizens face hundreds of collateral consequences — that is, punishments that last even after they have finished their sentence and that get in the way of finding good jobs, securing a place to live, and connecting with loved ones. Their return home is further complicated by the stigma attached to people who have been through the criminal system.

Our new issue brief shares important insights from returning citizens, providing a vision for reentry from the people who live it. It explores the myriad obstacles formerly incarcerated people face when they leave prison, as well as the policies that could meaningfully address those obstacles.

To conduct this research, the WVCBP partnered with Race Matters, an organization that works closely with Black West Virginians and other communities of color in southern West Virginia to address economic inequality, health disparities, and civic engagement. We wanted to give returning citizens the opportunity to imagine a better alternative to the reentry experience they had lived. With a focus on southern West Virginia, which has borne the brunt of the state’s economic decline, we gathered groups of returned citizens in Logan and Mercer counties and conducted one-on-one interviews and listening sessions to provide them space to share what release from prison would look like if the ultimate goal was their success.

Key Survey and Interview Findings:

Returning citizens know exactly what they need when they leave prison. They want what anybody wants, but what, in many cases, they never had. They want more opportunities to do good and fewer punishments. They want less crisis. They want to know what to expect, and to receive insight and support from people who had once been in their shoes. They want to land on their feet instead of being set up for failure. And they want a chance to live a full life and make a difference in their communities.

Policies to Smooth the Reentry Process:

We believe the best reentry policy would be to ensure that fewer people experience the harm of prison in the first place. Barring that, we must approach reentry as an opportunity to lift burdens and heal harms, and that work starts with listening to the people who have been made to carry those burdens and suffer those harms.

Read Sara’s full brief here.

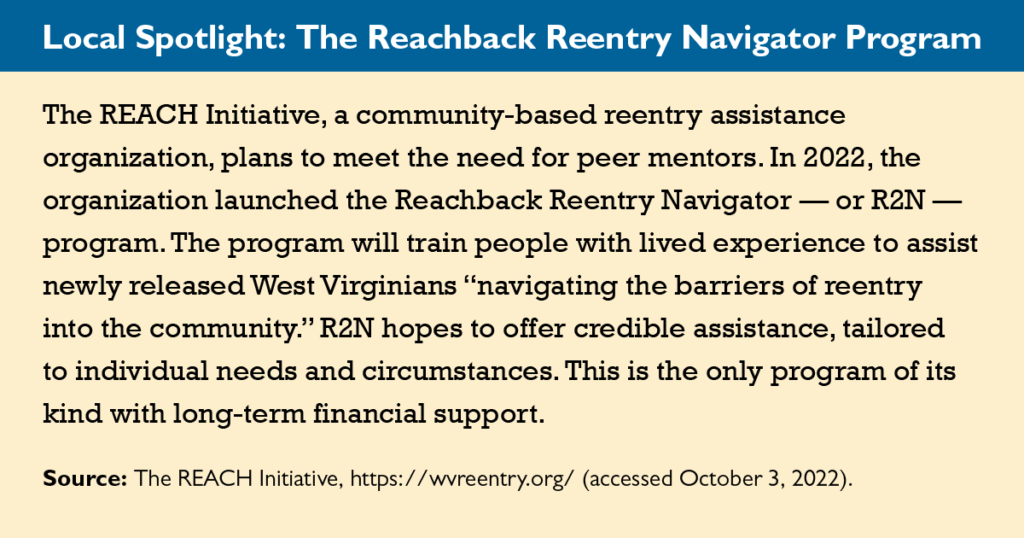

SNAP Stretch, a program that matches SNAP benefits spent at participating markets to increase fruit and vegetable affordability and access, is a proven tool to increase consumption of healthy foods among low-income households, boost sales at local farmers markets, and benefit our broader economy.

While SNAP Stretch has been incredibly successful among SNAP customers and markets in West Virginia, the program is currently limited in its reach due to the unprecedented popularity of the program and current funding restraints. Up to this point, SNAP Stretch has been funded through federal and foundation grants, which have allowed SNAP Stretch to be established and proven as a great success.

The return-on-investment is clear. In 2021, just under $498,000 in SNAP Stretch dollars ensured that $483,000 in federal SNAP dollars went to locally-owned and operated markets rather than big chain stores. And economic studies have found that the multiplier effect of SNAP goes beyond just that. In addition to directing additional income to the businesses where SNAP benefits are spent, the program also creates indirect and induced additional income to suppliers and their employees, who in turn spend more in the economy, further increasing the effect of the initial outlay of SNAP dollars.

For these reasons, West Virginia should allocate state dollars to the SNAP Stretch program to increase its impact even further. A $1 million annual investment in SNAP Stretch could have an estimated $2.84 million economic impact in the state.

Read Kelly’s full fact sheet.

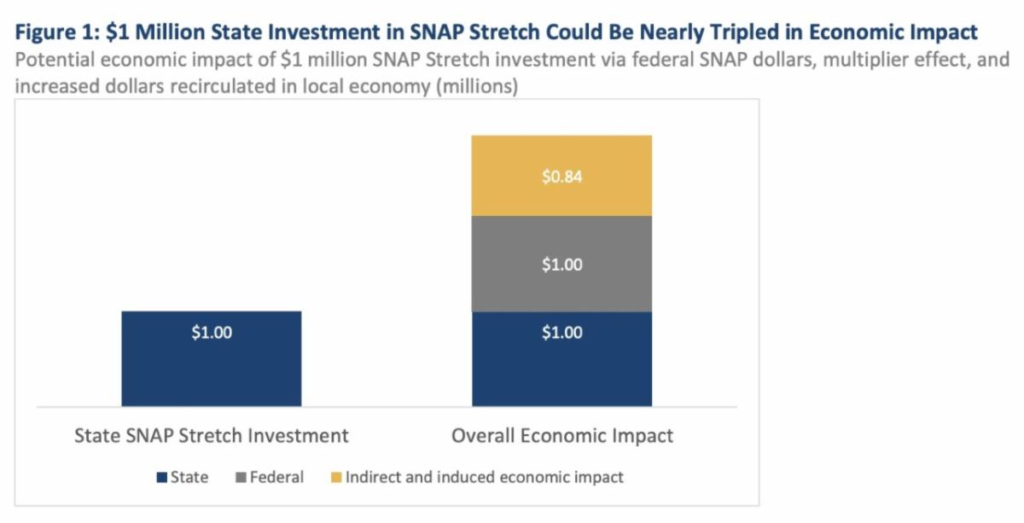

While recent tax collections are leading to calls for tax cuts, half of the surplus collections are from the highly volatile severance tax which is subject to energy prices.

Further, the flat budgets of recent years have created many unaddressed needs in our state. Amid staffing crises in our jails, thousands of families losing child care subsidies, a looming PEIA shortfall, cuts to higher education, and a woefully underfunded foster care system, to choose to prioritize more tax cuts for the wealthy is to choose to neglect ordinary West Virginians.

We can use our current revenue surplus to invest in PEIA, provide thousands of children with subsidized child care, enact paid family and medical leave for all workers, and more. This is how improve the lives of everyday people in our state.

Learn more about how we can meaningfully utilize our surplus here.

Join us on Dec. 15 at 6:30pm for our anti-stigma training, where we’ll discuss the social safety net, including Medicaid and SNAP. We’ll share lived experiences and how stigma affects accessing necessary services. And we’ll teach you how to combat that stigma and promote wellness in your community!

Register for the webinar here. RSVP to the Facebook event here.

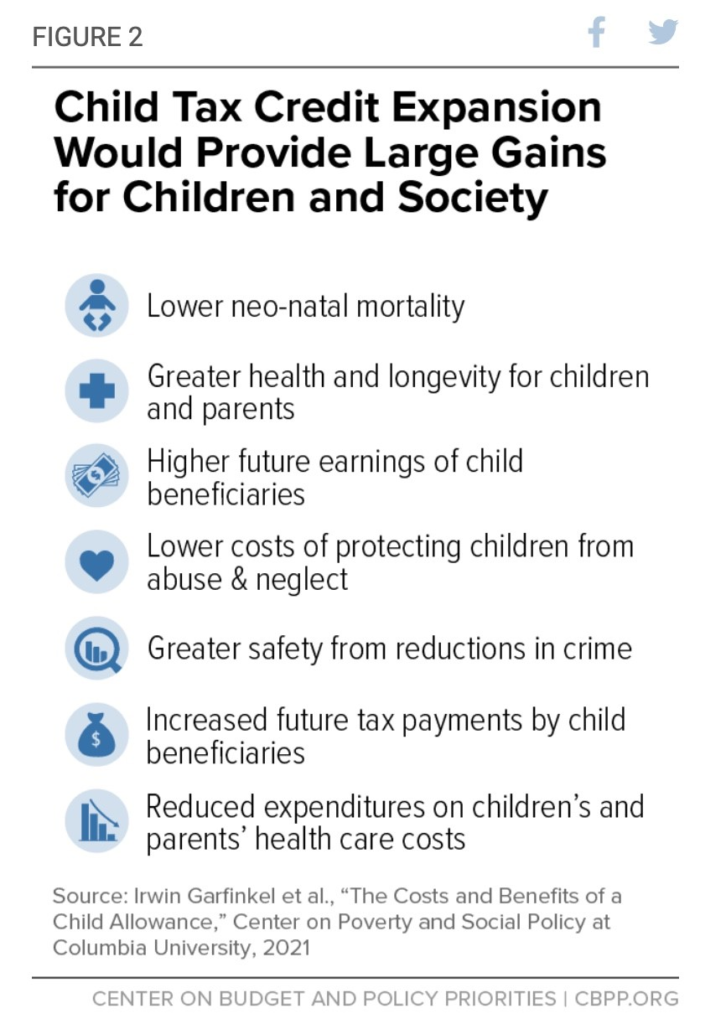

The Child Tax Credit (CTC) expansion included in last year’s American Rescue Plan Act gave millions of low-income families with children additional money in their pockets, helping them afford the rising costs of basic needs while driving child poverty down to a record low. Now that the expansion has expired, 19 million children nationwide are at risk of being pushed back into poverty or facing greater hardship if Congress doesn’t act. Our colleagues at the Center on Budget and Policy Priorities (CBPP) released a report this week detailing the success of the enhanced CTC and the importance of prioritizing readoption of the expansion in the federal end-of-year spending package over tax breaks for wealthy corporations. Excerpt below:

The American Rescue Plan’s expansion of the Child Tax Credit, which made the full credit available to children in families with the lowest incomes for the first time, succeeded in driving child poverty sharply downward in 2021, recent Census data showed. But that expansion has expired, once again leaving an estimated 19 million children in the lowest-income families — or more than 1 in 4 children under age 17 — ineligible for the full Child Tax Credit.

The Rescue Plan’s temporary expansion of the credit — which made the full credit available to all children except those with the highest incomes, increased the maximum credit amount, and included 17-year-olds — produced historic results. The expanded credit in combination with other relief efforts drove the child poverty rate to a record low of 5.2 percent. Without the Child Tax Credit expansion (but with other pandemic relief measures in place), the child poverty rate would have been 8.1 percent.

The success of the 2021 expansion showed us that high child poverty rates are a policy choice, not an inevitability. In the congressional lame duck session, policymakers will have the opportunity once again to expand the Child Tax Credit, so that more families get help they need to afford the basics. Indeed, Congress will likely consider tax legislation during this time, as business interests are pressing for corporate tax breaks that would undo some of the modest business tax increases that were enacted as part of the 2017 tax cuts, which gave extremely large net tax cuts to corporations. Expanding the Child Tax Credit is more important than undoing a few provisions of the 2017 tax law that were used to offset some of the massive corporate tax cuts. At a minimum, policymakers should not enact any year-end corporate tax breaks without expanding the Child Tax Credit.

Making the full credit available to children in families with the lowest incomes should be the priority in year-end tax legislation because they stand to benefit the most from an expanded credit. Living in a family with income below the poverty line as a child is associated with lower levels of educational attainment, poorer health in adulthood, and lower earnings. But research also finds that providing families with low incomes additional income significantly improves children’s long-term health and school performance, making it more likely they will finish high school and attend college and earn more as adults.

Without an expansion of the Child Tax Credit (and with the expiration of various other relief measures), child poverty is likely to return to about the same level as it was pre-pandemic — pushing millions of children back into poverty.

The stakes are high. Policymakers can expand the Child Tax Credit, or they can fail to act and see the Rescue Plan’s historic gains against child poverty evaporate. During year-end deliberations, they should choose on a bipartisan basis to expand the Child Tax Credit for children in families with low incomes.

Read CBPP’s full report here.

As the 2023 legislative session approach, the West Virginia Center on Budget and Policy staff would like to invite you to join us at our 10th annual Budget Breakfast, taking place on January 20, 2023.

Each year, the WVCBP holds this event to provide analysis of the Governor’s proposed budget. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and our chosen keynote speaker, to be announced closer to the event.

Please find further event details below. You can register for the event here.

WHAT: WVCBP’s 10th Annual Budget Breakfast

WHEN: January 20, 2023. Breakfast will be available starting at 7:30am. The WVCBP’s analysis of the Governor’s 2024 proposed budget will begin at 8am, followed by keynote speaker presentation and time for Q&A.

WHERE: Charleston Marriott Town Center (200 Lee Street East, Charleston, WV 25301)

WHO:

PLEASE NOTE: The cost of a single standard ticket is $50, but if you take advantage of our Early Bird Special (available to all who register by 12/31/22), you will receive $10 off.

We appreciate your ongoing support of the WVCBP and we hope you can join us at next year’s event!

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.