West Virginia’s economy continues to be impacted by the COVID-19 pandemic, nearly two years after impacts were first felt in the state. After historic job losses in the spring of 2020, the state underwent a steep, but partial recovery in the summer. However, growth has been sluggish in recent months, and a substantial jobs gap remains. As of November 2021, total nonfarm employment in West Virginia is still down 25,800 jobs from its pre-pandemic level. Government, health care, and leisure and hospitality jobs make up the bulk of the state’s job shortfall.

West Virginia experienced solid job growth in the first half of 2021, adding an average of 2,100 jobs per month, as expanded unemployment benefits and stimulus checks helped to boost and sustain the economy. However, the federal supports that were boosting the economy have now ended. Along with the expiration of federal support, the rise of the Delta and Omicron COVID-19 variants may have played a role in weakening economic growth. Average monthly job growth in West Virginia was cut in half in the second half of 2021, averaging just 1,040 jobs per month. At that rate, the state will not recover all of the jobs lost during the pandemic until 2024.

Further, state gross domestic product (GDP) growth has also slowed in 2021, and as the state economy generally has slowed down, economic insecurity has begun to rise. In December, 41 percent of adults in households with children, and 35 percent of adults overall, reported difficulty paying household expenses.

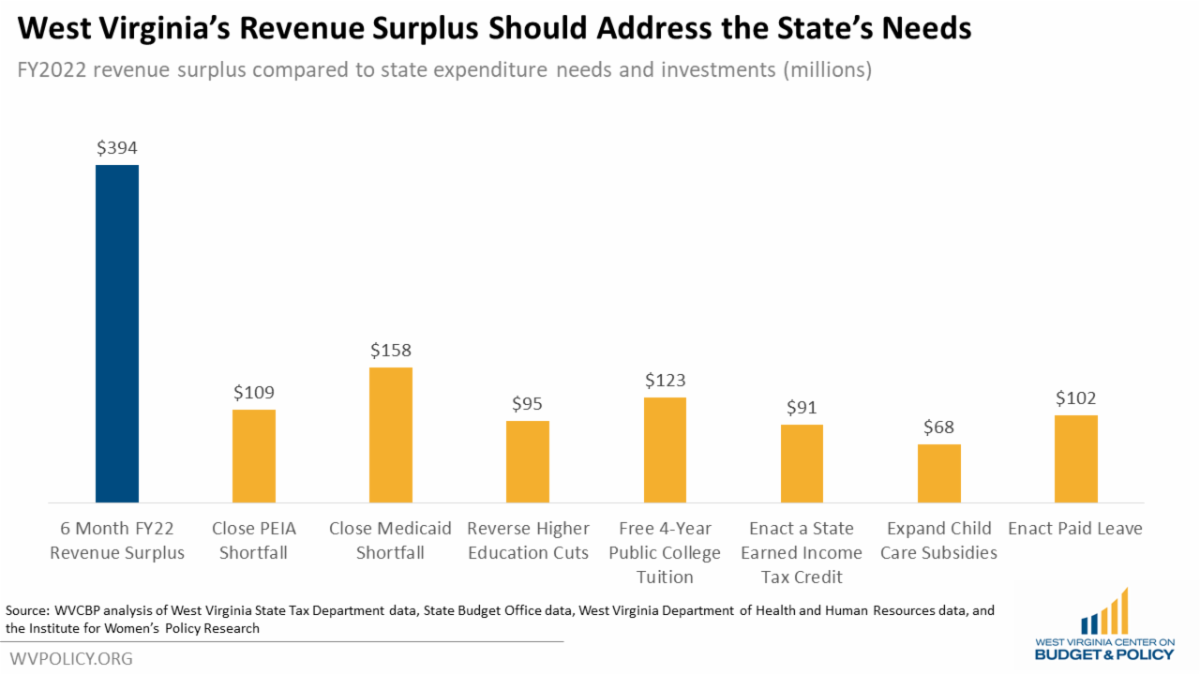

While the economy is showing signs of slowing down, West Virginia currently is enjoying a revenue surplus, with revenue collections exceeding estimates by $394 million so far in FY 2022. However, it is imperative to note that this surplus is in large part thanks to rising energy prices, the $12 billion in federal aid that has been pumped into the state, and lowered revenue estimates.

Some legislators are already proposing to use the surplus to pay for various tax cuts, acting as if the current surplus is a permanent feature and not a one-time result of extraordinary circumstances. Choosing to do this would be fiscally irresponsible. Rather than funding unnecessary and costly tax cuts, any surplus revenue should be directed toward the state’s numerous unaddressed needs, such as closing the PEIA and Medicaid shortfalls or reversing cuts to higher education.

Read Sean’s full blog post here.

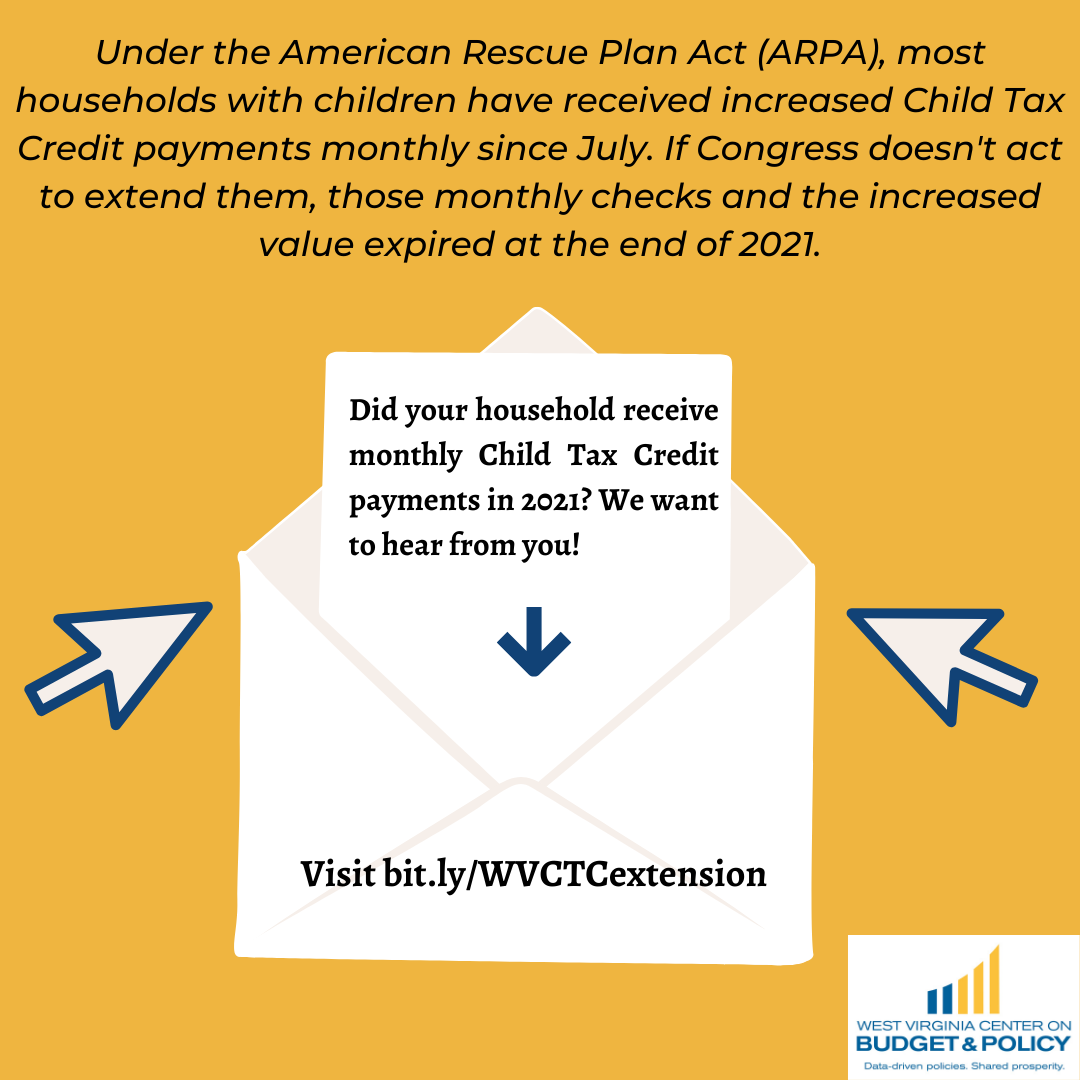

Since July 2021, most households with children have received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and will expire at the end of 2021 unless Congress acts to extend it through the Build Back Better Act.

If you’ve received monthly Child Tax Credit payments, we’d love to hear how they’ve been helping your family and how your family will be impacted if you no longer receive them in 2022.

Join us in our advocacy by completing our survey here.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here or in recent articles featuring our data here and here.

Join us for our 9th annual Budget Breakfast!

Each year, the WVCBP holds this fundraising event to provide analysis of the Governor’s proposed budget. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and our keynote speaker, Brian Elderbroom of Justice Reform Strategies.

Please find further event details below. You can purchase a ticket for the event here.

WHAT: WVCBP’s 9th Annual Budget Breakfast

WHEN: January 21, 2022. Breakfast will be available starting at 7:30am. The WVCBP’s analysis of the Governor’s 2023 proposed budget will begin at 8am, followed by keynote speaker presentation and time for Q&A.

WHERE: Charleston Marriott Town Center (200 Lee Street East, Charleston, WV 25301)

Please note, while the event will be taking place in-person, the presentations will also be streamed live onto our Facebook page to accommodate those who do not wish to attend an in-person event.

WHO:

We appreciate your support of the WVCBP and our work, and we hope to see you in January!

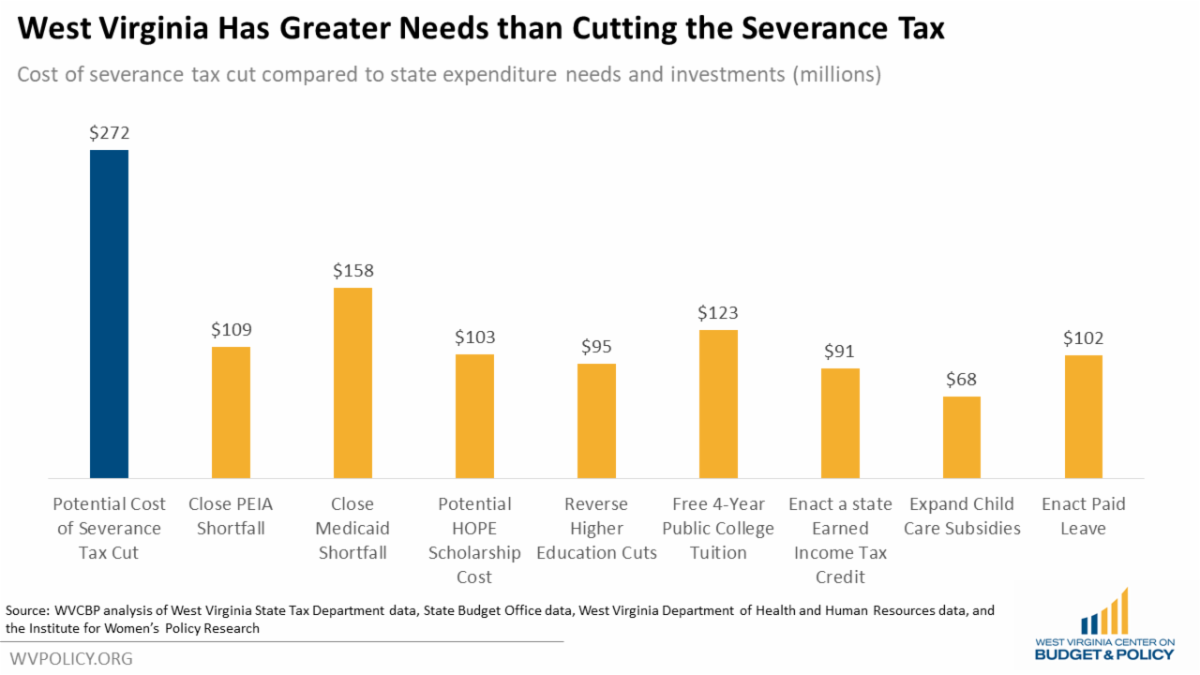

During the most recent legislative interim session, the Joint Committee on Finance proposed legislation to — yet again — cut the state’s already low severance tax. This would prove costly and harmful to our state budget.

This announcement to further cut the severance tax comes on the heels of a sizable severance tax cut passed in 2019, which lowered the severance tax rate on steam coal from five percent to three percent, at a cost of $64 million annually. While the 2019 tax cut was targeted to the steam coal industry in an unsuccessful effort to give the industry a boost during tough times, this new proposal would cut severance taxes across the board, reducing the rate on metallurgical coal, natural gas, and oil from five percent to three percent.

According to documents from the State Tax Department, energy prices would have to more than double from the pre-pandemic levels just to maintain previous revenue levels if the severance tax is cut from five percent to three percent for coal, natural gas, and oil.

This additional proposed severance tax cut would mean West Virginia would miss out on hundreds of millions of much needed new revenue (over $270 million according to estimates from the tax department) that it could otherwise use to address outstanding needs or make new — and needed — investments.

Learn more in Sean’s full blog post and in this recent article featuring his insight.

The proposed Build Back Better Act includes much-needed social spending investments that could have a transformative impact on the lives of West Virginians. Despite this, what’s in store for the legislation remains uncertain amid opposition from Senator Manchin. As the future of the bill hangs in the balance, West Virginians continue to speak up about all the Mountain State has to gain from significant federal social spending investments.

WVCBP executive director Kelly Allen was recently interviewed by NPR-affiliate, WBUR, to lend her insight about what West Virginians most need and what Senator Manchin may be willing to support. She was joined live by Josh Sword, president of the West Virginia AFL-CIO, and the segment also featured pre-recorded comment from Steve Roberts, president of the West Virginia Chamber of Commerce, and JoAnna Vance, a recovery fellow and organizer at the American Friends Service Committee.

You can listen to the segment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.