West Virginia levies a severance tax on the production value of coal, natural gas, oil, and other natural resources produced in the state. During the most recent legislative interim session, the Joint Committee on Finance proposed legislation to — yet again — cut the state’s already low severance tax. This comes on the heels of a sizable severance tax cut passed in 2019, which lowered the severance tax rate on steam coal from five percent to three percent, at a cost of $64 million annually, as well as a “severance tax rebate” which could potentially cost the state millions more.

At the time, the coal industry and sympathetic legislators argued that the severance tax cut was necessary to boost production and employment in the state’s struggling steam coal industry, despite research showing that severance tax cuts are ineffective at boosting production and employment, and West Virginia’s five percent rate wasn’t enough to influence other factors that determine production and demand. And unsurprisingly, the tax cut failed to spur an employment boom in the state’s coal industry. According to Workforce West Virginia, after the tax cut went into effect, coal mining employment in the fourth quarter of 2019 was down 565 jobs from its average in 2018, before collapsing even further during the pandemic.

But while the 2019 severance tax cut was targeted to the steam coal industry in an unsuccessful effort to give the industry a boost during tough times, this new proposal would cut severance taxes across the board, reducing the rate on metallurgical coal, natural gas, and oil from five percent to three percent, and come at a time when skyrocketing global energy prices in the context of the pandemic are giving the industry a mini-resurgence. So the script has flipped — instead of severance tax cuts for a struggling industry, legislators are proposing tax cuts for a booming one.

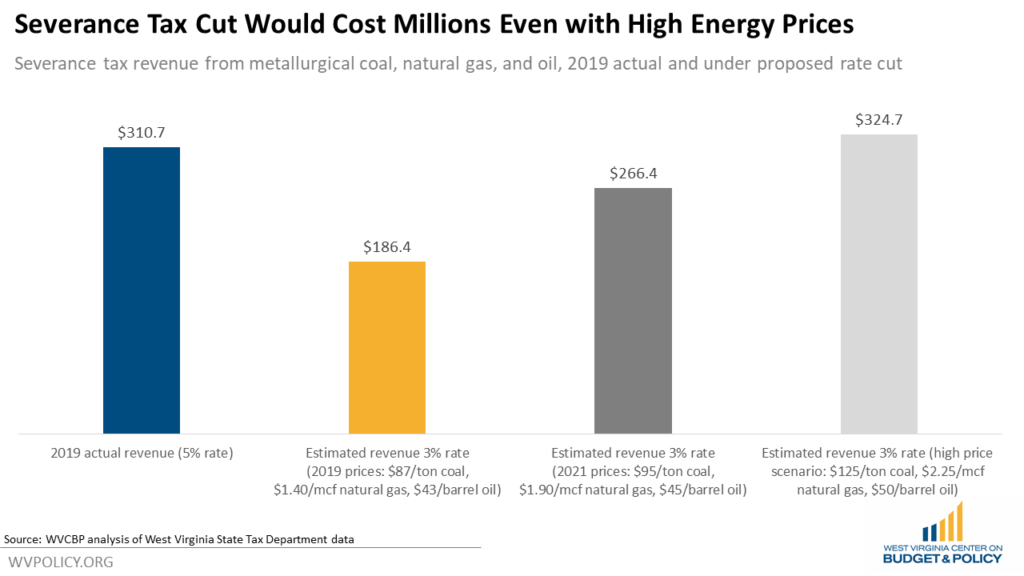

Even with extraordinarily high energy prices, additional severance tax cuts would likely prove just as costly and harmful to the state budget as previous severance tax cuts have been. According to documents from the State Tax Department, energy prices would have to more than double from the pre-pandemic levels just to maintain previous revenue levels if the severance tax is cut from five percent to three percent for coal, natural gas, and oil.

According to the Tax Department, in 2019, before the pandemic and current spike in energy prices, the West Virginia price was $87.78/ton for metallurgical coal, $1.40/mcf for natural gas, and $43.00/barrel for oil. After collapsing during the pandemic, those prices have spiked in 2021 — averaging $95.00/ton for metallurgical coal, $1.90/mcf for natural gas, and $45.00/barrel for oil — and have climbed even higher in recent months. However, even at those elevated prices, slashing the severance tax from five percent to three percent would lead to a huge loss in revenue. In 2019, severance tax collections from metallurgical coal, natural gas, and oil totaled $310.7 million. Severance tax revenue would fall by $44.3 million to $266.4 million, even at 2021’s elevated prices and increased production. If prices return to 2019 levels in the near future, revenue would fall even further to $186.4 million, $124.3 million below 2019’s level. Today’s sky-high energy prices — with coal prices over $125/ton, natural gas prices over $2.25/mcf, and oil over $50.00/barrel — would have to become permanent for the state not to lose significant amounts of revenue.

How likely is it that today’s inflation-fueling energy prices are going to remain permanently high? Fortunately for West Virginia families facing high energy bills and gas prices at the pump, not very likely. As Deputy Revenue Secretary Mark Muchow told legislators, the severance tax roller coaster, “goes in both directions,” warning that the current spike in severance tax collections is likely to be temporary, and the state will be on the “down slope” in the near future. And while we’ll have to wait until next month for the latest projections, the FY 2022 budget projections for the severance tax show that after spiking in FY 2022, the severance tax is expected to fall back below pre-pandemic levels in the coming years, even before rates are potentially cut. So while that is good news for families currently struggling with high energy costs, it is bad news for the state budget.

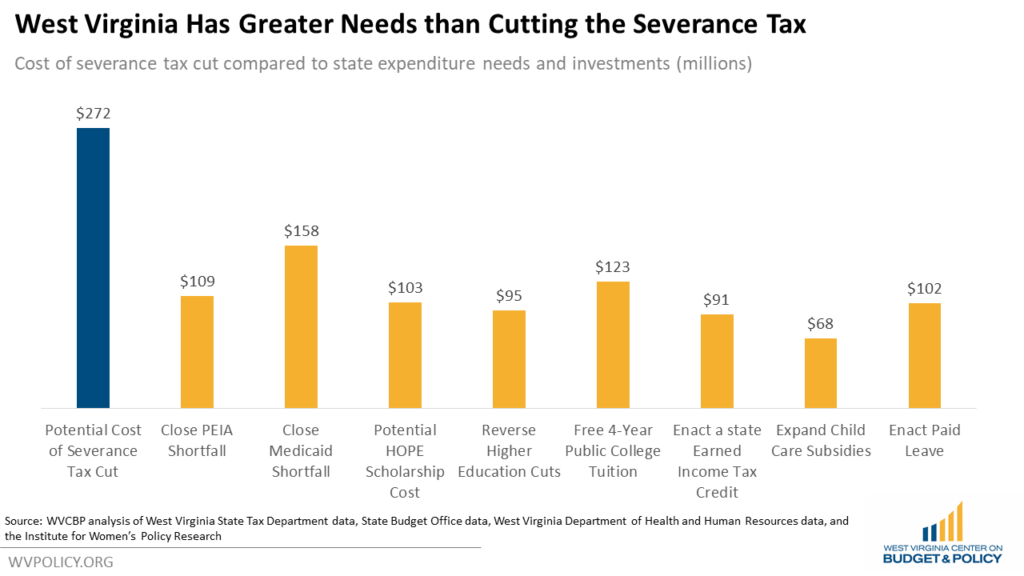

In the event that high energy prices persist, the state would miss out on millions of much needed new revenue, over $270 million according to estimates from the tax department. And the state budget could really use the extra revenue the current spike in energy prices are bringing in. Revenue collections have taken a hit during the pandemic — despite billions in federal stimulus and aid, the revenue estimate for FY 2022 was lowered by $360 million from its original pre-pandemic projection. Previous budget projections showed the state needing revenue to close future budget gaps, with the state needing to raise $109.2 million for PEIA and $158.4 million for Medicaid in FY 2024 and FY 2025. New expenditures will also need to be paid for, including over $100 million for the public employee pay raises announced recently by Governor Justice, and the potential $103.5 million cost of the HOPE Scholarship.

And even if those outstanding needs are somehow able to be met, the state has many other needs that could be addressed with a potential severance tax windfall. The state could reverse years of cuts to higher education, permanently solve PEIA, bring investments in education up to par, enact free tuition for four-year public colleges, or pursue any number of policies to support working families.

The pandemic put West Virginia’s budget in a unique situation, and soaring energy prices have provided a temporary windfall. But while the severance tax is booming currently, history tells us that those booms inevitably turn into busts. An unexpected spike in revenue calls for careful budget planning, addressing needs, and making smart investments — not more needless, expensive, and ineffective tax cuts.