30+ community orgs sent a letter to West Virginia’s state leadership this week urging them to reject tax cuts that would take away the state’s ability to provide critical public services or that would shift tax responsibility from the wealthy and corporations onto the West Virginia families who’ve been most impacted by the pandemic.

“We urge you to take bold action to strengthen public support and invest in West Virginia’s future. Every dollar spent in uplifting people, communities, small businesses, and local governments is a dollar that will enhance the economy and pay dividends for years to come.

“In contrast, budget and revenue cuts will sacrifice West Virginians’ safety, health, economic security, and public education, all for a short‐term solution. Instead of cuts, we urge that you look to protect revenue to invest in West Virginia’s long‐term prosperity. We understand that you must balance the state budget. Still, as we reflect on lessons from the Great Recession, it is evident that cuts to public services will only slow down economic development, in both the public and private sectors, ultimately harming all of us.”

Read the full letter here.

Join us and send a letter of your own urging legislators to prioritize investing in West Virginia’s families and communities over providing a tax cut to the state’s wealthiest here.

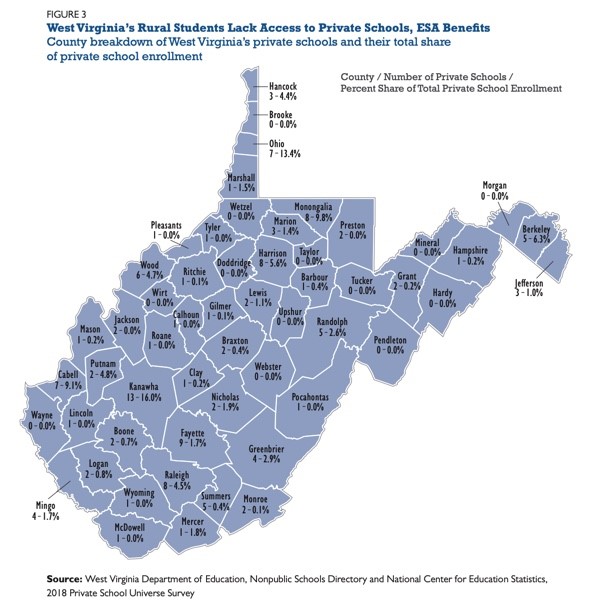

State-funded vouchers use existing state funds intended for public schools and instead redirect them for use in non-public, private education programs. Education Savings Accounts (ESAs) are a form of these state-funded vouchers. The primary difference between ESAs and traditional vouchers is that with ESAs, the public funds go directly to the family of the student – rather than the private school – and can be used for almost any educational services and supplies, involving less oversight than with traditional vouchers.

Our school districts are struggling to keep up with increased costs as funding levels remain flat. During the legislative session, lawmakers are considering approving ESAs, which could divert significant amounts of money away from the public education system in the wake of a pandemic when children are returning to in-person public schooling and resources are needed more than ever.

To learn more about why most West Virginia families do not benefit from ESAs, read our ESA Fast Facts sheet or watch our explainer video.

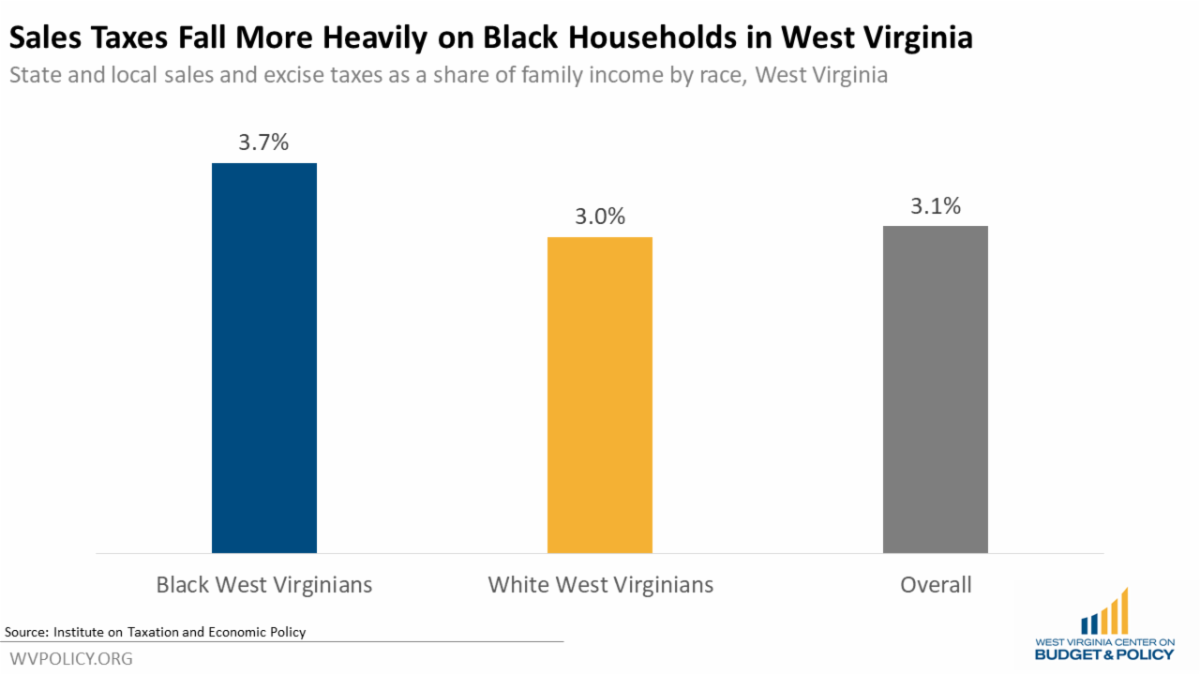

Historic and present-day injustices, both in public policy and in society more broadly, have resulted in vast disparities in income across race and ethnicity in West Virginia. And West Virginia’s upside down tax system does little to address those disparities. The average income of white families is 53.7 percent higher than that of Black families in West Virginia. After state and local taxes are applied, the gap between white and Black average income is nearly unchanged at 53.6 percent.

While it would be unrealistic to expect state and local taxes to remedy income disparities across race and ethnicity, West Virginia’s tax system fails to make even a meaningful attempt to address this issue and recent proposals to eliminate the income tax and replace it with a higher sales tax would exacerbate the problem even further.

As we’ve covered before, different taxes have different impacts by income group. West Virginia’s income tax, with its tiered, progressive rates, is the state’s fairest tax — higher-income residents pay a larger share of their income in personal income taxes compared to low- and middle-income residents. In contrast, the state’s sales tax is regressive. Since low- and middle-income West Virginians spend a higher percentage of their overall income, and save less, the sales tax falls most heavily onto them.

And because Black West Virginians on average have lower incomes than white West Virginians — again, as a result of myriad historical and current inequities that disadvantage Black people — the state tax system has different impacts by race, as well. The state’s sales tax actually worsens disparities in income by race and ethnicity in West Virginia. Black households in West Virginia pay an average effective sales and excise tax rate of 3.7 percent, 23 percent higher than the rate paid by the average white household (3.0 percent).

Read Sean’s full blog post.

For more on why eliminating the personal income tax is bad policy, check out our previous blog posts here, here, and here.

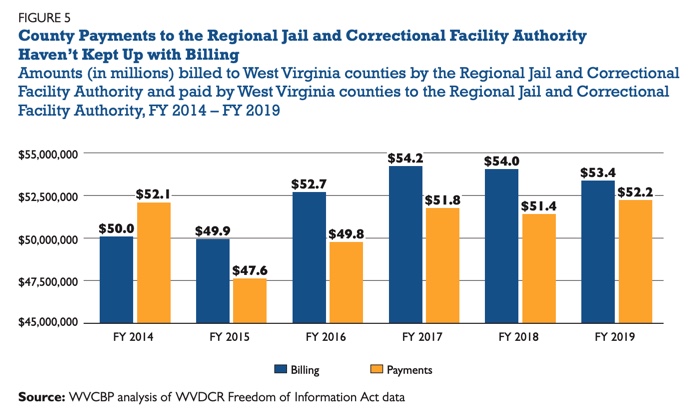

Last month, WVCBP published an issue brief from our criminal justice policy analyst Quenton King that explored the recent surge in West Virginia’s use of jail incarceration, as well as the gap between the cost of this incarceration and counties’ ability to pay the associated bills.

Last Sunday, the Charleston Gazette-Mail published a piece that drew upon on our brief’s findings. Excerpt below:

West Virginia is incarcerating more people than its regional jail system is meant to hold, and it is costing some county governments more money than they can pay.

At least 10 counties in West Virginia are more than 90 days past due on a combined $9 million in jail bills, according to the West Virginia Department of Homeland Security. That agency covers the balance with taxpayer money when payments come up short.

From 2000 to 2019, West Virginia’s jail population increased by 81% according to a report by the West Virginia Center on Budget and Policy. That follows a longer national trend, Quenton King, criminal justice policy analyst for the center, wrote in the report.

“As counties look for ways to pay for needed investments in public services that could aid residents and businesses, there are few discussions about reducing the jail population despite the rising costs of incarceration,” King said.

Read the full article here.

Marshall University professor and WVCBP board president, Marybeth Beller, had an op-ed published last weekend on what’s at stake for higher education in West Virginia if the state personal income tax is eliminated. Important excerpt below:

Enrollment in higher education decreased 6.1% from 2010 to 2018, and that was before the devastating effects of COVID-19 hit the state. The Center on Education and the Workforce, Forbes and the Wall Street Journal all agree that an educated workforce is necessary for any state to be competitive and for people to earn good jobs. Cutting the personal income tax will only reduce revenue to the state which, in turn, will make a college education more out of reach, defeating the goals of economic progress our state leaders claim to want. It is a misguided notion that should not be made into policy.

Read the full op-ed here.

Last week’s Criminal Justice Reform Summit was a tremendous success!

A sincere thank you to all who joined from the WV Criminal Law Reform Coalition for your interest and willingness to engage. And of course, our endless gratitude to our incredible lineup of speakers who so generously shared their time, energy, and great wealth of knowledge with us. We hope this summit left folks feeling more informed about the problems and solutions, more equipped to take action, and more connected.

If you weren’t able to join us, you can still check out the majority of the summit’s content. All sessions we received permission to record and share are now available here. We welcome you to give them a watch!

As Solutions Oriented Addiction Response’s (SOAR) harm reduction efforts come under threat, WVCBP reaffirms our full support of the organization’s life-saving work.

At the end of 2020, we published a blog exploring the surge in HIV and Hepatitis C cases in Kanawha County largely due to the sharing of needles to inject drugs, and how syringe services programs (SSPs) like those operated by SOAR play a critical role in reducing the spread of these diseases. SSPs are effective, cost-saving, and treat those in our community who inject drugs with the dignity that all folks deserve.

Currently, SOAR’s work is deemed 100% legal in Charleston. Over the next couple weeks, Charleston City Council will likely vote on a new ordinance that would make SOAR’s current harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

Again, we at WVCBP wholeheartedly believe that SOAR’s work makes the Charleston community both kinder and safer. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

We wrapped up our Legislative Preview Facebook Live series this week with a conversation on the harms of Education Savings Accounts to our state’s public education system. In the two weeks prior, we had explored the expected threats to the business personal property tax and the impact such threats would have on our counties, as well as the catastrophic potential of eliminating the state personal income tax.

If you couldn’t tune in to those conversations, you can find the recordings below:

We hope you find these dialogues informative and valuable!

Join us for our 8th annual Budget Breakfast!

Due to COVID-19 considerations, this year’s event will be held virtually via Zoom.

WVCBP’s analysis of the Governor’s 2022 proposed budget will start at 8:00am, followed by keynote panel presentation and time for Q&A.

Our keynote panelists, Rep. Don Hineman and Duane Goossen, will highlight the failed Brownback tax experiment in Kansas and why West Virginia lawmakers should avoid going down the same path. Don Hineman is a Republican member of the Kansas House of Representatives, representing the 118th District. He has served since 2009. He was the Majority leader from 2017 to 2019. Duane Goossen is the former Kansas Secretary of Administration and the Director of the Kansas Division of the Budget. Goossen has served as the Secretary of the Kansas Department of Administration since 2004 and Director of the Kansas Division of the Budget since 1998. Goossen also served in the Kansas House of Representatives 1983 to 1997.

While attendees are welcome to join the webinar at no cost, we hope you will consider supporting the WVCBP’s work and contributing to our annual fundraiser by donating the usual cost of an in-person ticket ($50).

You can find registration here.

We hope to see you there!

We are now accepting applications for the summer of 2021! Priority will be given to applications received by February 26, 2021.

WVCBP seeks a summer policy associate for an internship to work on issues associated with our research and advocacy priorities. Our summer policy associates work closely with WVCBP staff, coalition partners, and stakeholders in an immersive experience in research and advocacy for evidence-based solutions, policies, and practices surrounding issues that impact low- and moderate-income West Virginians.

The WVCBP internship program’s mission is to partner our organization with highly motivated undergraduate and graduate students committed to building shared prosperity through policy change. Our internship program prepares students for potential employment in the non-profit policy world by training them to conduct rigorous data and policy analysis or outreach and advocacy while developing effective communications strategies.

Find the full job posting and instructions to apply here.