Making ends meet is a struggle for many West Virginians employed in lower-wage jobs. In fact, 23% of workers in West Virginia are employed in low-wage jobs and a quarter of those live in poverty. People working in their communities as daycare workers, restaurant servers, home health aides, administrative assistants, and many other lower-income jobs deserve to be able to support their families.

One policy that has been shown to boost working people’s income is the federal Earned Income Tax Credit (EITC). The EITC puts money in the pockets of hard-working families making low wages, pushing them towards the middle class. West Virginia can build on this success by providing a state-level refundable EITC piggybacking off the federal EITC. This provides a bottom-up tax cut for the working poor.

Current House Bill 2340 proposes an additional state-level refundable EITC worth 15% of the federal EITC amount for West Virginia’s workers. This is a modest investment that can make a big difference in people’s lives—offering low-income tax payers a hand-up rather than a handout through encouraging and supporting work. Newly released data show the impact a state EITC would have for working, low-income West Virginia families.

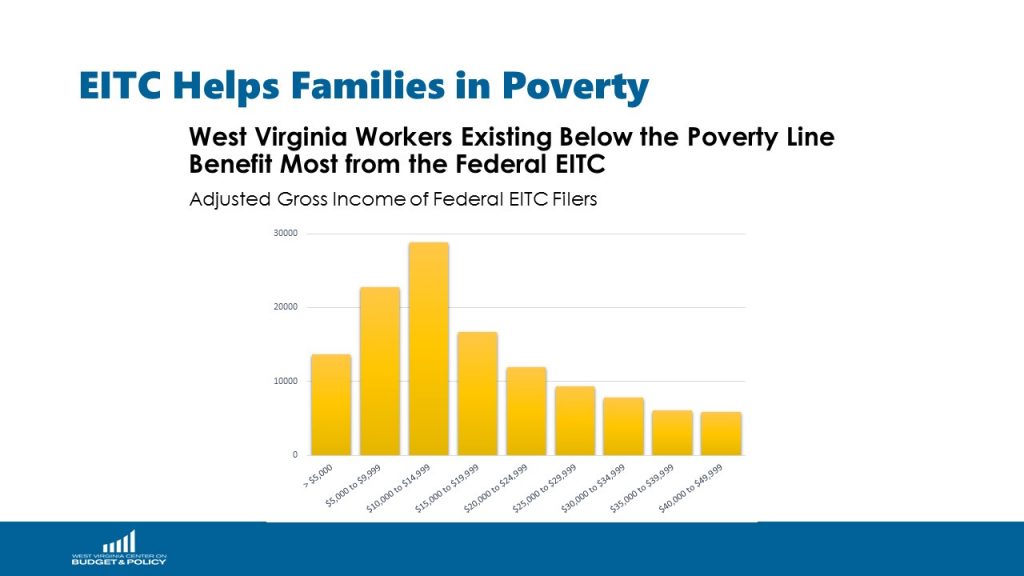

The idea behind the EITC is straight-forward—providing a tax incentive for low-income people who work. When passed in the 1970s, the EITC had broad bipartisan support. President Reagan further expanded the program calling it, “the best anti-poverty, the best pro-family, the best job creation ever to come out of Congress.” By rewarding work, the federal EITC supplemented the wages of 159,000 West Virginians in 2015, helping them pay for basic needs such as childcare and transportation. With an average credit of $2,230, this amounts to $355 million introduced into the hands of hard-working West Virginians in 2015.

The federal EITC works by providing a tax credit to working people based on how much money they earn and the size of their family. The majority of the federal EITC goes to workers raising children. An estimated 185,570 children throughout West Virginia were helped through this policy in 2015:

EITC Income Limits and Range for Tax Year 2018

| Number of Qualifying Children | For Single/Head of Household/Widow(er) Income Must Be Below: | For Married Filing Jointly Income Must Be Below | EITC Range |

| 0 | $15,270 | $20,950 | $2-$519 |

| 1 | $40,320 | $46,010 | $9-$3,461 |

| 2 | $45,802 | $52,592 | $10-$5,716 |

| 3 or more | $49,194 | $54,884 | $11-$6,431 |

But the benefits of the EITC have been shown to go beyond boosting the amount of money available for the working poor. It has also been shown to:

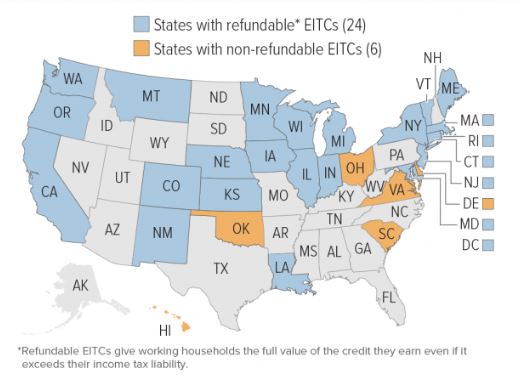

Twenty-nine states and the District of Columbia offer a state EITC. Right now, West Virginia is missing out on a proven policy to help move people out of poverty. States that enact an EITC also boost participation in the federal EITC, putting even more money into the homes of low-income families and the economy. WVCBP analysis of the latest available data shows that a 15% refundable West Virginia EITC could bring an estimated additional $48.2 million into the hands of working families each year from the state EITC alone.

The majority of states have already recognized the value of enacting an EITC. West Virginia can join them and show support for its working families—giving them a better chance at achieving financial stability and independence—by passing this common-sense piece of legislation.

To see how a West Virginia EITC would impact your legislative district, visit www.investinwvfamilies.org.