Federal student loan debt has more than tripled since 2007, jumping from $516 billion in 2007 to nearly $1.6 trillion in March 2021. West Virginia borrowers hold $6.5 billion of that debt. The freeze on student loan payments and the temporary zero percent interest rate have been a relief to borrowers since implemented in March 2020, but those provisions are set to expire on September 30, 2021. Federal lawmakers have proposed several options for reducing student loan debt, all of which would bring extended and much-needed relief to West Virginians, who continue to face rising college tuition and have the fifth highest rate of student loan defaults in the country. Student debt forgiveness could also have significant positive impacts on our state’s economy, impacting young West Virginians’ ability to buy homes, start families, and spend money in the local economy.

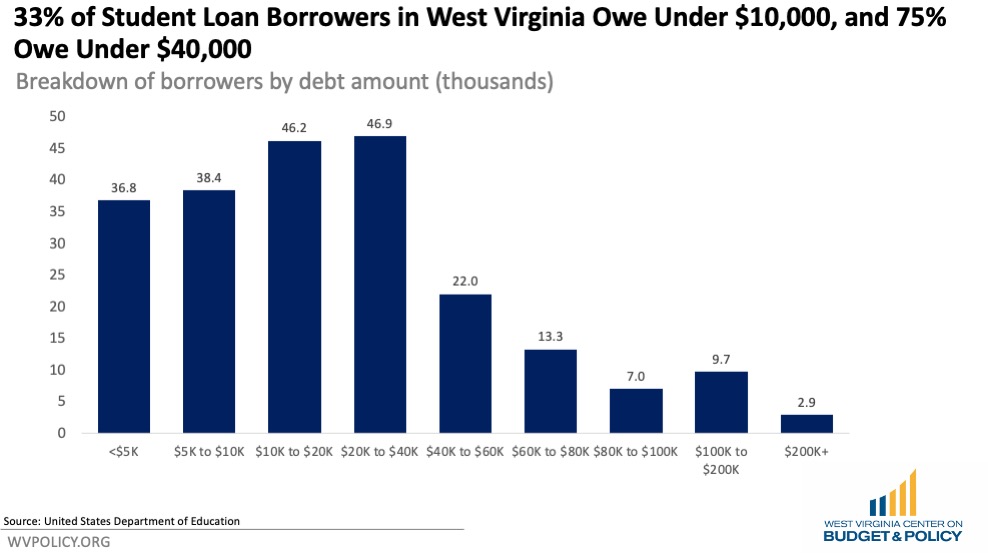

Approximately 223,000 West Virginians have federal student loans, according to the latest data from the Department of Education. More than 33 percent of borrowers in West Virginia owe under $10,000 in loans, and 75 percent owe less than $40,000. Many of these borrowers who owe relatively low amounts of debt are people who made progress toward getting a degree or certification, but never finished their programs. These people are saddled with debt, but may find it difficult to pay off their balances.

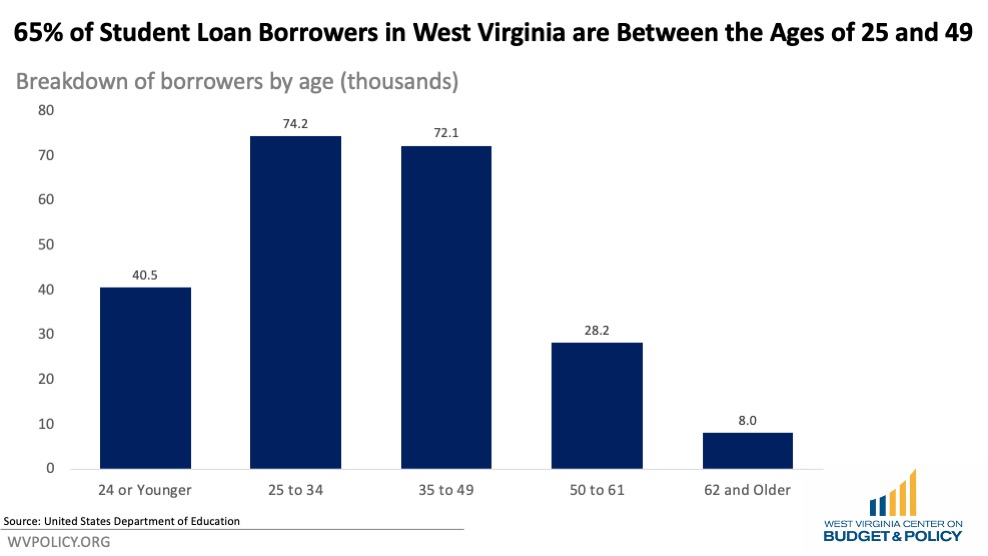

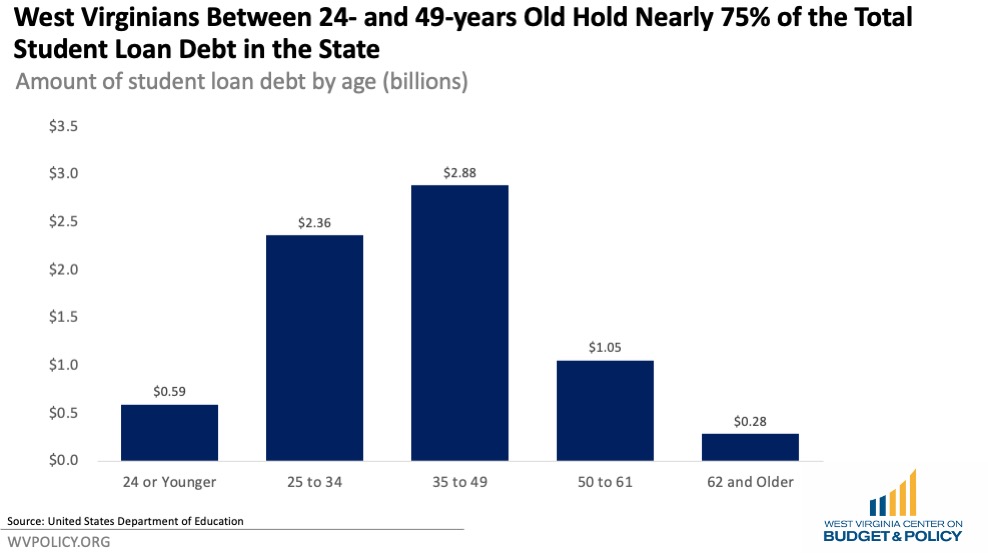

Thirty-three percent of borrowers in West Virginia are between the ages of 25 and 34, and another 32 percent are between the ages of 35 and 49. These age ranges also have the biggest share of debt. One reason why millennials have been significantly impacted by student loan debt is that many entered adulthood during the Great Recession. Amid public job losses and cuts to higher education, graduating millennials faced either a difficult job market or rising tuition costs. Graduate school enrollment, which typically costs more than undergraduate education, increased during the Great Recession, which likely indicates that people chose this path as a way to increase their competitiveness in a tight labor market.

Large amounts of debt are burdensome for people leaving college as they begin to transition into adulthood. Numerous reports have documented how millennials in particular have delayed traditional milestones such as starting a family or buying a house as a result of their student loan debt. While race data for student loan borrowers is not readily available at the state-level, national trends show that there are disparities between how student debt impacts white people and people of color. Nearly 75 percent of Black borrowers have a higher loan balance now than they did originally, compared to only 51 percent of white borrowers. Black student loan borrowers on average also have $7,000 more debt immediately after graduation than their white counterparts.

College costs have increased in West Virginia in recent years, even as enrollment has declined. Enrollment was trending downward even before the COVID-19 pandemic. One reason for the increase in costs has been the persistent defunding of higher education in the state. The PROMISE scholarship used to cover a significant portion of tuition and fees at the state’s public colleges and universities, but it now covers less than 63 percent.

The rising costs of colleges and universities have likely contributed to the state’s high loan default rates. The most recent data from the Department of Education indicates that West Virginia has the fifth highest rate of default, but in past years, the state had the worst rate of default. Nearly 13 percent of borrowers who entered into repayment plans for their student loan debt in 2017 had already defaulted by 2020. Over 44,000 borrowers in West Virginia are currently defaulted on their student loans, owing more than $1 billion in total.

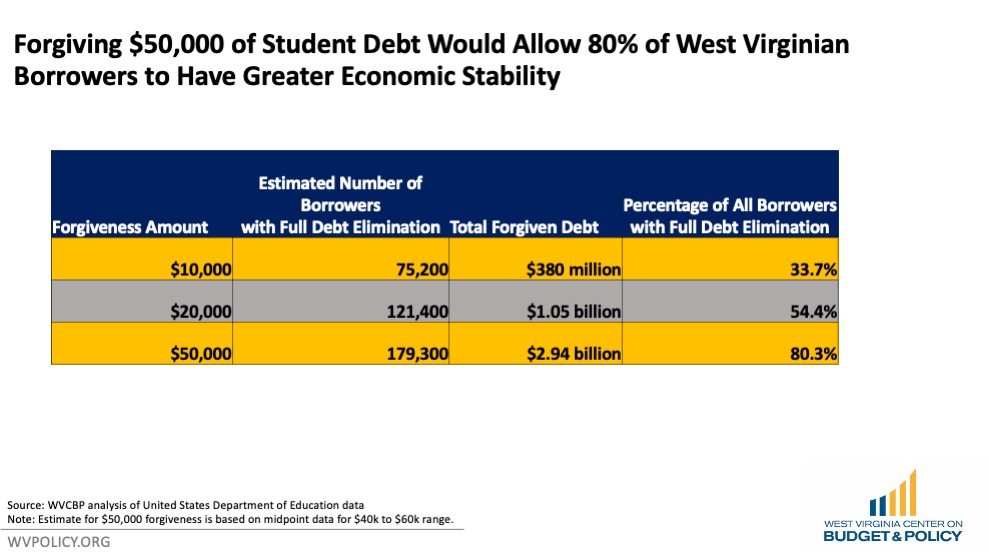

As a candidate, a piece of Joe Biden’s platform was to forgive $10,000 of student debt per person, either by calling on Congress to do so or by issuing an executive order. Senator Elizabeth Warren and other members of Congress have supported forgiving $50,000 of student debt for every person who has a federal or private loan. Some researchers and activists have even called for all debt to be forgiven. Any amount of forgiveness would benefit thousands of West Virginians and millions of Americans. If President Biden were to forgive $10,000 of student debt for every borrower, 75,000 West Virginians would see their debt completely eliminated. Senator Warren’s plan to clear $50,000 in debt could give approximately 179,000 West Virginians the chance to be free from student debt and participate more fully in the economy.

An educated and diverse workforce is key for West Virginia’s economy and future. The Higher Education Policy Commission has projected that 60 percent of West Virginians will need postsecondary certifications or degrees by 2030 in order to meet the state’s future workforce needs. But it’s important to ensure that encouraging students to further their education will not lead to more West Virginians struggling with student loan debt and forestalling the life choices they may prefer. Research suggests that student loan forgiveness could have far-ranging benefits for the social, physical, and economic wellbeing of our state. Borrowers have indicated they would be more likely to purchase homes, start new businesses, eat a more nutritious diet, and start families if they did not need to consider their debt. These benefits would extend to all borrowers, not just those with high amounts of debt. A combination of student loan forgiveness and increased higher education funding are vital for securing West Virginia’s future.